Jun 19, 2025

All 208 Amazon Fees (and counting…)

You probably noticed, that some Amazon seller fees are not well described on Seller Central, or even worse - not described at all.

Get Your Amazon Fees Under Control with Shopkeeper

You can bookmark this page as a reference, to come back and look up any fee you were charged and would like to know more about.

Table of Contents

- A2Z Guarantee Recovery

- ABA Fee

- Advertise Catalog

- Advertise Coupons

- Advertise Deals

- Advertise Excess FBA Inventory

- Advertise Items with Low Traffic

- Advertise New Products

- Advertise Seasonal Products

- Advertise Top Selling Items

- Amazon Accelerator Fee

- Amazon Exclusives Fee

- Amazon For All Fee

- Amazon Shipping Chargebacks

- Amazon Shipping Charges

- Amazon Shipping Reimbursement

- Amazon Upstream Processing Fee

- Amazon Upstream Storage Transportation Fee

- Automated Campaign

- Bubblewrap Fee

- FBM Bump

- Buyer Recharge

- Buy with Prime CS Error Non Itemized

- Buy with Prime Customer Refund

- FBM Carriage

- Cast a Wide Net

- Catch All

- Category Targeting

- Chargeback Recovery

- CLI Planned Fee Reimbursement

- COD Chargeback

- COD Item Charge

- COD Item Tax Charge

- COD Order Charge

- COD Order Tax Charge

- COD Shipping Charge

- COD Shipping Tax Charge

- Commission

- Commission Correction

- Compensated Clawback

- Coupon Redemption Fee

- CReturn Wrong Item

- CSBA Fee

- CS Error Items

- Customer Return HRR Unit Fee

- FBA Customer Return Per Order Fee

- FBA Customer Return Per Unit Fee

- FBA Customer Return Weight Based Fee

- Debt Adjustment

- Delivery Fulfillment Fee

- FBA Delivery Services Fee

- Digital Services Fee

- Digital Services Fee FBA

- Disbursement Correction

- FBA Disposal Fee

- EPR Pay on Behalf Eco-contribution - EEE

- EPR Pay on Behalf Eco-contribution - Toys

- EPR Pay on Behalf Service Fee - EEE

- EPR Pay on Behalf Service Fee - Toys

- EPSO Chargeback Fee

- EPSO Cross-Border Fee

- EPSO Payment Auth Fee On Finalize

- EPSO Payment Settle Fee On Finalize

- Estimated Commission

- Estimated FBA Fees

- Estimated Principal

- Estimated Tax

- Excess inventory

- Export Charge

- Failed Disbursement

- FBA001 Auto

- FBA Fee

- FBA Per Order Fulfillment Fee

- FBA Per Unit Fulfillment Fee

- Fee Adjustment

- Free Replacement Refund Items

- Generic Deduction

- Get Paid Faster Fee

- Gift Wrap Charge

- Gift Wrap Chargeback

- Gift Wrap Commission

- Gift Wrap Tax

- Global Inbound Transportation Duty

- Global Inbound Transportation Freight

- Goodwill

- High Volume Listing Fees

- Import Taxes Amount

- Inbound Carrier Damage

- FBA Inbound Convenience Fee

- FBA Inbound Defect Fee

- FBA Inbound Shipment Carton Level Info Fee

- FBA Inbound Transportation Fee

- FBA Inbound Transportation Program Fee

- FBA Inbound Transportation Service Fee

- Increase Visibility on Low Traffic Items

- Inspection Amount

- FBA Inventory Fee

- Incorrect Fees Items

- FBA International Inbound Freight Fee

- FBA International Inbound Freight Tax And Duty

- Inventory Placement Fee

- Item TDS

- Labeling Fee

- Local Shipping Amount

- FBA Long Term Storage Fee

- Lost Or Damaged Reimbursement

- Low Value Goods Tax - Other

- Low Value Goods Tax - Principal

- Low Value Goods Tax - Shipping

- Manufacturing Amount

- Marketplace Facilitator Regulatory Fee - Principal

- Marketplace Facilitator Tax

- Marketplace Facilitator VAT - Principal

- Marketplace Facilitator VAT - Restocking Fee

- Marketplace Facilitator VAT - Shipping

- MFN Delivery Service Fee

- MFN Postage Fee

- MFN Shipmate Cost

- Misc Adjustment

- Multichannel Order Damage

- Multichannel Order Late

- Multichannel Order Lost

- FBA Multitier Per Unit Fee

- Non-subscription Fee Adjustment

- Opaque Bagging Fee

- FBA Overage Fee

- Paid Services Fee

- Payment Method Fee

- Payment Retraction Items

- Payment Retraction Non-Itemized

- PoA Per Unit Fulfillment Fee

- POA Service Fee

- Points Adjusted

- Policy Violation

- Polybagging Fee

- Postage Billing - Carrier Pickup

- Postage Billing - Congestion Charge

- Postage Billing - Delivery Area Surcharge

- Postage Billing - Delivery Confirmation

- Postage Billing - Fuel Surcharge

- Postage Billing - Import Duty

- Postage Billing - Insurance

- Postage Billing - Oversize Surcharge

- Postage Billing - Postage

- Postage Billing - Postage Adjustment

- Postage Billing - Signature Confirmation

- Postage Billing -Tracking

- Postage Billing - Transaction Fee

- Postage Billing - VAT

- Postage Refund - Carrier Pickup

- Postage Refund - Congestion Charge

- Postage Refund - Delivery Area Surcharge

- Postage Refund - Delivery Confirmation

- Postage Refund - Fuel Surcharge

- Postage Refund - Import Duty

- Postage Refund - Insurance

- Postage Refund - Oversize Surcharge

- Postage Refund - Postage

- Postage Refund - Postage Adjustment

- Postage Refund - Signature Confirmation

- Postage Refund - Tracking

- Postage Refund - Transaction Fee

- Postage Refund - VAT

- Premium Experience Fee

- Prep Fee Refund

- Pricing Error

- Prime Wardrobe Reimbursement

- Prime Wardrobe Reimbursement Manual

- Principal

- Product Cost VAT

- Product VAT

- Production

- Promotion Meta Data Definition Value

- Promotions

- ReCommerce Grading And Listing Charge

- ReCommerce Grading And Listing Refund

- Re-Evaluation

- Referral Fee

- Refund Admin Fee

- Refund Commission

- Region Shipping Amount

- Regulatory Fee

- Reimbursement Clawback

- Remote Fulfillment Credit

- FBA Removal Fees

- Removal Order Damaged

- Removal Order Lost

- Renewed Program Fee

- Reserve Credit

- Reserve Debit

- Restocking Fee

- Return Postage Billing - Carrier Pickup

- Return Postage Billing - Delivery Area Surcharge

- Return Postage Billing - Delivery Confirmation

- Return Postage Billing - Fuel Surcharge

- Return Postage Billing - Oversize Surcharge

- Return Postage Billing - Postage

- Return Postage Billing - Postage Commission

- Return Postage Billing - Tracking

- Return Postage Billing - Transaction Fee

- Return Postage Billing - VAT

- Return Shipping

- Reversal Reimbursement

- Run Lightning Deal Fee

- SAFET Reimbursement Charge

- Sales Commission

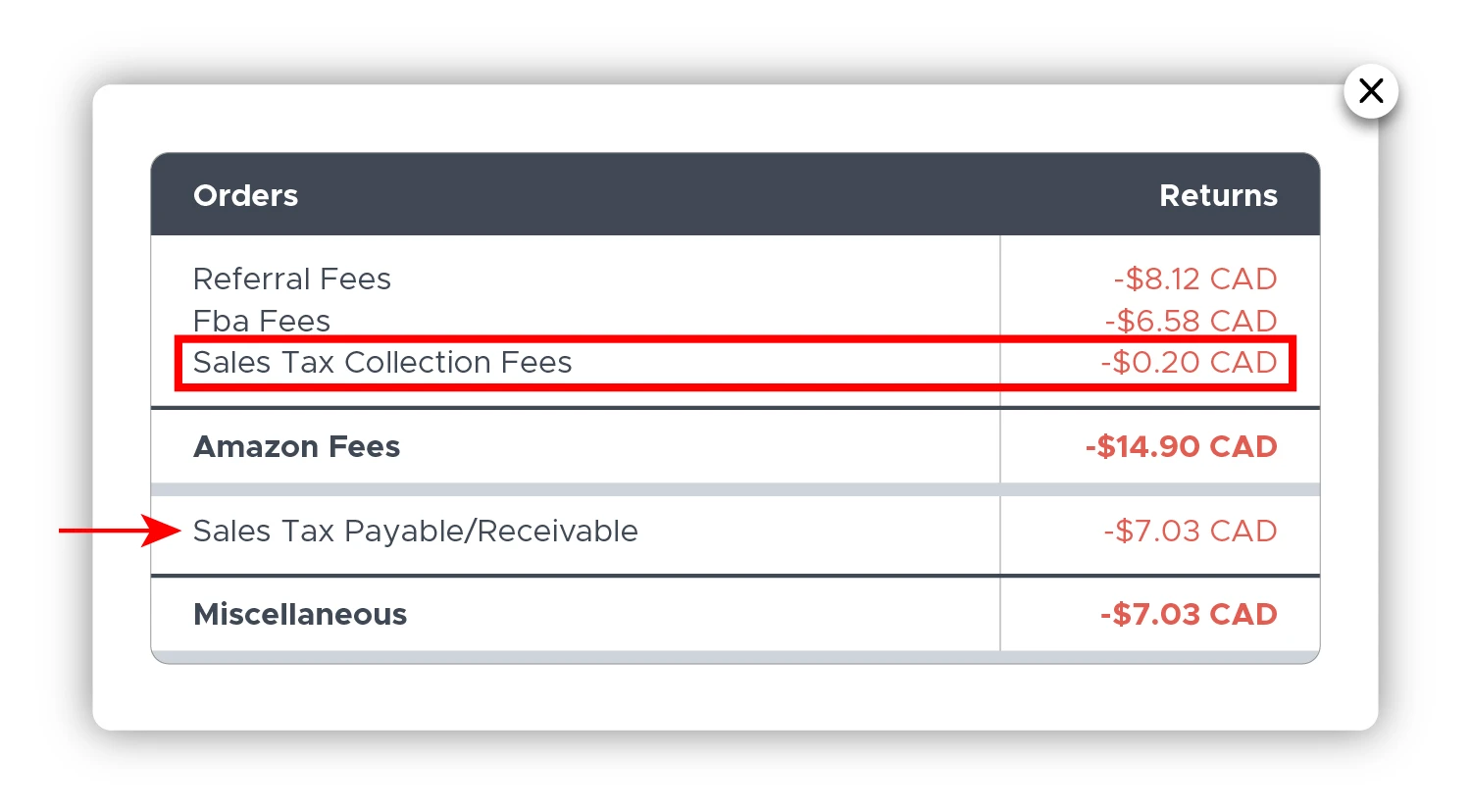

- Sales Tax Collection Fee

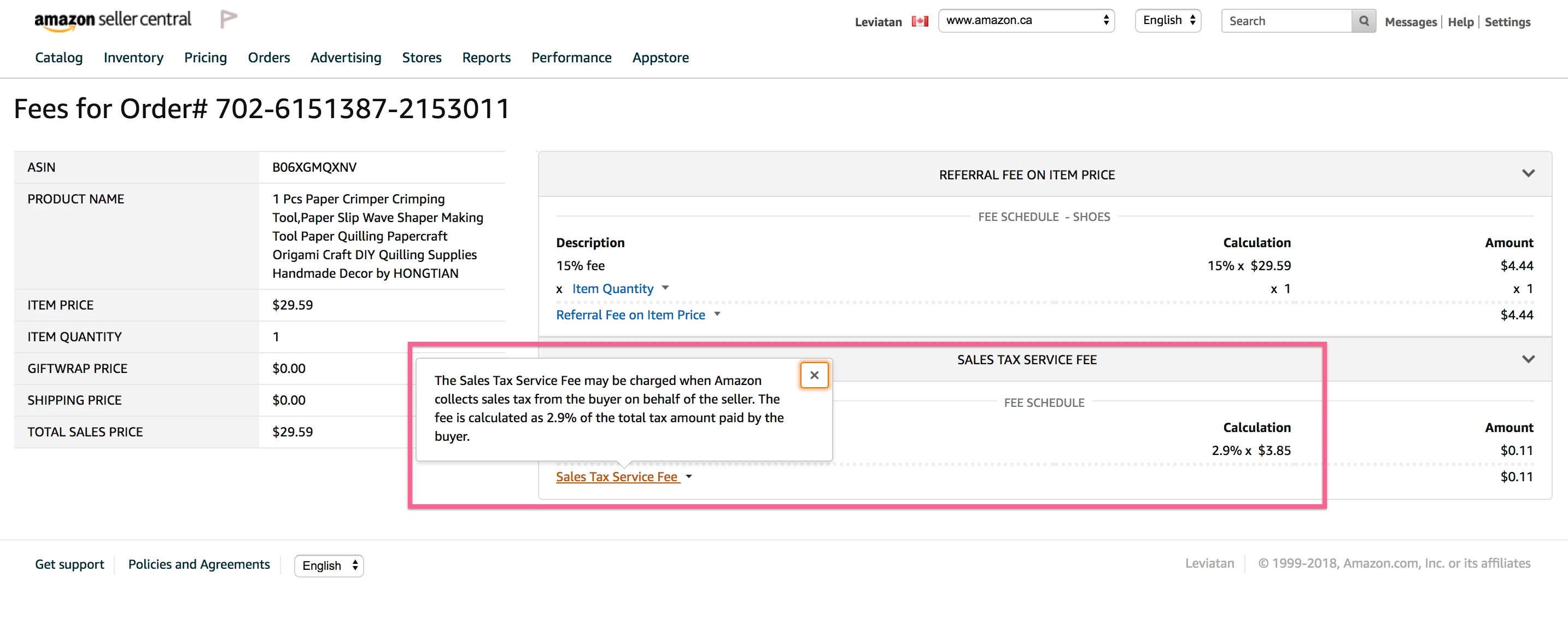

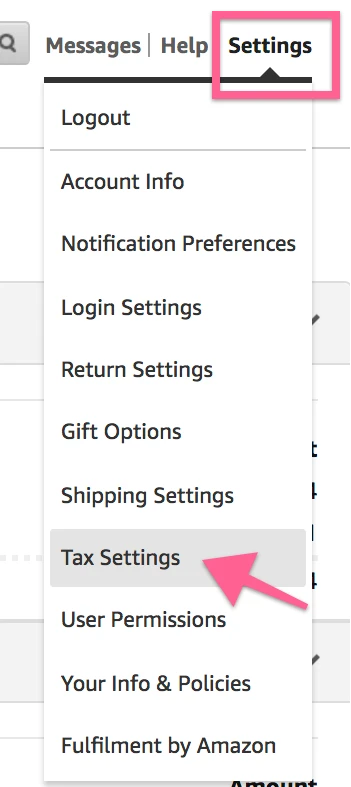

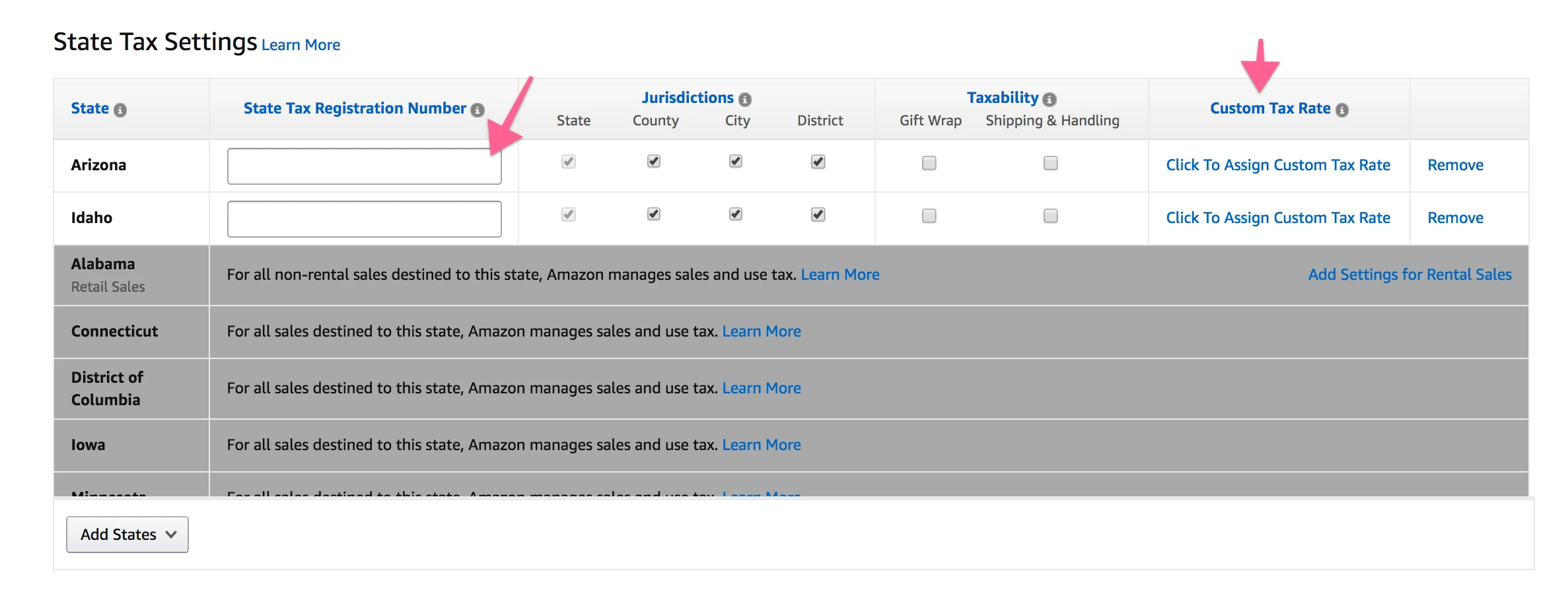

- Sales Tax Service Fee

- Seller Rewards

- FBM Shipment

- FBM Shipping

- Shipping Charge

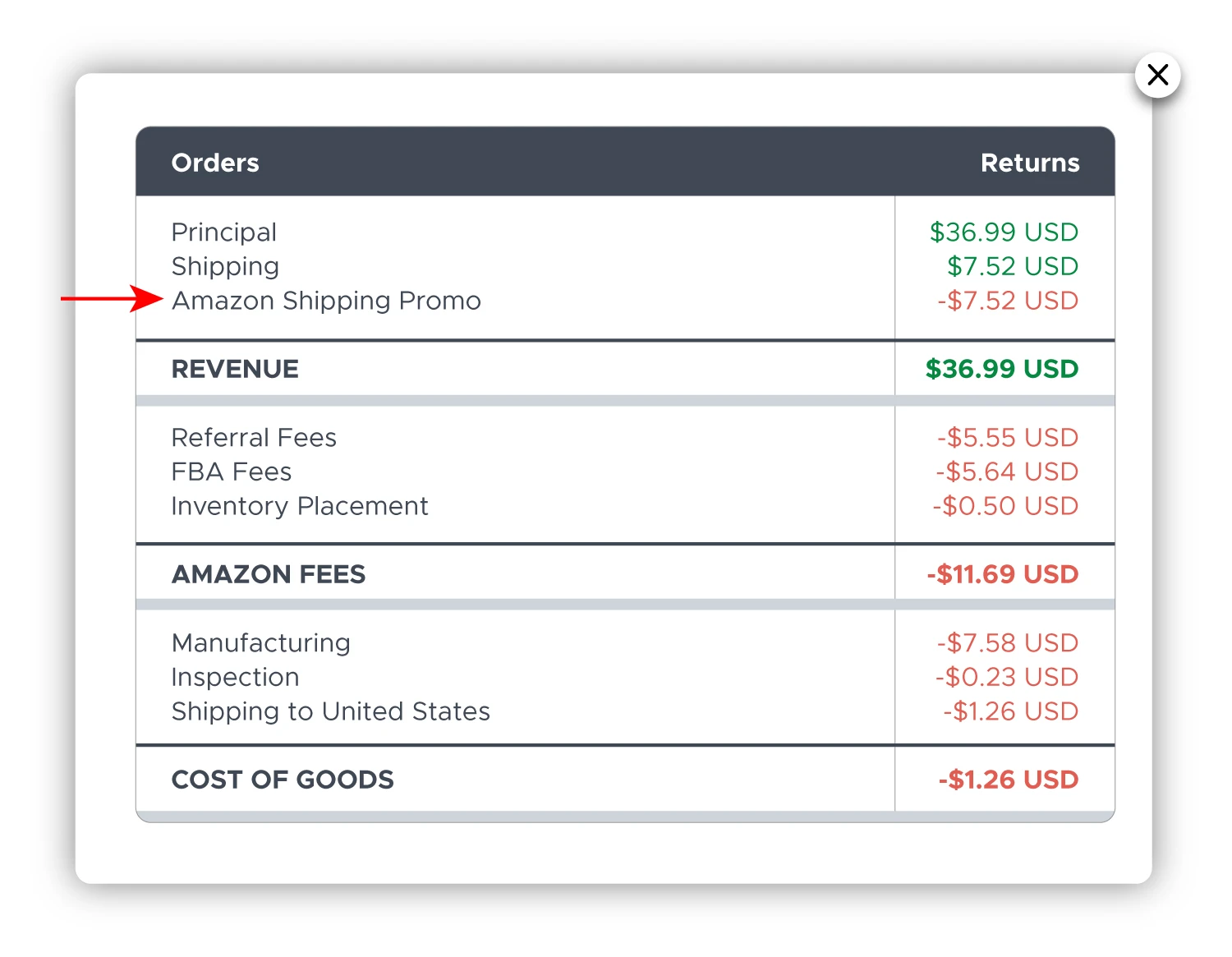

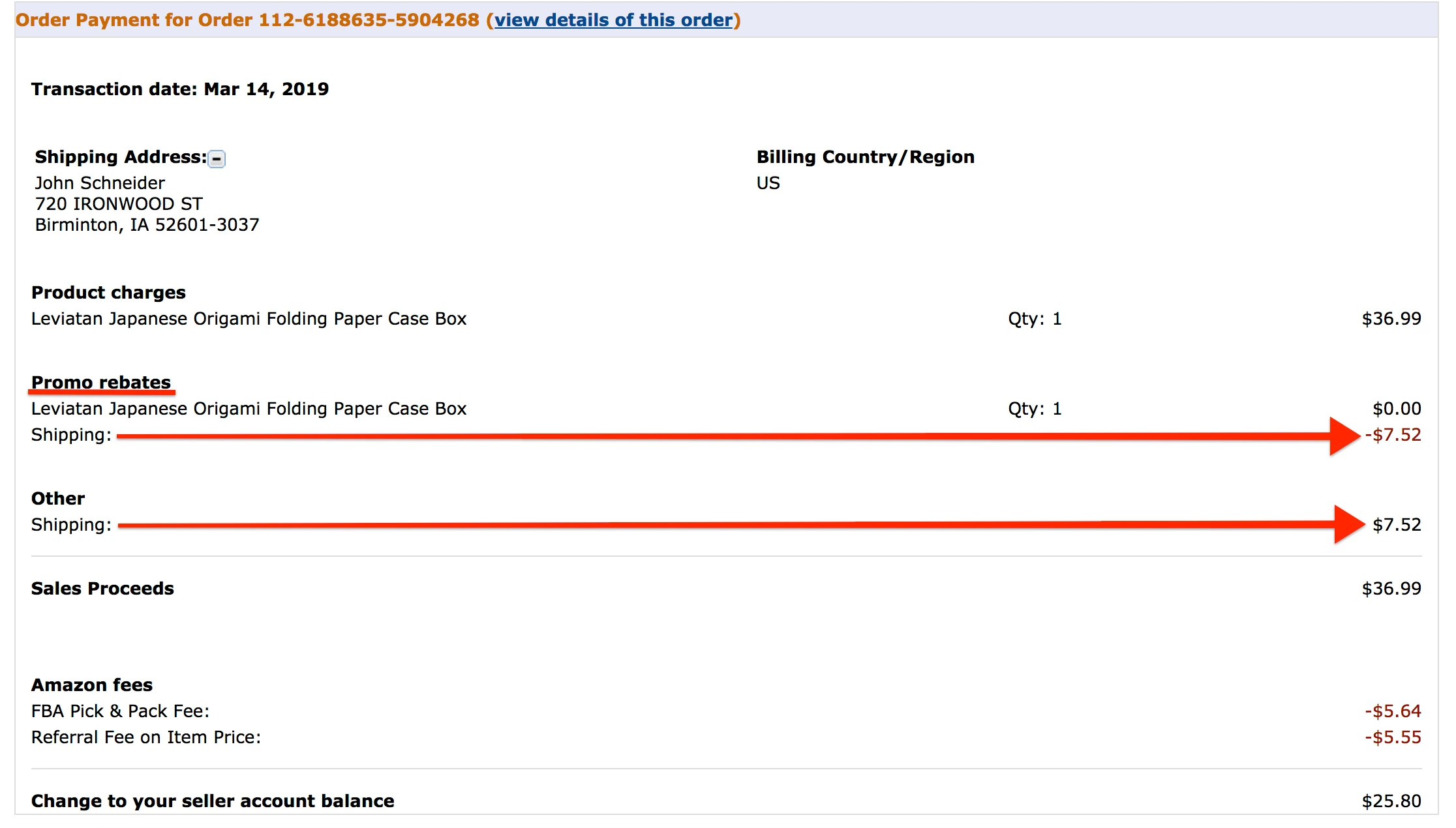

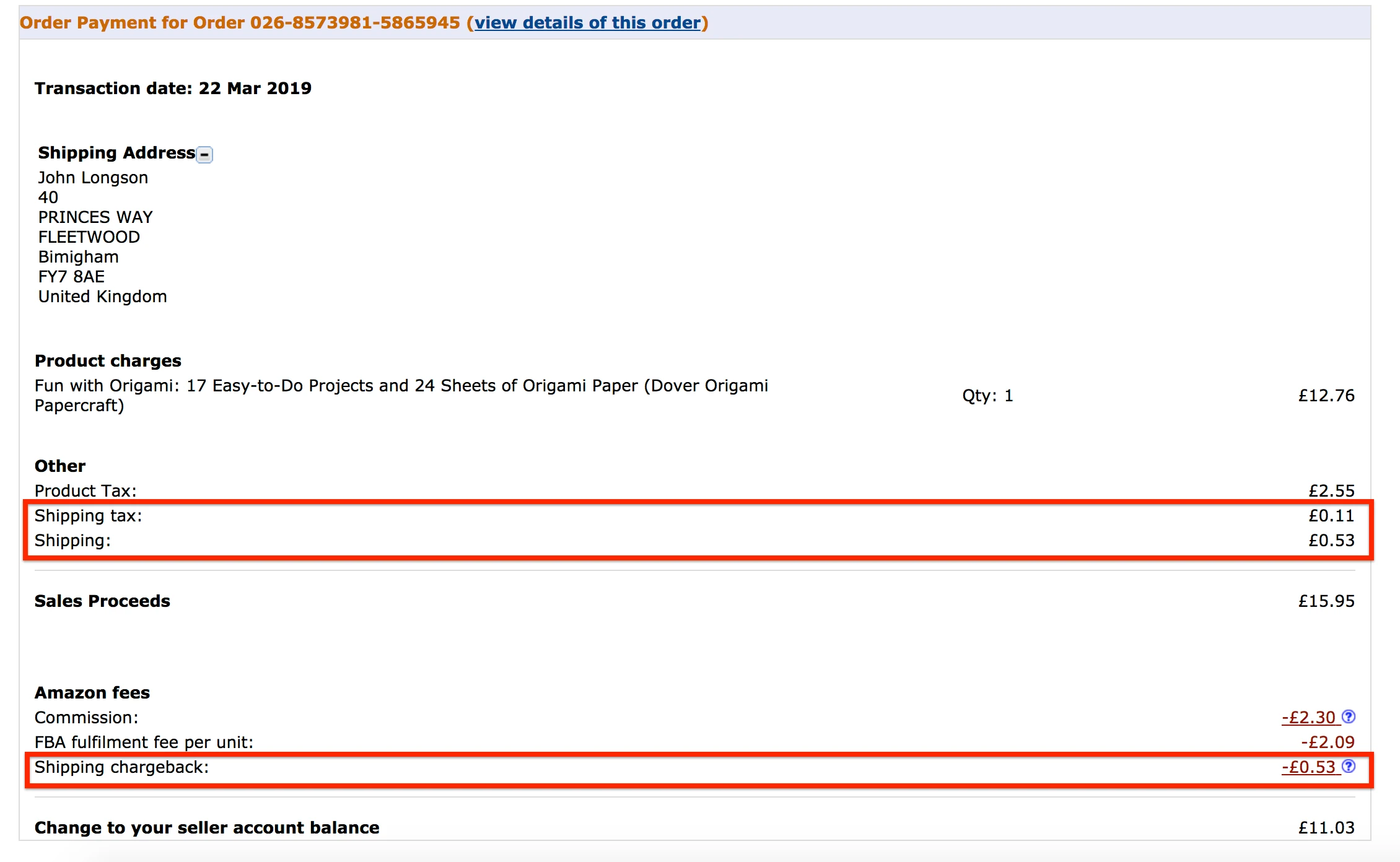

- Shipping Chargeback

- FBM Shipping Fee

- Shipping Holdback Fee

- Shipping Promo

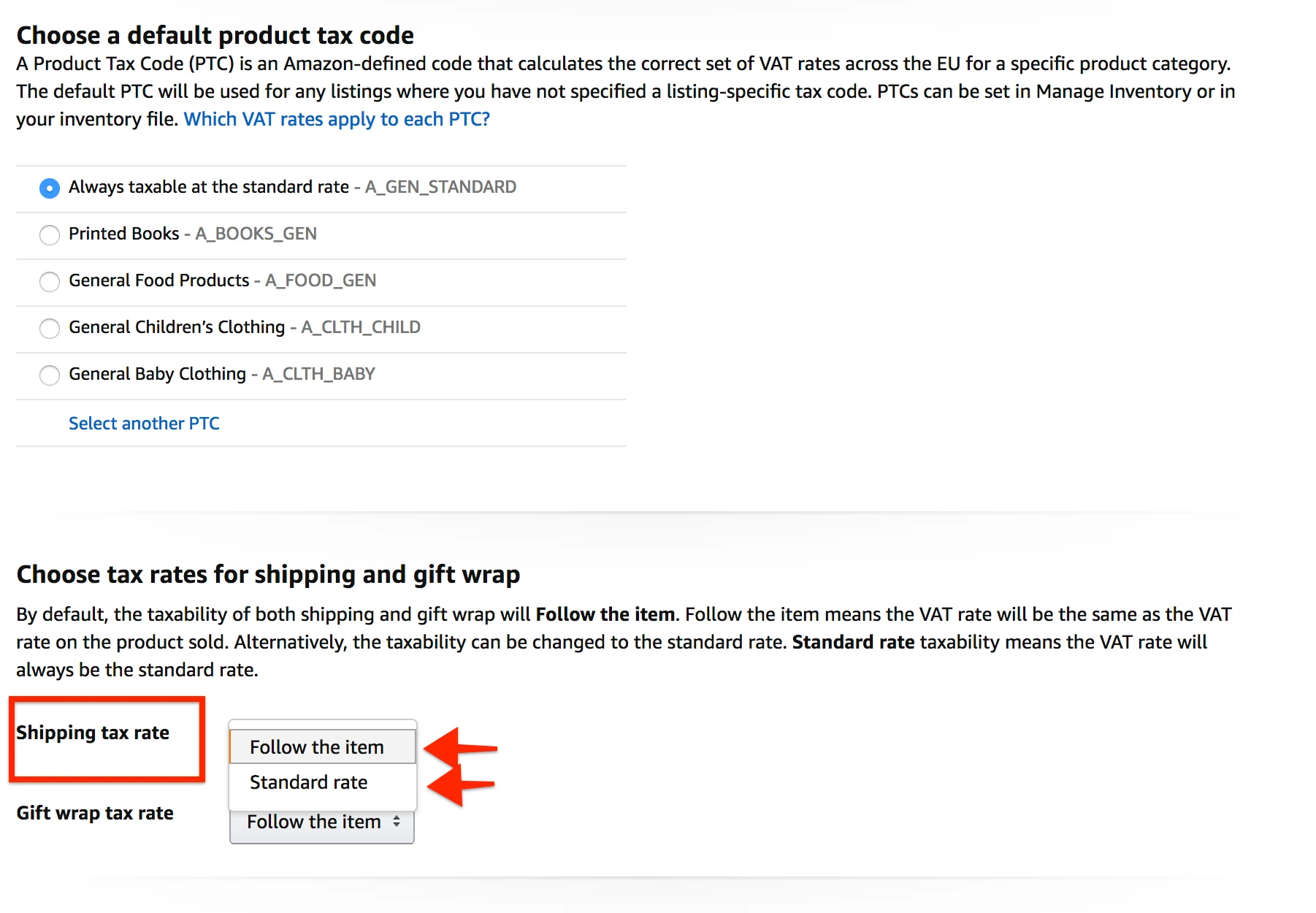

- Shipping Tax

- STAR Storage Billing

- STAR Storage Fee

- Subscription

- Subscription Fee Correction

- FBA Storage Fee

- Taping Fee

- Tax

- Tax Collected At Source

- Technology Fee

- FBA Transportation Fee

- FBA Try Before You Buy Multitier Per Unit Fee

- Variable Closing Fee & Fixed Closing Fee

- VAT Amazon Technology Fee

- VAT Fiscal Representation Fee

- VAT Manufacturing

- VAT Partner Fee

- VAT Product Cost

- VAT Purchase

- VAT Registration Fee

- VAT Transfer Fee

- Vine Fee

- Warehouse Damage

- Warehouse Damage Exception

- Warehouse Lost

- Warehouse Lost Manual

A2Z Guarantee Recovery

A2ZGuaranteeRecovery describes the credit note that Amazon gives to sellers in the event that an A-Z warranty case ends in the sellers' favor. This credit signifies a settlement in the seller's favor and compensates for any losses suffered as a result of the dispute. In essence, it pays vendors for any returns or exchanges that clients receive as part of the A-Z Guarantee scheme. This credit remark certifies the seller's compliance with Amazon guidelines and dedication to client happiness. By guaranteeing that sellers receive payment when conflicts are settled in their favor, it also contributes to the upkeep of fairness and trust in the marketplace.

ABA Fee

ABAFee is often referred to as the "Amazon Buy Box Adjustment Fee." It is payable to sellers who win the Buy Box but do not meet specific performance requirements established by Amazon. It's a penalty cost for failing to meet Amazon's minimum standards for merchants to remain competitive in the Buy Box. This fee is intended to motivate vendors to improve their performance indicators to better serve Amazon's consumers.

Advertise Catalog

This is a fee charged to the seller for running a broad campaign that promotes most or all of the products in their catalog. The goal is to drive visibility across the seller’s entire product offering. This is a seller advertising cost.

-

Advertise Catalog_ONB is an advertising fee charged to the seller as part of an onboarding program designed to quickly promote their full catalog. It’s usually offered to new sellers to help jumpstart traffic and sales. This is a seller-side campaign fee.

-

Advertise Catalog_Opt applies to an optimized version of the catalog ad campaign, using Amazon’s automation and performance data to improve reach and efficiency. It’s still a seller-paid advertising expense, designed to get better ROI on large catalog promotions.

Advertise Coupons

This is a seller fee for advertising products that currently have coupons enabled. It helps increase visibility of these offers in search results and deal pages, attracting discount-seeking shoppers. The cost is paid by the seller.This is a seller fee for advertising products that currently have coupons enabled. It helps increase visibility of these offers in search results and deal pages, attracting discount-seeking shoppers. The cost is paid by the seller.

Advertise Deals

This fee is charged to sellers who are running ads on limited-time promotions like Lightning Deals or Best Deals. These campaigns help boost traffic during the promotion period and are a form of paid visibility for the seller.

Advertise Excess FBA Inventory

This is a seller advertising fee aimed at moving overstocked or slow-selling FBA inventory. Amazon suggests or runs these campaigns to help sellers avoid long-term storage fees by encouraging sales. The seller pays for the ad spend.

Advertise Items with Low Traffic

This is a fee charged to the seller for advertising products that are not receiving much organic traffic. The campaign helps bring attention to underperforming listings. It’s a seller-driven marketing cost.

-

Advertise Items with Low Traffic_ONB - This version of the low traffic campaign is part of a new seller onboarding flow. It targets listings with little visibility and helps new sellers gain traction. The seller is responsible for this ad fee.

-

Advertise Items with Low Traffic_Opt - An optimized campaign for low-traffic products, this fee reflects advertising costs paid by the seller to improve performance using Amazon’s algorithmic suggestions. It’s part of a strategy to rescue slow listings.

Advertise New Products

This fee is for campaigns that focus on newly launched listings. It’s designed to help sellers generate early traffic and sales velocity. The seller pays this as part of their ad strategy.

Advertise Seasonal Products

This is a seller fee for promoting products relevant to specific seasons or holidays, such as summer gear or Christmas décor. These campaigns help sellers tap into seasonal demand and trends.

Advertise Top Selling Items

This is a fee charged to the seller for campaigns centered around their best-performing products. These campaigns often have a high return on ad spend, and sellers pay to maintain top product visibility.

-

Advertise Top Selling Items_Opt is the top-selling item campaign uses Amazon’s performance data to optimize ad placements. The fee is paid by the seller and is intended to increase efficiency and profitability on already popular listings.

Amazon Accelerator Fee

For merchants who enroll in Amazon's Launchpad program, there is an additional fee known as the AmazonAcceleratorFee. This initiative supports startups and emerging brands by increasing their awareness and providing marketing assistance. The Accelerator Fee is additional to Amazon's standard selling fees and is typically calculated as a percentage of each sale.

Link Your Amazon Account Now

Amazon Exclusives Fee

The AmazonExclusivesFee is a fee charged by Amazon to sellers who want to enroll their products in the Amazon Exclusives program. This program is designed for sellers who have unique and innovative products and want to showcase them exclusively on Amazon.

Amazon For All Fee

AmazonForAllFee describes a charge for Amazon services that are intended to increase accessibility or encourage diversity. This fee may be part of programs or initiatives designed to support sellers or enhance customer experiences across diverse demographics. For the most up-to-date information on this cost, it is recommended to consult your Seller Central account or Amazon's official paperwork, as the specifics and intent may differ.

Amazon Shipping Chargebacks

Penalties known as AmazonShippingChargebacks are levied against sellers or outside logistics companies who violate Amazon's particular shipping regulations. Inaccurate labeling, poor packaging, missed shipping dates, inappropriate routing, or a lack of paperwork can all lead to these problems. When shipments to Amazon's fulfillment centers don't meet the necessary requirements, chargebacks happen, and a seller's revenue may suffer from repeated infractions. To avoid these fines, you must adhere to Amazon's shipping policies.

Amazon Shipping Charges

When using Amazon's fulfillment services to ship their products, sellers must pay Amazon shipping charges. These fees change according to the product's weight, size, and delivery time. Shipping, packing, and storage are all covered by fees for Fulfillment by Amazon (FBA). Merchant Fulfilled Network (MFN) merchants are in charge of their own delivery and pricing. Shipping may be included in the Prime membership for products that qualify for Prime, but sellers are still responsible for fulfillment fees.

Amazon Shipping Reimbursement

Amazon Shipping Reimbursement reimburses sellers for inventory that is misplaced, damaged, or handled improperly. Issues like misplaced or broken goods, improper customer returns, inaccurate fulfillment, and delays are all covered by reimbursements. Based on the value of the impacted inventory, Amazon reimburses sellers who submit claims.

Learn About the New Reimbursement Claim Deadlines

Amazon Upstream Processing Fee

AmazonUpstreamProcessingFee is a fee associated with Amazon's inventory management and supply chain services. This includes handling inventory before it gets to the fulfillment centers, labeling, packing, and ensuring the products satisfy Amazon's specifications. In addition, the cost consists of extra services like quality inspections and other essential processes to guarantee that the goods are prepared for transportation and storage. This charge supports the upkeep of quality and efficiency in Amazon's supply chain.

Amazon Upstream Storage Transportation Fee

Inventory moved from an upstream storage facility—which is located outside of Amazon's primary fulfillment centers—to an Amazon fulfillment center is subject to a transportation fee called AmazonUpstreamStorageTransportationFee. With the charge covering the cost of transportation, this service assists sellers in managing inventory by storing extra merchandise in less expensive storage facilities and moving it to Amazon's warehouses when needed.

Automated Campaign

This is a fee for an Amazon-run campaign where Amazon automatically selects keywords and targeting based on the seller’s product content. It’s an advertising charge to the seller and is meant to simplify ad setup.

Bubblewrap Fee

When products need to be packaged with bubble wrap, there is a fee known as the BubblewrapFee. It ensures that sellers are charged for the additional materials required to protect their items during transit, maintaining the quality of the goods while in Amazon's fulfillment network.

FBM Bump

FBM Bump is charged when an FBM seller's listing is granted a higher ranking or "bump" in search results or on the product page, potentially improving visibility and sales. The particular nature and conditions of this fee can vary, but it is usually part of Amazon's efforts to regulate and optimize the placement of FBM listings in its marketplace.

Get FBM Fees Breakdown in Seconds

Buyer Recharge

The BuyerRecharge is a fee charged to sellers when buyers pay with prepaid method such as gift cards. This fee helps Amazon cover the costs of processing these payments and varies based on the payment method and country of origin. Sellers should consider this fee because it influences their overall selling costs on the marketplace.

Buy with Prime CS Error Non Itemized

BUY_WITH_PRIME_CS_ERROR_NON_ITEMIZED appears to be related to an error or problem with customer support in the "Buy with Prime" program. The "Buy with Prime" function enables sellers to provide Prime benefits (quick delivery and easy returns) directly on their own websites. The CS_ERROR_NON_ITEMIZED component indicates that this price is for a non-itemized issue, which means that the error or expense is not broken down by product or service.

For example, if Amazon encounters a customer service difficulty when fulfilling an order through the "Buy with Prime" program, such as a system error at checkout or a delivery issue, this fee may be charged to offset the associated costs. It could be around $5, but it's most likely situational and unpredictable.

Buy with Prime Customer Refund

BUY_WITH_PRIME_CUSTOMER_REFUND is applied when Amazon processes a customer refund via the "Buy with Prime" program. If a buyer purchases a product through "Buy with Prime" and decides to return it, Amazon refunds the customer and charges the seller for the refund. The charge could cover the cost of processing the return or any associated services.

FBM Carriage

FBM Carriage refers to the shipping and handling fees incurred by a seller when fulfilling orders directly through the Fulfilled by Merchant (FBM) service. This fee covers the costs associated with packaging, transporting, and delivering products directly to customers rather than using Amazon's fulfillment services. The FBM Carriage Fee is calculated using parameters such as shipping mode, distance, and the size and weight of the objects being sent.

Cast a Wide Net

This campaign is a broad reach strategy where Amazon targets a wide audience, often beyond your typical customer base. The fee is paid by the seller and is meant to discover new customer segments.

-

Cast a Wide Net_OOC - "OOC" stands for "Out of Category." This version of the broad targeting campaign reaches customers browsing unrelated product categories. It’s a seller-paid fee designed to expand market exposure.

-

Cast a Wide Net_SO - "SO" stands for "Similar Offers." This campaign targets shoppers who are browsing products similar to yours, including those sold by competitors. The fee is paid by the seller to gain a competitive edge.

Catch All

These are typically generic ad campaigns or buckets created in Sponsored Ads (like Sponsored Products or Sponsored Brands) to capture broad or leftover traffic.

-

"SO" might stand for "Sponsored Offers"

-

"SSO" could mean "Sponsored Store Offers" or a similar variation depending on the ad setup

These are often used when campaigns are designed to grab residual traffic from non-targeted or lower-priority keywords.

Category Targeting

This refers to category-level advertising targeting in Amazon Ads.

Instead of targeting specific keywords, you're choosing to show your ads to shoppers browsing within certain product categories (e.g., "Sports Nutrition").

It helps increase visibility within related listings, especially during product launches or when testing performance across broad audiences.

Chargeback Recovery

ChargeBackRecovery is a fee that sellers must pay when a customer disputes a charge and requests a chargeback from their bank. This fee helps Amazon cover the costs associated with managing and resolving these disputes.

CLI Planned Fee Reimbursement

The process of paying Amazon sellers for planned fees, such fulfillment or referral fees, is referred to as CLI_PLANNED_FEE_REIMBURSEMENT. It makes sure that sellers get paid for any fees that they are entitled to but that were either levied in error or changed as a result of policy changes. This aids sellers in controlling expenses and preserving profitability.

COD Chargeback

CODChargeback is a fee applied to sellers when a customer disputes a Cash on Delivery (COD) order and demands a refund. This charge covers the costs of processing the dispute. Sellers should be aware of this fee because it impacts their total expenses when COD chargebacks occur. Sellers should be aware of this fee because it might influence their total profitability, particularly if they receive frequent COD chargebacks. Understanding and handling COD orders efficiently can help to reduce the occurrence of such fees.

Track Your Chargebacks

COD Item Charge

CODItemCharge applies to individual items in a Cash on Delivery (COD) order. It covers the additional fees associated with processing each item when paid for via Cash on Delivery (COD) .

COD Item Tax Charge

CODItemTaxCharge is a fee charged to sellers to handle the tax associated with items made via Cash on Delivery (COD). It is applied to each individual item in a COD order. This fee covers the additional costs associated with processing and collecting the tax amount when clients pay in cash at the time of delivery. Since COD payments require specific handling and additional administrative work to ensure that the tax is properly managed and recorded, this charge helps Amazon cover those extra expenses.

COD Order Charge

CODOrderCharge is a fee charged to sellers when customers pay for their goods using Cash on Delivery (COD) per order. This fee is meant to offset the additional costs associated with accepting and processing COD payments, such as the logistical fees involved in collecting cash from clients at the time of delivery.

COD Order Tax Charge

CODOrderTaxCharge is charged on the total order amount if the customer selects Cash on Delivery (COD) as the payment method. It includes the expenses related to managing and gathering the tax for the entire purchase.

COD Shipping Charge

CODShippingCharge is a charge that sellers incur for managing and shipping orders that are paid for using Cash on Delivery (COD). This fee includes additional expenses for shipping cash on delivery orders, such as managing payment collection upon receipt.

Start Tracking Your Shipping Fees Now

COD Shipping Tax Charge

The CODShippingTaxCharge is a charge sellers must pay to cover the tax linked to shipping orders paid through the Cash on Delivery (COD) method. This charge covers the extra expenses related to handling and dealing with the shipping fee for cash on delivery purchases. When a customer chooses Cash on Delivery (COD), the tax on the shipping fee must be computed, gathered, and managed distinctly.

Commission

Amazon earns a variable sales fee, commonly known as a Commission or referral fee, from your sales on their platform. This fee is a core charge for the privilege of selling on Amazon and is typically 15% of the gross sales, varying by category. While the most common fee is 15%, it can range from 6% for personal computers to 96% for warranties. For example, if you sell a $1000 PC, your commission to Amazon would be $60, and for a $100 warranty, the commission would be $96. It's important to check the official Amazon list of commission fees for accurate and up-to-date information as these fees can change.

Commission Correction

CommissionCorrection represents an adjustment to previously assessed Amazon referral commissions. It may occur when an order is refunded, updated, or re-categorized into a different commission structure.v

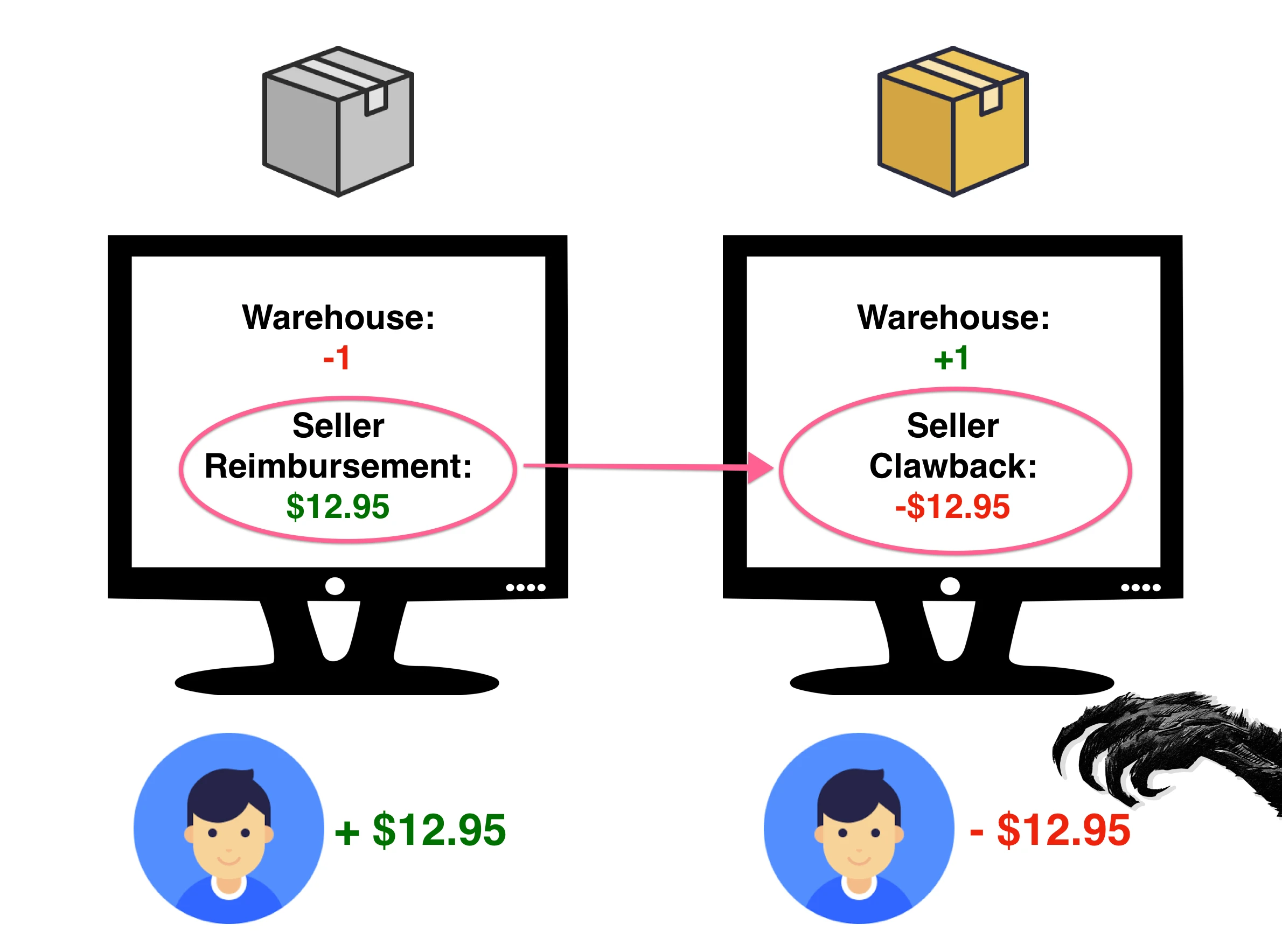

Compensated Clawback

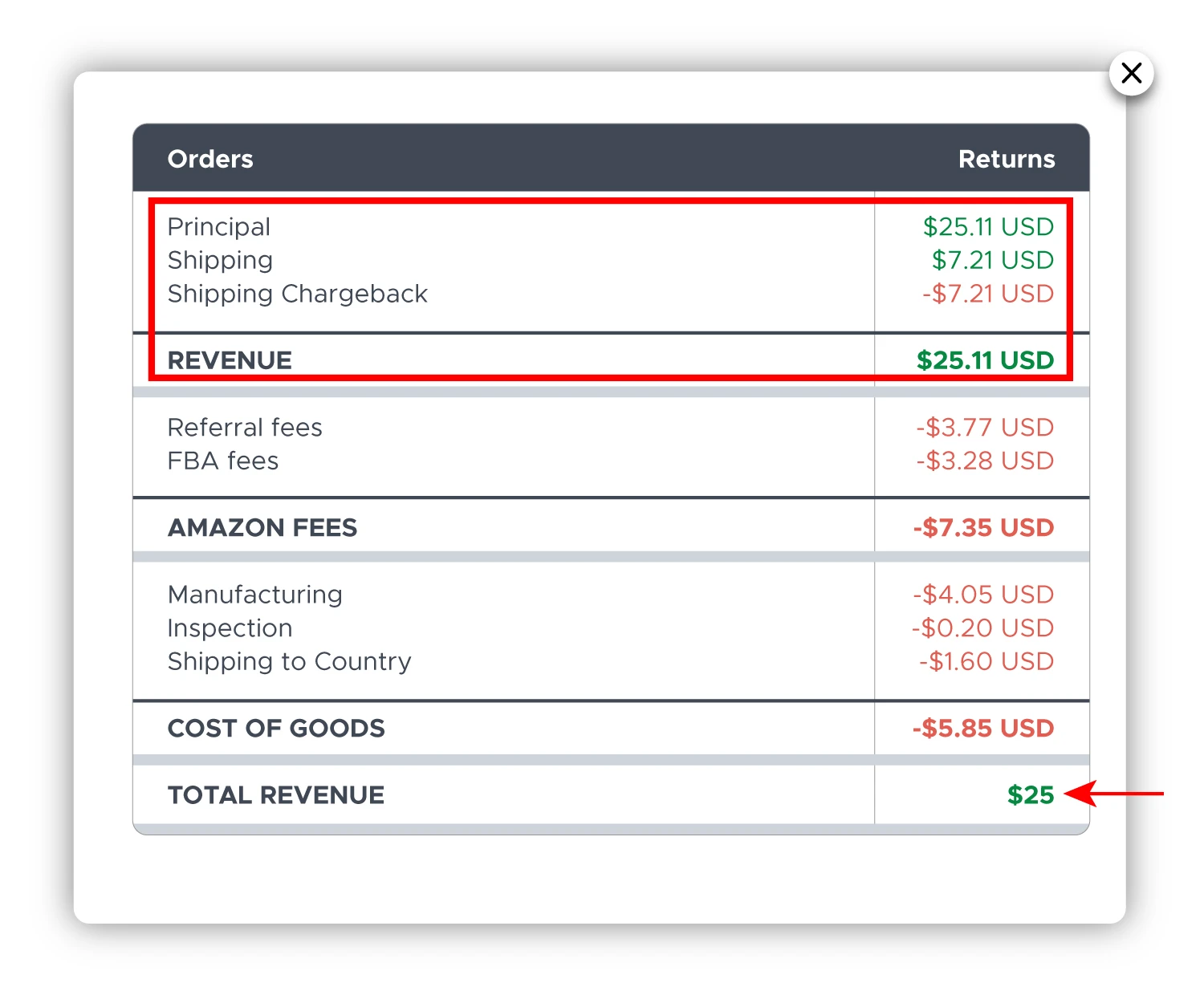

| Clawback is also called Reversal Reimbursement, MISSING_FROM_INBOUND_CLAWBACK, COMPENSATED_CLAWBACK. |

|---|

Compensated Clawback is when Amazon takes back ("claws back") the money that they paid you as a reimbursement before.

You could just watch this video I recorded about Amazon Clawbacks, instead of reading this section:

Here's a typical clawback event story:

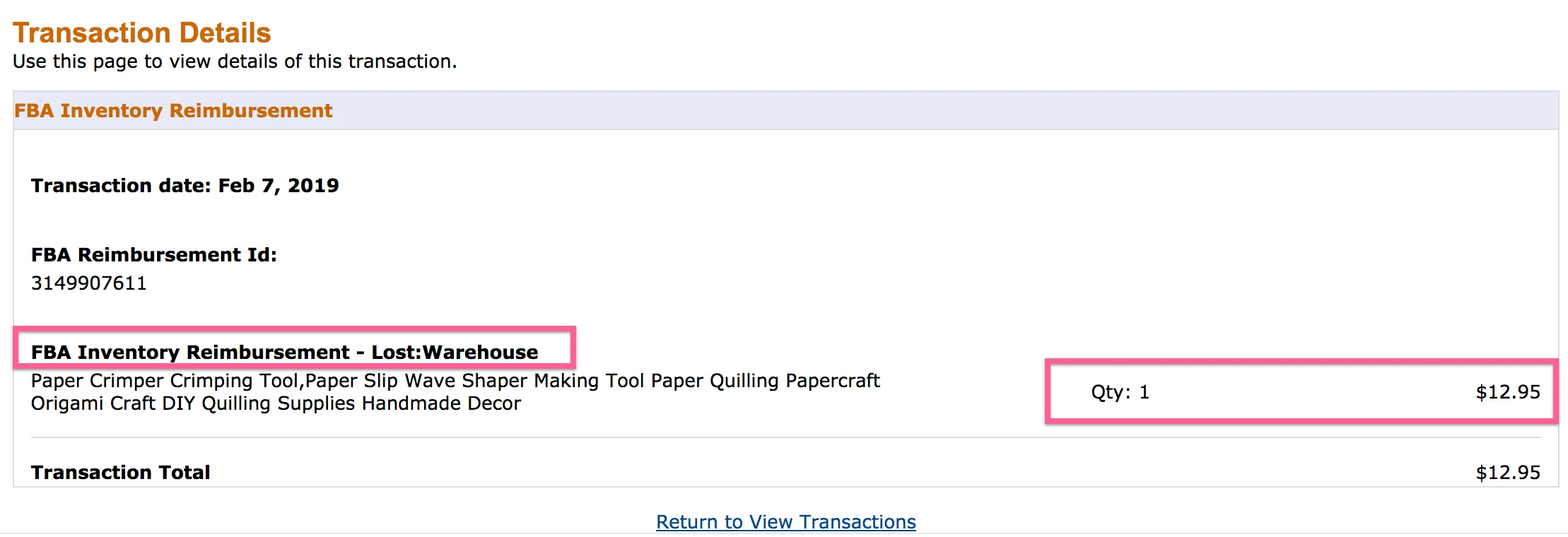

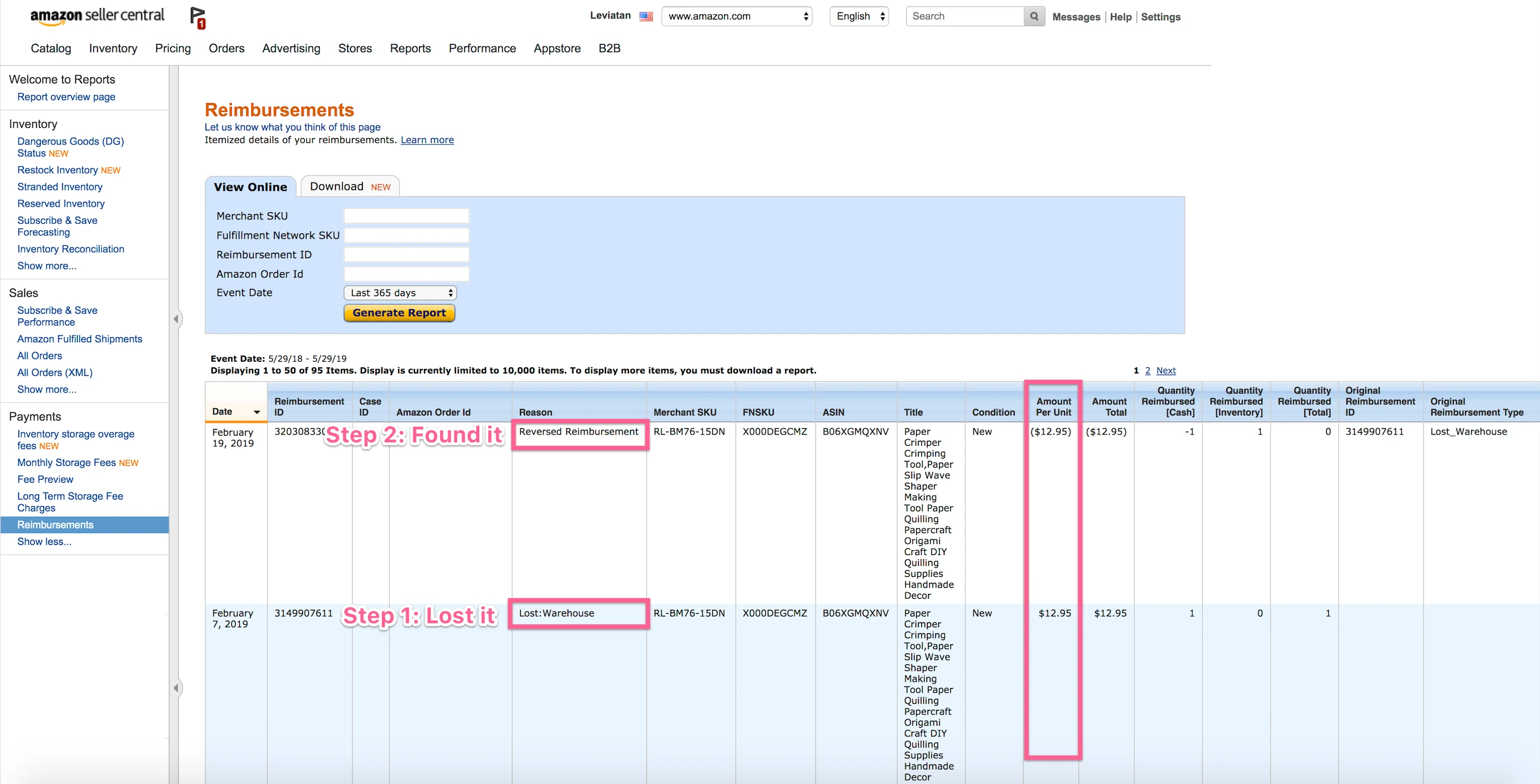

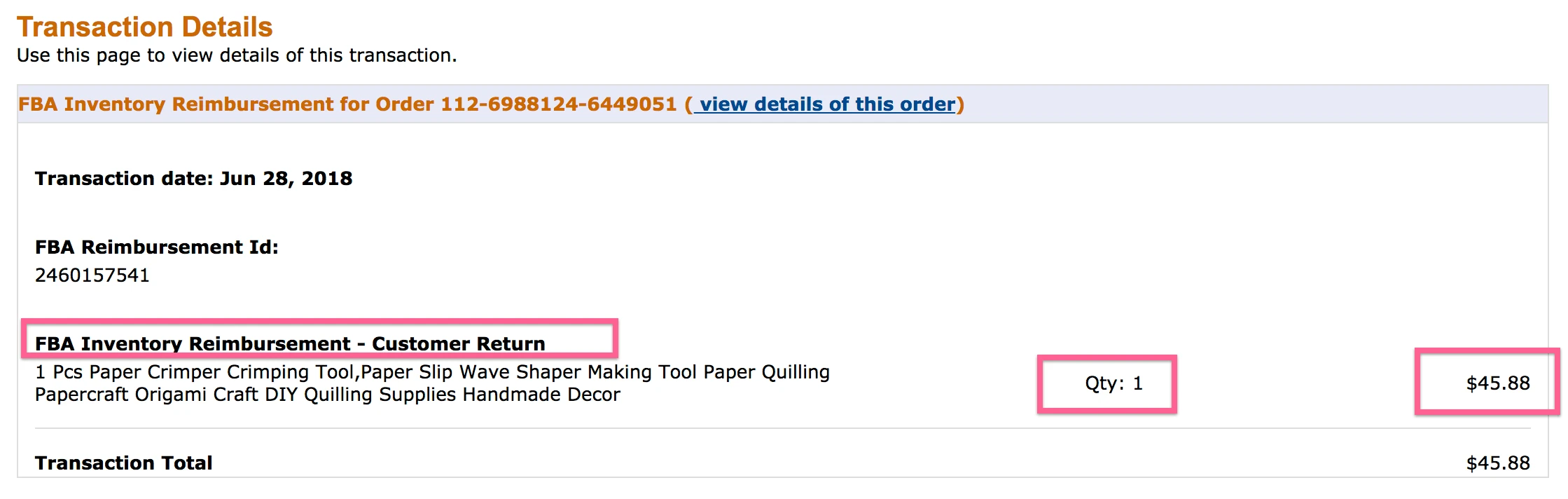

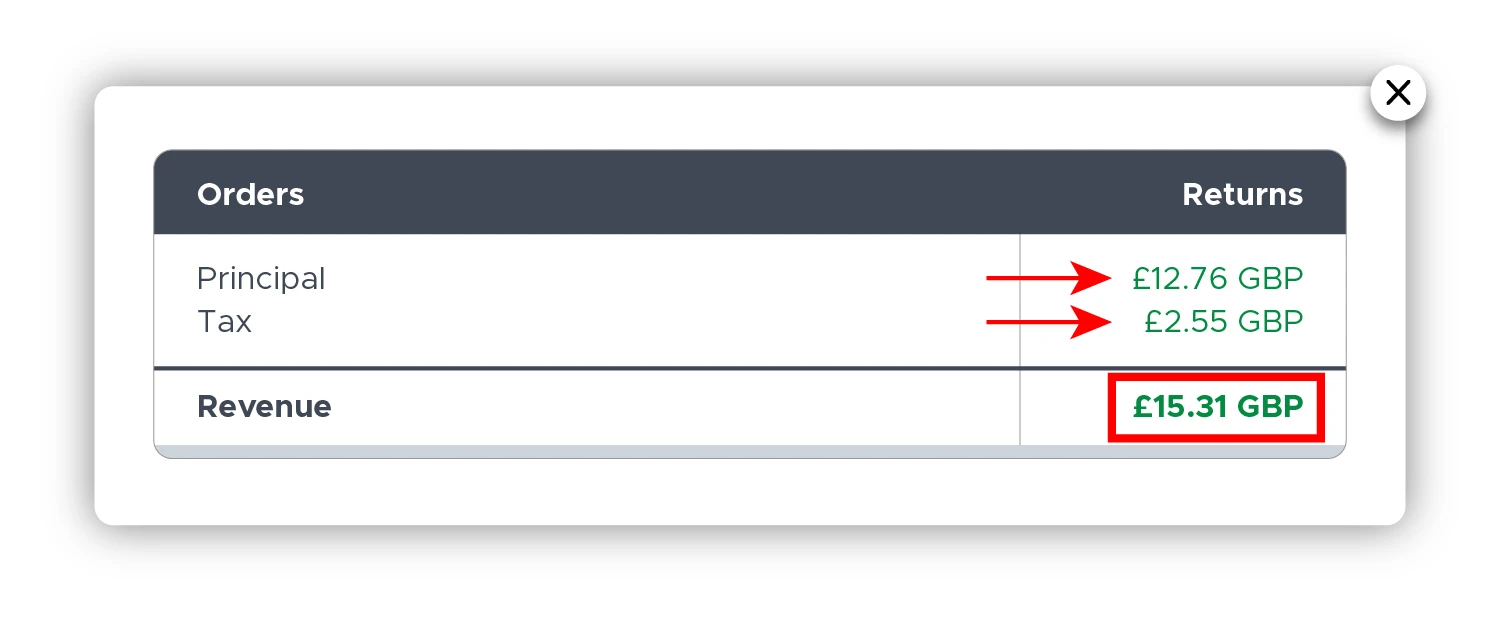

Step 1. Amazon warehouse loses or damages your product, so they issue you a reimbursement to compensate for it. It is called FBA Inventory Reimbursement, and it looks like this in Seller Central:

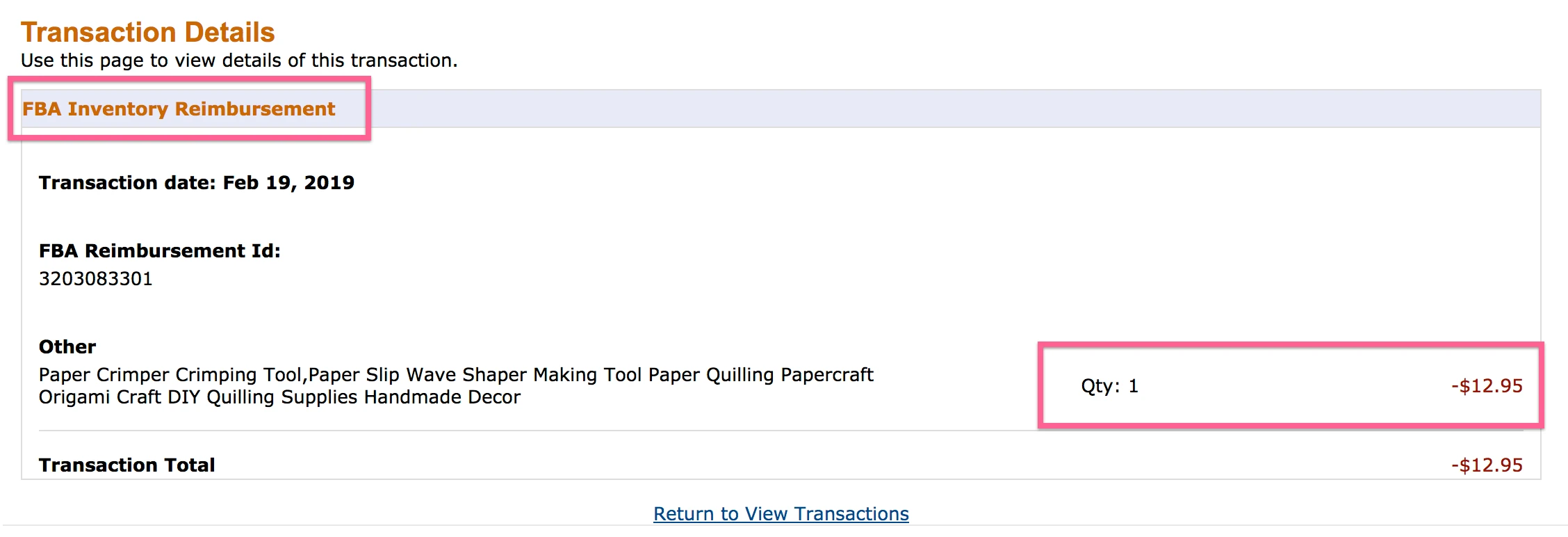

Step 2: Amazon later rediscovers/finds lost item, so they take back ("claw back") the previously reimbursed amount. The Compensated Clawback is recorded as a negative Inventory Reimbursement event (they charge you):

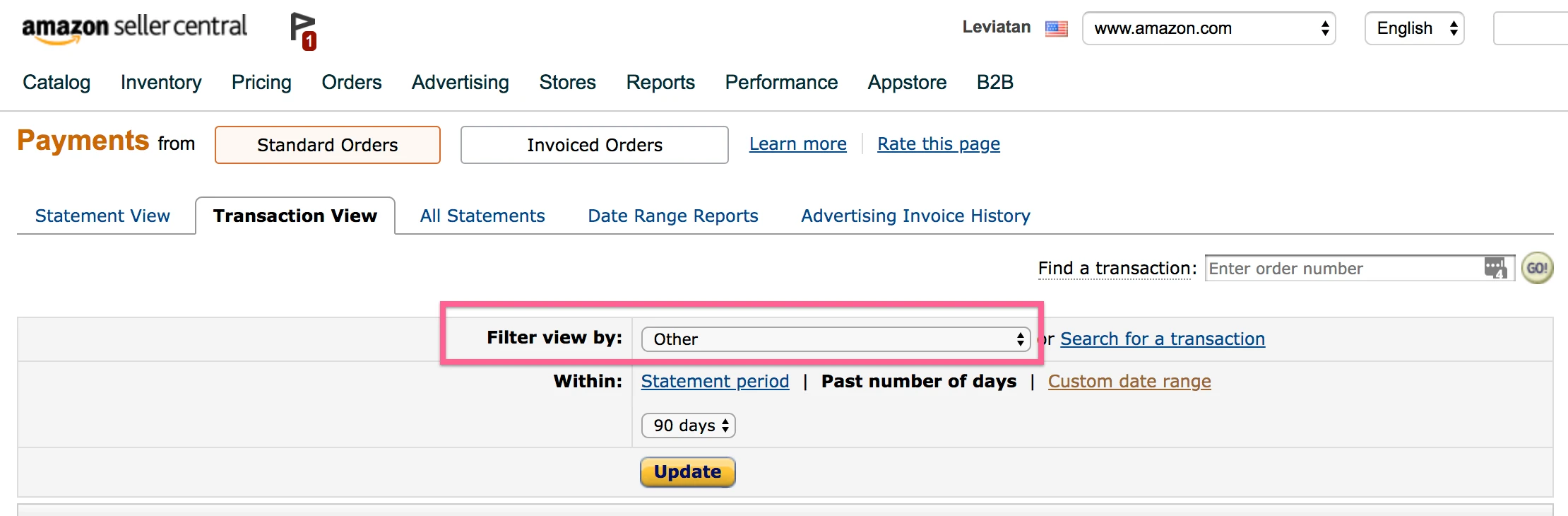

Most likely you will first stumble upon Step 2 transaction in your Transaction reports, and you won't be able to easily track down what was the original reason for the reimbursement and what date it happened.

To find the original event, you will have to go to your Reimbursements Report on Seller Central:

It becomes clear from Reimbursement Report, that the item was lost by the warehouse and 12 days later found again.

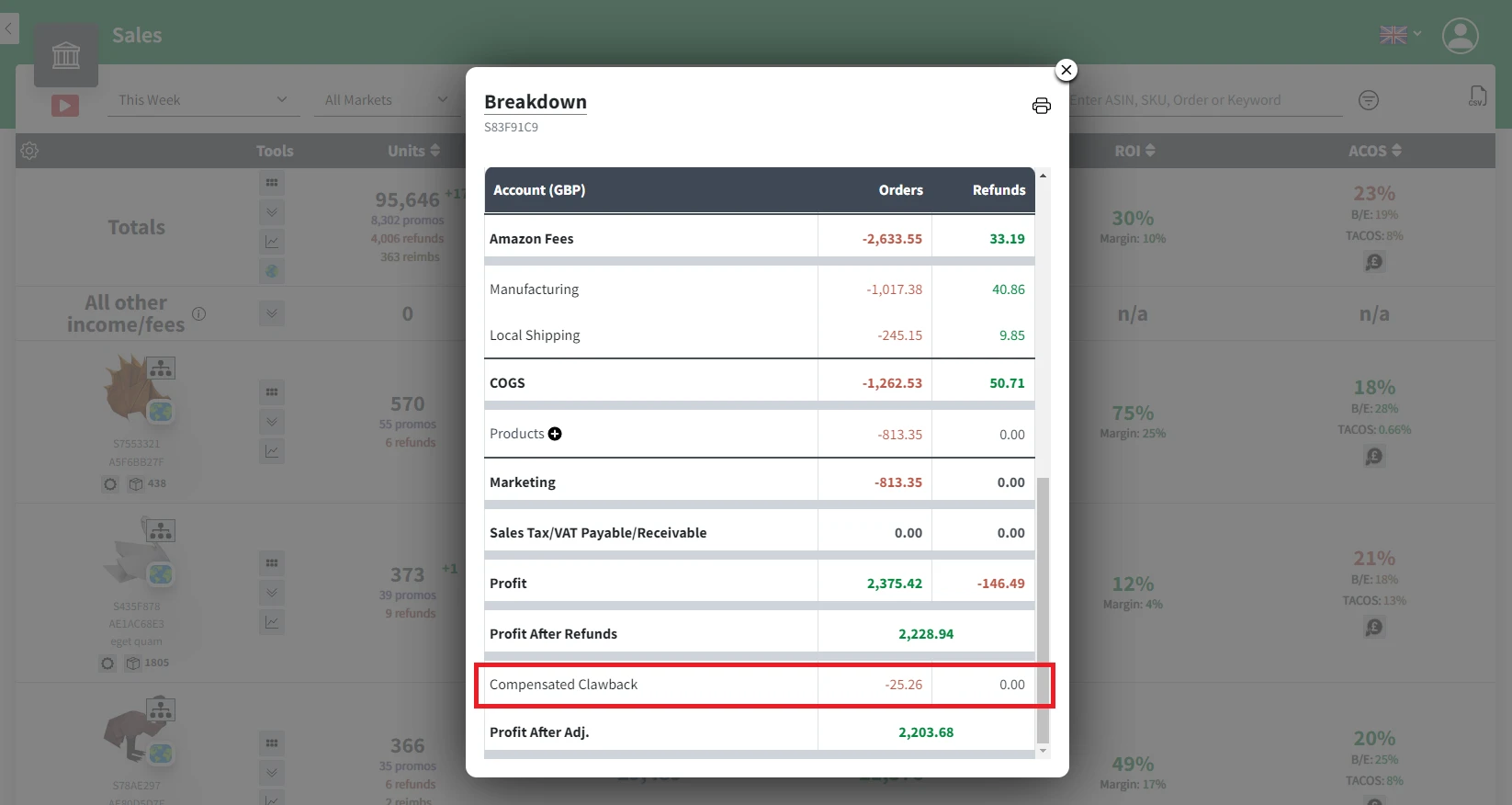

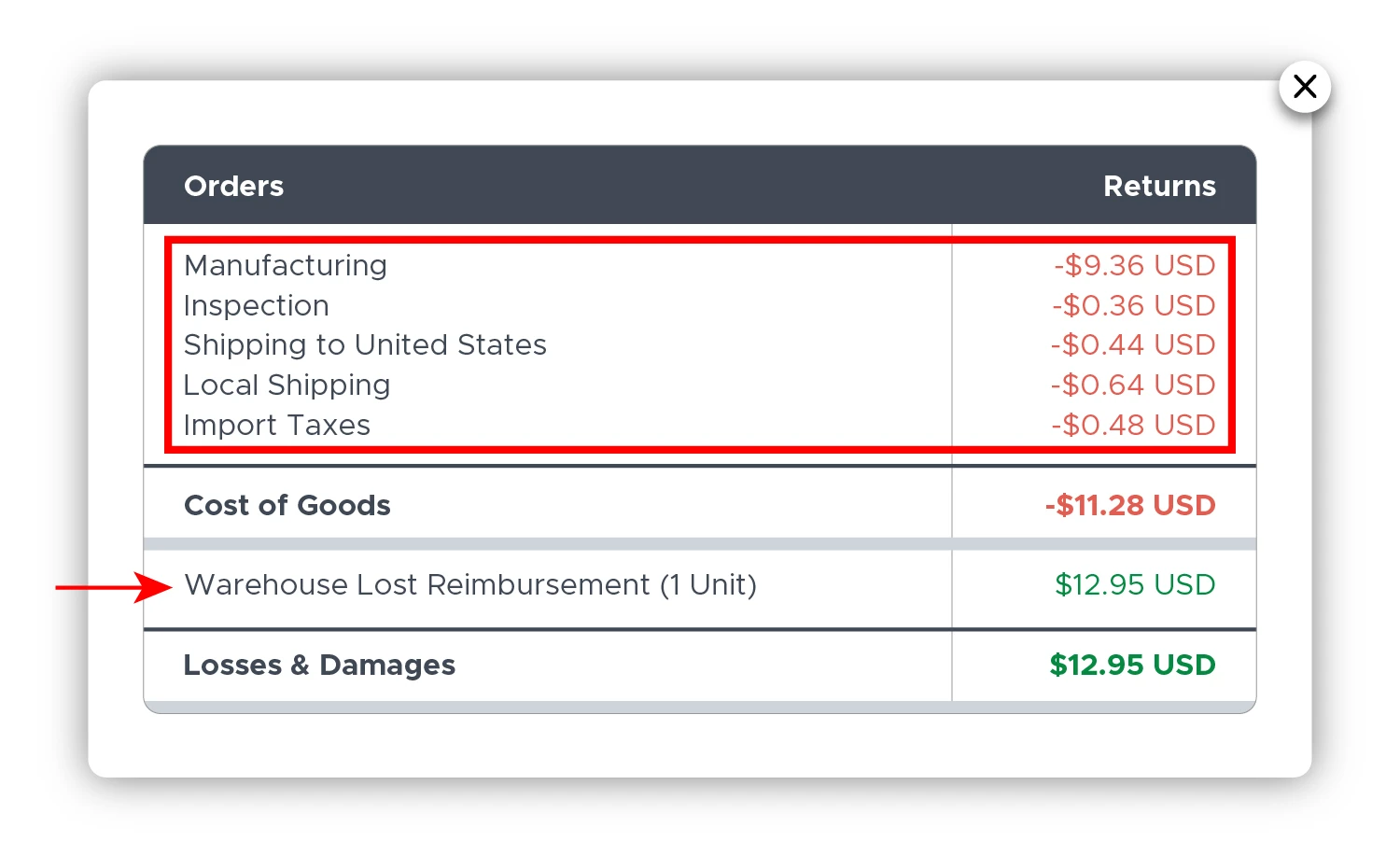

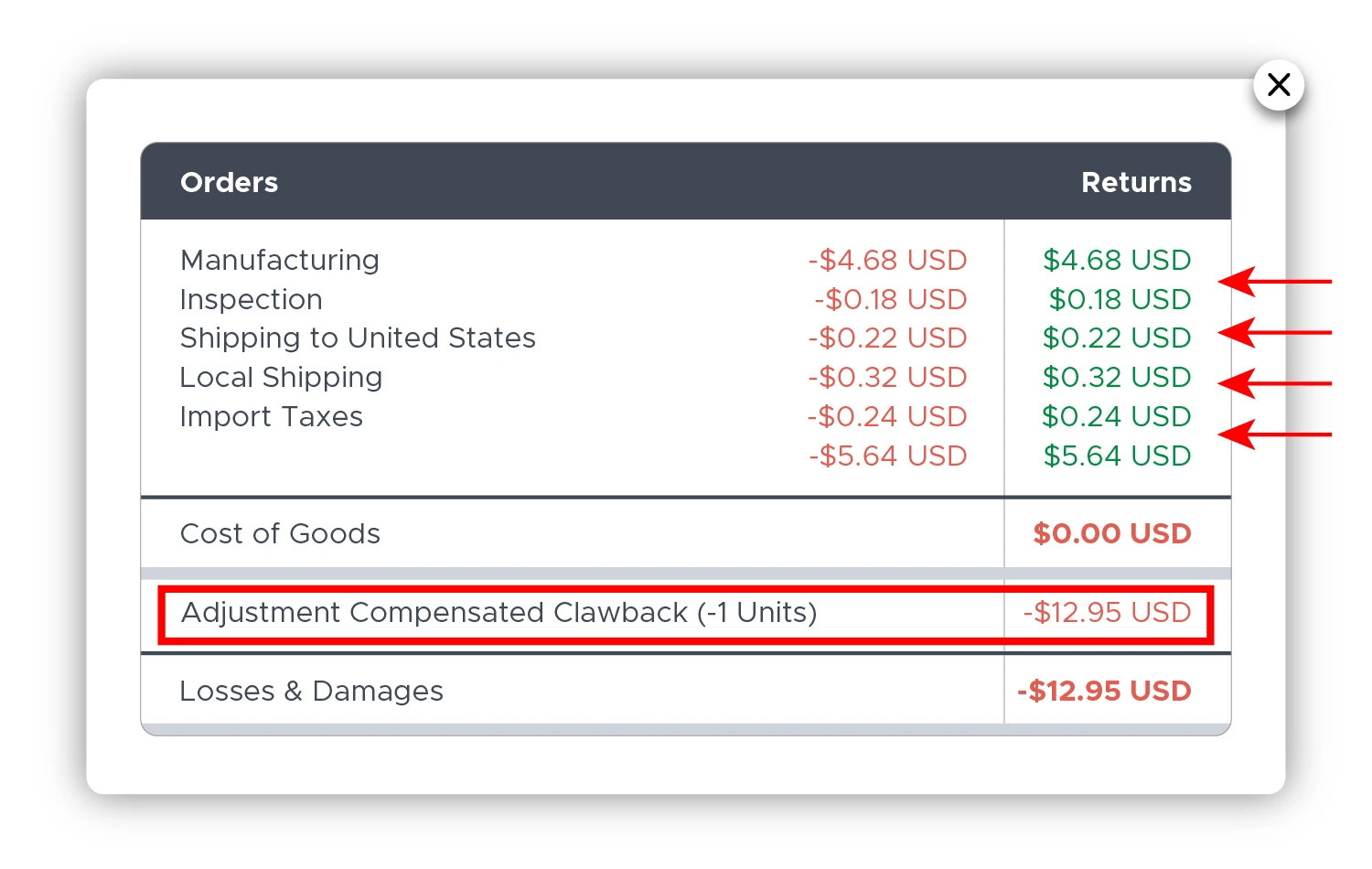

Shopkeeper will track both the Reimbursement and the Compensated Clawback, and assign both financial transactions to the affected ASIN:

Shopkeeper will also account for the fact that when you lose a unit, you incur Manufacturing and Shipping costs for it.

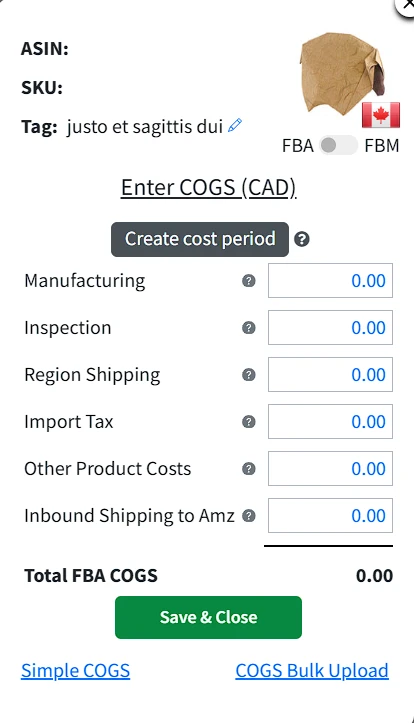

Let's say your costs for one unit are these:

When Amazon loses your item and sends you some money for it to reimburse you, then you want to offset that income with your costs for the lost item - manufacturing, shipping, import tax, etc. Otherwise it would just look like you made 12.95 in profit.

Shopkeeper subtracts your costs for the unit, on the day Amazon loses it:

When the clawback is issued and reimbursement gets reversed 12 days later, Shopkeeper puts back the Manufacturing and other custom costs for your product, to your balance.

Because Amazon found your lost unit, it means you don't want to actually show the costs yet - the item is still in your warehouse. Manufacturing and other costs of goods will be applied when the next sale comes in or another unit is lost.

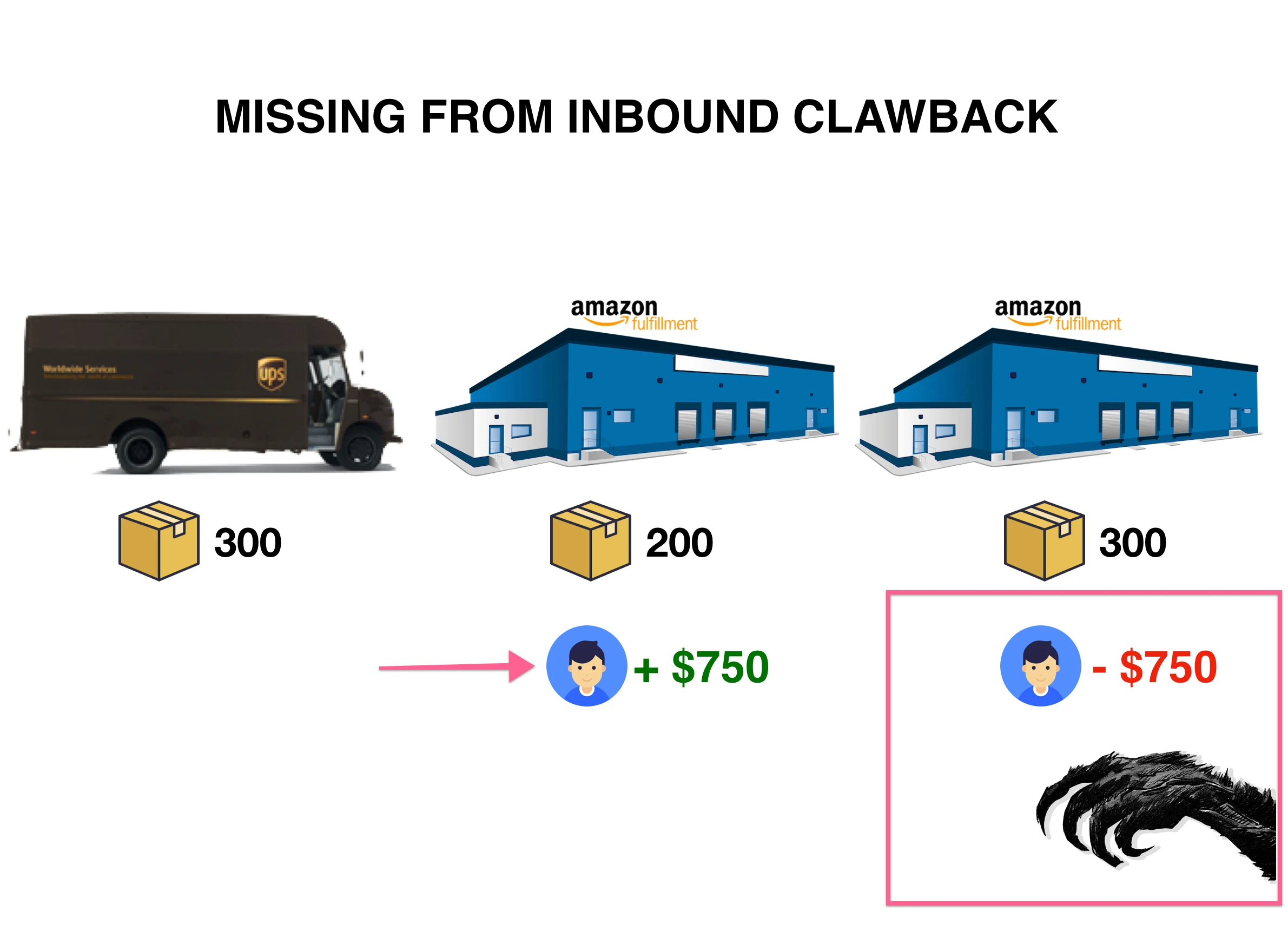

Missing from Inbound Clawback is also a Reversal Reimbursement, but applied specifically in cases where a previous reimbursement was issued due to units missing in the inbound delivery process.

For example, if UPS truck was bringing 300 units to Amazon warehouse, but only 200 arrived - Amazon will issue a Reimbursement for 100 units to you. If they later magically find the missing units, Amazon will "claw back" the reimbursed amount from you:

Manage Clawbacks Now

Coupon Redemption Fee

Amazon charges sellers a fee called the CouponRedemptionFee when shoppers use coupons during checkout for discounts. This fee covers the costs of managing coupon redemptions. Amazon charges a $0.60 redemption fee per coupon used. The fee varies based on factors like the product type and discount amount. Sellers should consider this fee when planning prices and promotions. Understanding and budgeting for the Coupon Redemption Fee helps sellers manage costs and make the most of their coupon offers to attract customers and boost sales.

CReturn Wrong Item

| CReturn Wrong item is also called CRETURN_WRONG_ITEM. |

|---|

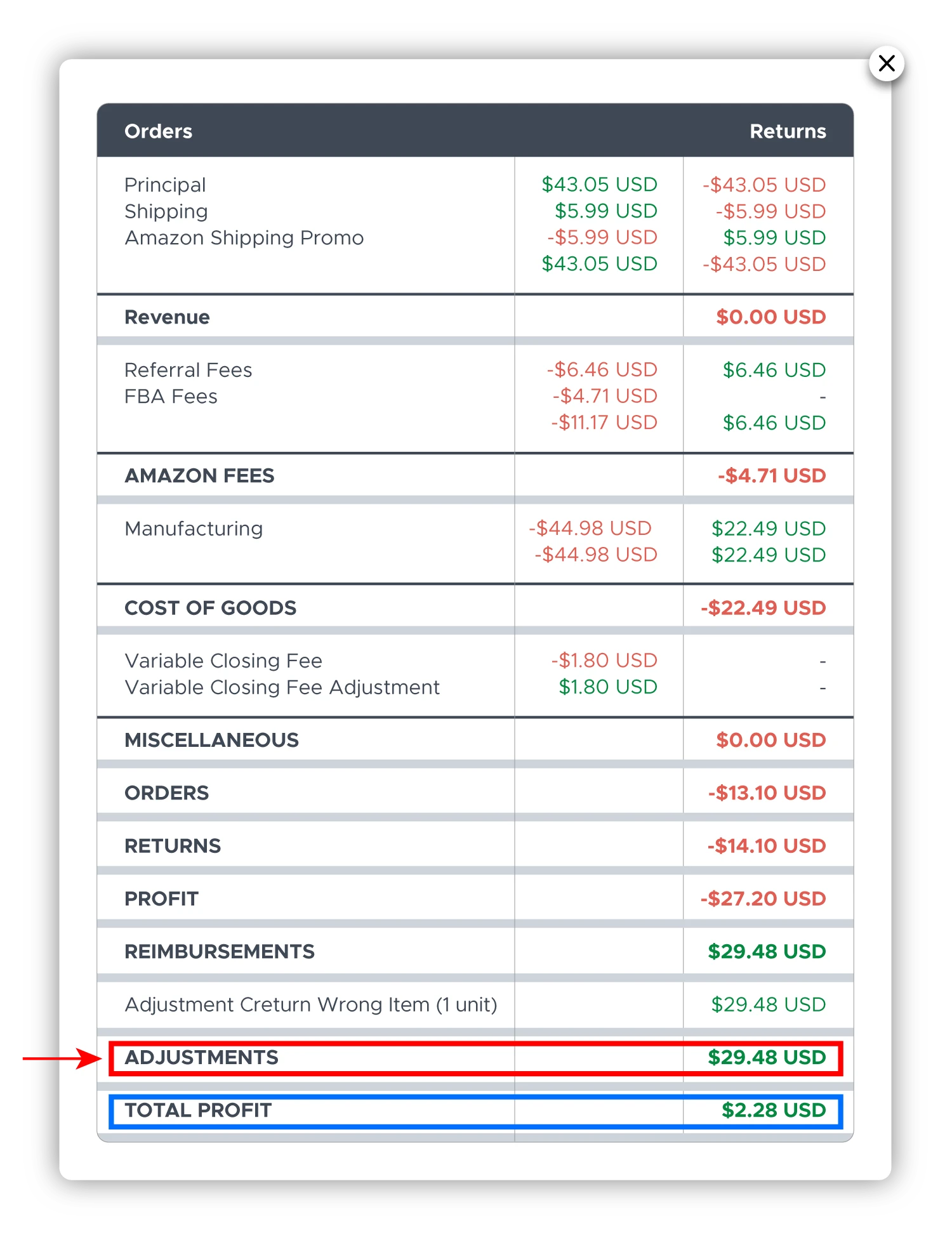

CRETURN_WRONG_ITEM is a reimbursement, issued to you by Amazon on FBA orders, when a customer returns a wrong item to the Amazon warehouse after a refund.

So basically customer buys a 32GB USB Stick from you, files a refund, and then sends back in the wrong item, for example, 10GB USB Stick instead.

This is similar to normal Inventory Reimbursement, when a customer does not return the item back to Amazon in 45 days. With Inventory Reimbursement, when an item is refunded, but not physically returned to the warehouse in 45 days - Amazon charges your customer and gives you a reimbursement for the item.

The same happens with CReturn Wrong Item Reimbursement. When a customer returns the item back to Amazon, but it's not the item he purchased, Amazon assumes that he did not return the item and charges the customer for it, reimbursing you at the same time.

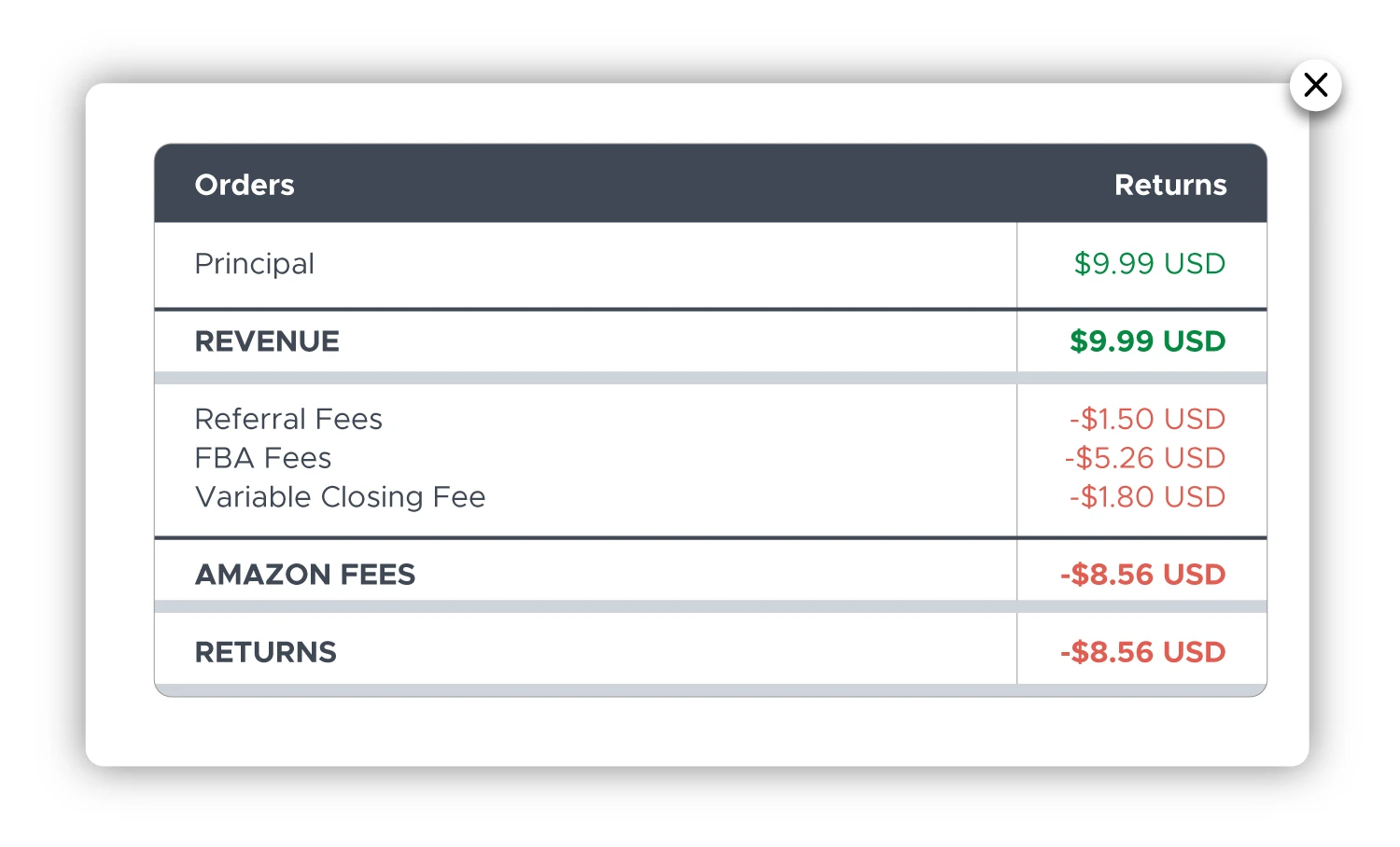

Here is how you will see CRETURN_WRONG_ITEM reimbursement in Shopkeeper:

Instead of showing $-27.20 loss due to a refund, Shopkeeper takes into account Reimbursement for this unit, and shows you total profit of $2.28.

The way Shopkeeper shows it together in one view, lets you see a more complete picture of what happened with this particular order. Now you know that each refunded item which is not returned properly, actually makes you $2.28 USD in profit.

You should be happy when customers are Switcheroos or Forgetfuls. Amazon charges them and you recoup some money from a refund, when normally you would be just losing money.

CReturn Wrong Item reimbursement is only issued automatically on AFN (Amazon-fulfilled) orders. That is, only when Amazon is the one handling the returns.

If your order was MFN (Merchant-fulfilled), then you will have to file a SAFE-T claim, to get a similar reimbursement.

Note: this is an article in Progress, another 49 fees to be added in the next two months.

CSBA Fee

The CSBAFee is a fee charged to Amazon sellers for customer service support, which helps to ensure that customers receive timely and professional assistance. If a seller chooses to conduct customer service through Amazon and incurs fees connected with managing returns or resolving customer inquiries, the CSBAFee will cover these costs. For example, if a consumer complains about a purchase and Amazon resolves it on the seller's behalf, the CSBAFee will be deducted from the seller's account.

CS Error Items

| CS Error Items is also called CS_ERROR_ITEMS, CS_ERROR_NON_ITEMIZED, CSErrorNonItemized |

|---|

This is an error adjustment, related to or performed by customer service department.

Most often it's a positive deposit to your account, made after Amazon overcharges you on something. To correct previous charges, they issue a deposit to you which shows up in Other transactions:

Sometimes an order-id is associated with it, and sometimes it is not.

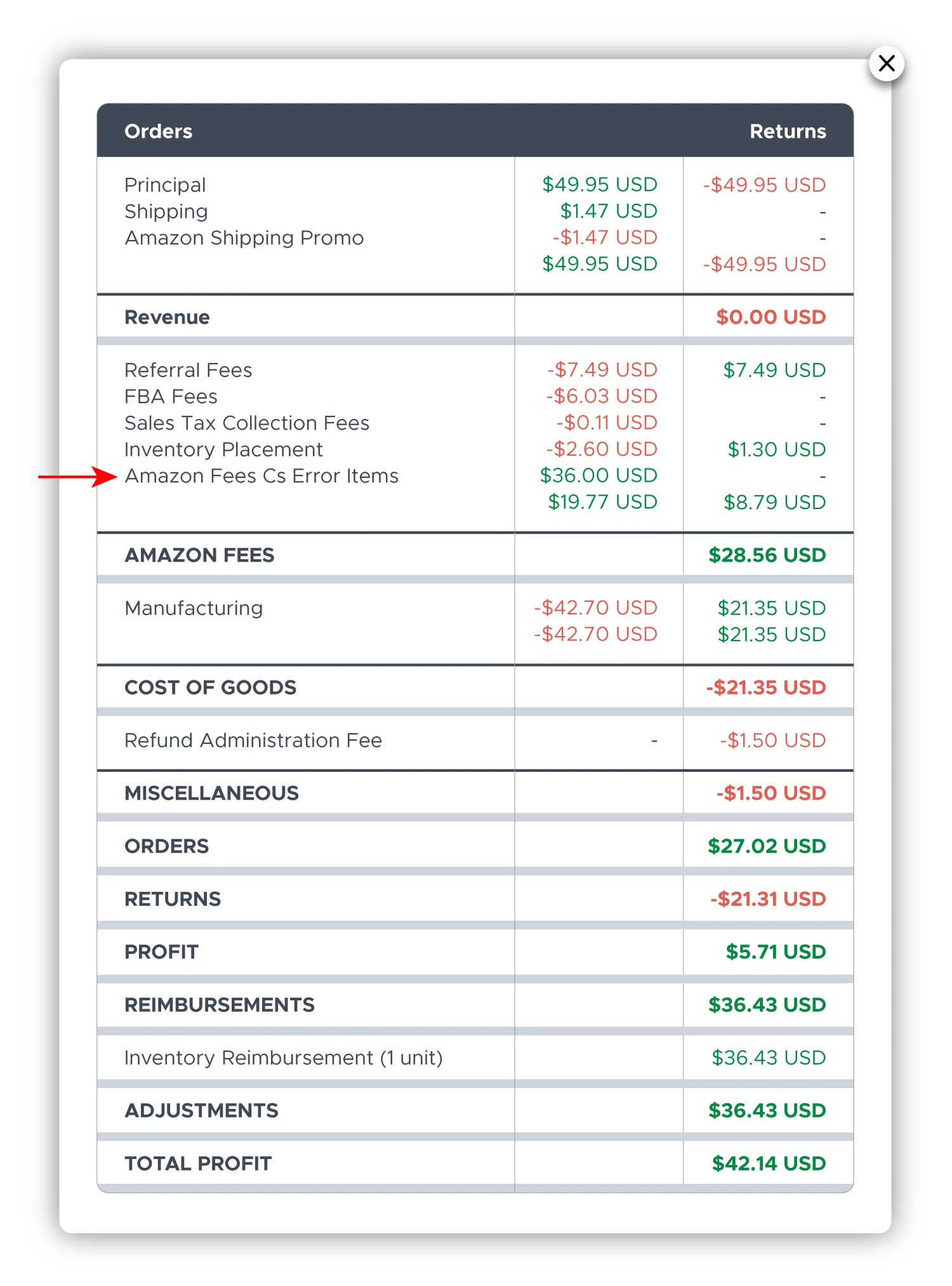

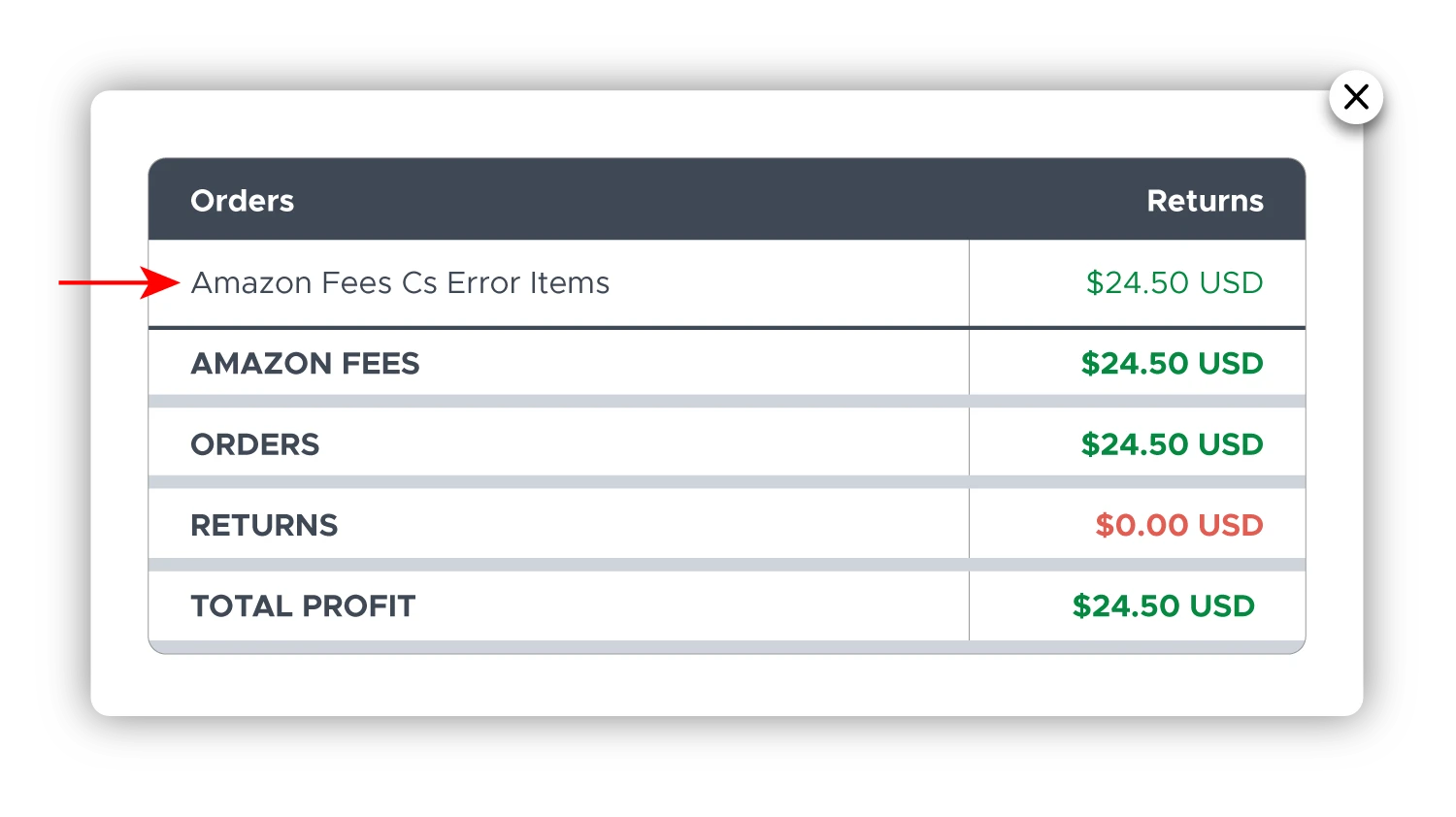

Shopkeeper shows this adjustment either on a particular order-id, like this:

..or on the ASIN on the day that it was charged:

Even if a product had no sales on that day, Shopkeeper will still show all financial activity that happened during that day and is related to that product. For example, here, Amazon Seller Fees were adjusted in a CS Error Items transaction.

Customer Return HRR Unit Fee

CustomerReturnHRRUnitFee is charged when a customer returns a High Return Rate (HRR) unit fulfilled by Amazon. It helps cover the processing, inspection, and reintegration of returned items back into inventory.

FBA Customer Return Per Order Fee

FBACustomerReturnPerOrderFee is incurred when a consumer returns an item delivered by FBA. It often applies to goods categories that provide free returns, such as clothing and shoes. The fee is per returned order, which means that each time a buyer returns a product fulfilled by Amazon, the seller is paid a fee for processing the return.

FBA Customer Return Per Unit Fee

When a customer returns an item, sellers are charged a FBACustomerReturnPerUnitFee. The seller's account balance is debited for this fee, which is applied on a per-unit basis. It includes a range of expenses associated with handling returned goods, such as inspection, possible repackaging, and restocking. The particular cost of the fee may change based on things like the type of product being returned and how it was in when it got to Amazon's fulfillment center. This charge should be taken into account by sellers when analyzing their total cost of operations and profitability on the marketplace.

See How Return Fees Impact Your Profits

FBA Customer Return Weight Based Fee

FBACustomerReturnWeightBasedFee is a fee based on the weight of an item returned by a customer under the FBA program. It reflects the cost of return shipping and restocking services for heavier or oversized products.

Debt Adjustment

Debt Adjustment refers to the process where Amazon corrects any errors or discrepancies in a seller's account balance. This could happen for various reasons, such as refunds given to customers, reimbursements for lost or damaged items, adjustments for fees, or fixing overpayments or underpayments.

Amazon regularly checks accounts to make sure all financial transactions between sellers and the platform are accurate. Debt adjustments may show up on a seller's account statement as changes to balance out any mistakes that occur while doing business on Amazon. For more specific information about debt adjustments, sellers should contact Amazon's seller support or refer to their financial documents.

Delivery Fulfillment Fee

The charge that sellers pay to pick, package, and send goods to buyers is known as the Delivery Fulfillment Fee. The cost of Fulfilment by Amazon (FBA) is determined on the item's dimensions, weight, and delivery time. Seller Fulfilled Prime allows sellers to meet Prime delivery requirements while paying for their own shipping. This charge guarantees that the logistics of delivering goods to clients are controlled.

FBA Delivery Services Fee

FBADeliveryServicesFee is the amount for transporting the product to the consumer, which includes packing, handling, and shipping. It depends on the item's size and weight. For a modest item, like a book, the delivery charge could be roughly $3. For a larger, heavier item, such as a microwave, the price could be $10 or higher.

Digital Services Fee

Amazon charges DigitalServicesFee for providing digital services, typically applied to the sale of digital goods or media. It helps support the infrastructure needed to deliver digital content like eBooks, software, and media files.

Digital Services Fee FBA

DigitalServicesFeeFBA is a digital services fee applied specifically to products fulfilled by Amazon (FBA). It supports the delivery of digital functionality or services tied to the FBA-distributed product.

Disbursement Correction

DisbursementCorrection is an adjustment made to a prior payment to fix errors, account for refunds, or correct miscalculated fees. For example, if Amazon paid a seller $500 initially but subsequently found out that $30 should have been taken for a returned item, they will make this right by deducting $30 from the seller's subsequent payment.

FBA Disposal Fee

When Amazon handles the disposal of your FBA goods, you'll be charged a FBADisposalFee. This fee includes the costs associated with managing and getting rid of inventory that can't be resold, like damaged, expired, or unsuitable items. The specific fee amount varies based on the size and weight of the item being disposed of.

Calculate Your FBA Fees

EPR Pay on Behalf Eco-contribution - EEE

This is an eco-contribution fee Amazon collects and pays on your behalf for Electrical and Electronic Equipment (EEE) sold in regions where EPR regulations apply (e.g., France, Germany).

The fee supports proper recycling and disposal of electronic products.

It’s based on the product type, weight, and local EPR rules.

EPR Pay on Behalf Eco-contribution - Toys

This fee is similar but applies specifically to toys under EPR regulations.

Amazon handles the registration and reporting and charges sellers a fee to cover the required eco-contributions.

The goal is to ensure proper end-of-life management (e.g., recycling) of toy products.

EPR Pay on Behalf Service Fee - EEE

This is a service fee Amazon collects for managing Extended Producer Responsibility (EPR) compliance for electrical and electronic equipment (EEE). It covers administrative efforts Amazon undertakes to report and remit eco-contributions on behalf of sellers in regulated markets.

EPR Pay on Behalf Service Fee - Toys

This fee supports Amazon’s management of Extended Producer Responsibility (EPR) obligations for toy products. It includes compliance services for reporting, registering, and submitting environmental fees in jurisdictions where required.

EPSO Chargeback Fee

EPSO stands for "European Payment Services Organization." This group handles payment services and fees on Amazon's European sites. If a transaction is disputed and reversed due to a chargeback, the EPSOChargebackFee is charged. This fee covers the costs of managing and resolving the dispute.

EPSO Cross-Border Fee

The EPSOCrossBorderFee is imposed for transactions involving multiple nations or regions. It covers the additional costs associated with processing foreign transactions, such as currency conversion and regulatory compliance.

EPSO Payment Auth Fee On Finalize

EPSOPaymentAuthFeeOnFinalize takes place when Amazon verifies that there are sufficient funds to finish the transaction and the buyer's payment method—such as a credit card—is validated. Once the payment method has been approved, a fee is applied to cover the cost of the verification process.

EPSO Payment Settle Fee On Finalize

EPSOPaymentSettleFeeOnFinalize charged by Amazon when the transaction is completed and funds are transferred from the buyer's account to the seller's account. This process is called "settlement." It takes place when Amazon transfers the payment and the order has been fulfilled. This charge pays for the expenses associated with handling the payment and ensuring that the seller receives the money.

Estimated Commission

EstimatedCommission is the fee charged by Amazon for facilitating the sale of goods on their marketplace. It is typically a proportion of the product's selling price, which varies by category. This charge is also known as a referral fee because Amazon directs the buyer to your listing. The proportion can range from 6% to 45%, depending on the type of item sold, with the majority of categories ranging between 8% and 15%.

For example, if you're selling a laptop in the Electronics category and Amazon's referral fee is 8%, selling a laptop for $100 will result in an Estimated Commission of $8. So, out of the $100 sale, Amazon receives $8 in compensation for hosting the listing and connecting you with the customer.

Estimated FBA Fees

When using Fulfillment by Amazon (FBA), Amazon charges fees for storing, packaging, shipping, handling, and customer service related to your product. EstimatedFBAFees are determined based on the size, weight, and duration your product remains in Amazon's warehouse. Larger or heavier items incur higher fees, while smaller, lighter items have lower charges. For returnable products, FBA fees also include the cost of processing returns.

For instance, if you sell a phone case, a small, standard-sized item, the FBA fee might be around $3.50. Thus, when you sell the phone case for $100, Amazon will deduct $3.50 to cover fulfillment costs, including picking, packing, and shipping the item.

Calculate FBA Fees

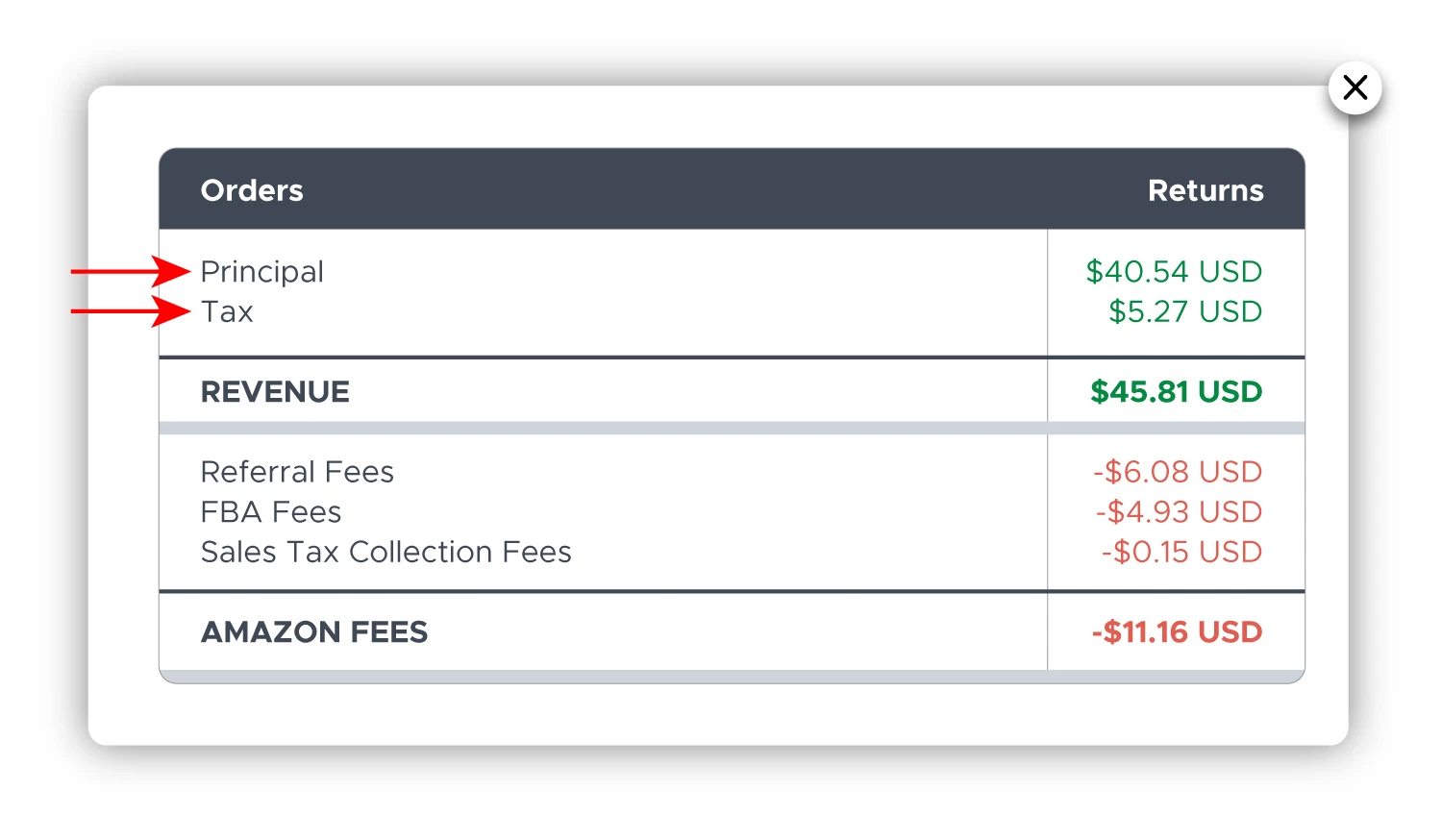

Estimated Principal

EstimatedPrincipal is the product's gross retail price before fees and taxes are deducted. This is effectively the total price the buyer pays for the product, excluding shipping, handling, and taxes. It is the "principal" or core portion of the transaction that the seller earns before Amazon charges fees.

If a buyer pays $100 for your product, the Estimated Principal will be $100. This amount does not include any further deductions, such as taxes or Amazon fees. This value shows the amount that the customer has agreed to pay for the item.

Estimated Tax

EstimatedTax is the sales tax that Amazon collects from buyers on behalf of the vendor. Sales tax rates vary according to the buyer's location and the local tax rules in their state or country. Sellers using Amazon Marketplace Tax Collection (MTC) can have Amazon compute and collect the tax at checkout, then remit it to the relevant tax body. The seller often does not handle these funds directly, but they are shown as part of the transaction.

Let’s say, if you sell a product for $100 and the buyer lives in a state with a 7% sales tax, Amazon will charge $7 in taxes. So the buyer pays a total of $107, but you only receive $100 (less Amazon's costs). The additional $7 is collected by Amazon and remitted to the government. Amazon collects the $7 tax, which is then paid directly to the local tax authorities rather than the seller.

Excess inventory

This fee is applied when a seller holds unsold or slow-moving inventory in Amazon’s fulfillment centers beyond optimal levels. It incentivizes sellers to manage inventory more efficiently and avoid unnecessary storage usage.

Export Charge

ExportCharge is any of the several fees that come with sending goods from vendors to buyers in other nations. Higher international transportation costs than domestic shipments are one example of this, as are any customs fees and taxes levied by the destination nation, which can differ according to the kind and value of the product. Sellers may also be charged handling costs for ordering from overseas and currency conversion fees if transactions are made in different currencies. Managing these fees and making sure that foreign shipping laws are followed are frequently the sellers' responsibilities, depending on the selling model. When selling internationally, sellers must take into account the various expenses associated with exporting goods, which are collectively referred to as export charges.

Failed Disbursement

When a payment distribution to a seller is unsuccessful, Amazon refers to the situation as a FailedDisbursement. This usually happens when there are problems with the bank account details that have been submitted, including an incorrect account number or routing number, or when there are other barriers impeding the transfer of money.

If a disbursement fails, Amazon tries to process the payment more than once. Every failed attempt is recorded under the FailedDisbursement category. To help with settlement and to keep track of past payment problems, these attempts are documented.

Sellers should take immediate action to resolve any problems that are preventing payments from being made, such as updating their bank account details or settling any unresolved disputes with their financial institution. They can guarantee seamless and fast.

FBA001 Auto

An automated FBA fulfillment fee that covers picking, packing, and shipping of orders. It is typically generated for standard orders processed through Amazon's Fulfillment by Amazon service.

FBA Fee

| FBA Fee is also called Fulfillment by Amazon Fee, FBA Pick & Pack Fee, FBAPerOrderFulfillmentFee, FBAPerUnitFulfillmentFee, FBAWeightBasedFee |

|---|

FBA stands for Fulfilment by Amazon. You pay an FBA fee if you store your products at Amazon warehouse and Amazon ships them to your customers for you. This includes shipping, refund management & support, inventory pick & pack, stocking, counting, delivering, loading etc.

FBA fee constantly keeps changing, mostly increasing. It's now roughly 2.50-5.50 USD per small item.

You can check current FBA fees here:

FBA Fees for Amazon North America

Check Your FBA Fee Breakdown

FBA Per Order Fulfillment Fee

FBAPerOrderFulfillmentFee is a flat fee charged per order fulfilled through Amazon’s FBA network. It covers the handling, packaging, and delivery of items regardless of quantity in the order.

FBA Per Unit Fulfillment Fee

FBAPerUnitFulfillmentFee applies per individual unit fulfilled by Amazon under the FBA service. It accounts for the operational costs associated with picking, packing, and shipping each item.

Fee Adjustment

Any change to the fees a seller pays Amazon is usually referred to as a FeeAdjustment charge on Amazon. This can occur for a number of reasons, including adjustments to past payments, modifications to service costs, or modifications pertaining to refunds or incentives. In essence, it is a method by which Amazon reconciles fees in response to modifications or additions to a seller's account or transactions. A fee adjustment typically means that the fees you were initially charged have changed.

Free Replacement Refund Items

FREE_REPLACEMENT_REFUND_ITEMS is used to monitor customer support actions when customers receive a free replacement or a refund for an item because of problems such as damage, flaws, or non-delivery.

Although it's not a direct charge, sellers may still be affected financially. If Amazon offers a customer a refund or replacement, the seller may have to pay the cost of the item out of their account. However, in certain circumstances, particularly when Amazon bears the responsibility (e.g., through Fulfillment by Amazon or FBA), sellers may receive reimbursement for these reimbursements or replacements.

Generic Deduction

GenericDeduction is applied to a seller's account and is frequently associated with other charges like refunds, special offers, or balance adjustments that have an effect on the seller's total. It helps guarantee correct charge charging and lowers the seller's overall earnings or balance. Sellers can check their account statements or get in touch with Amazon Seller Support with particular inquiries.

Get Paid Faster Fee

GetPaidFasterFee is a fee charged to sellers who choose to receive payments faster than the regular payment schedule. For example, if a seller prefers to be paid sooner for their sales rather than wait for the standard payout time, they can select this option, and Amazon will charge an extra fee for the faster payment service. This fee is deducted from the seller's earnings in exchange for quicker access to the funds.

Gift Wrap Charge

| Gift Wrap Charge is also called gift-wrap-price. |

|---|

Gift wrap charge is a fee your customers pay to get their purchased products wrapped in gift paper and have a card sent with it as well.

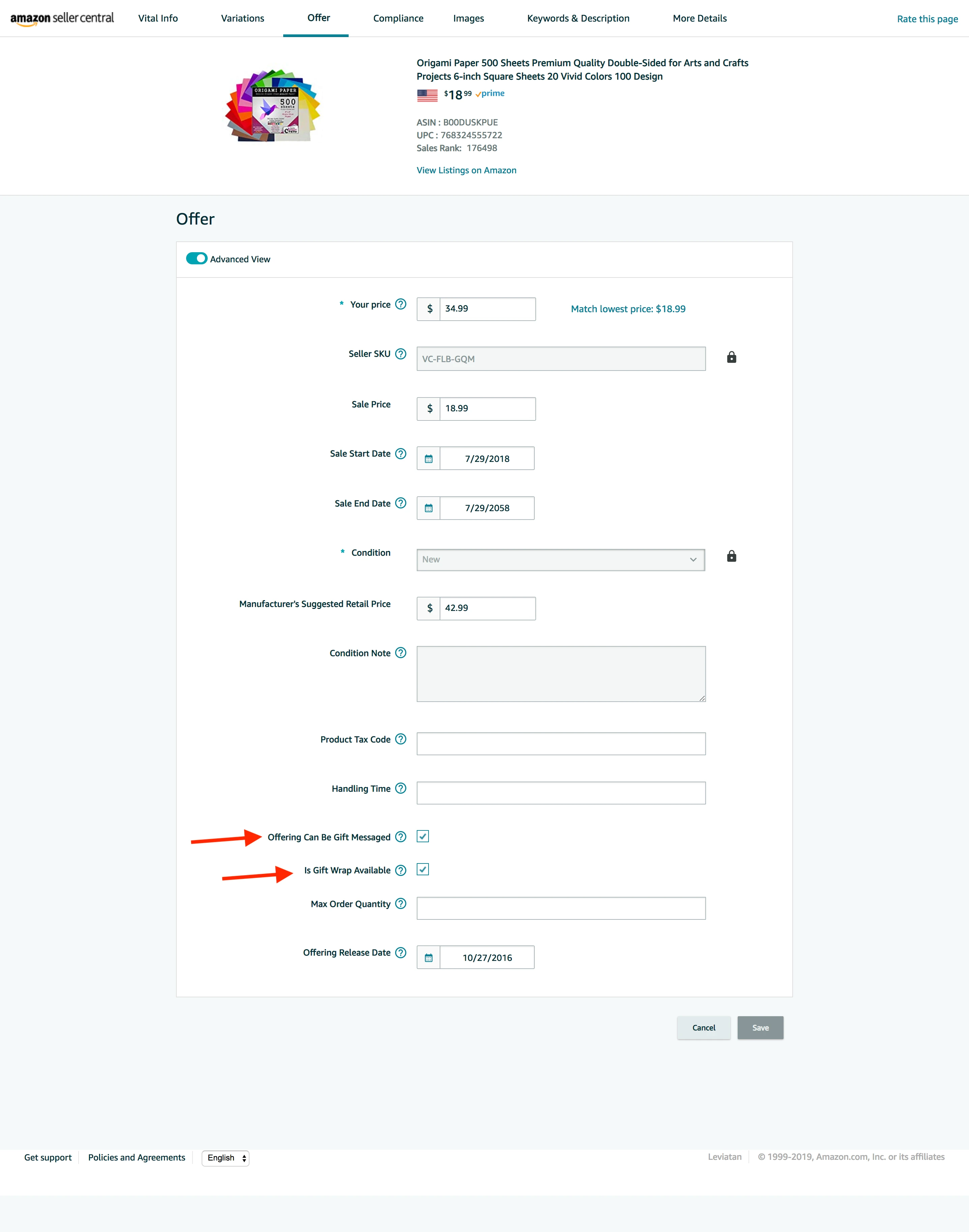

To have the Gift Wrap option enabled on your listings, you have to select these checkboxes in Seller Central:

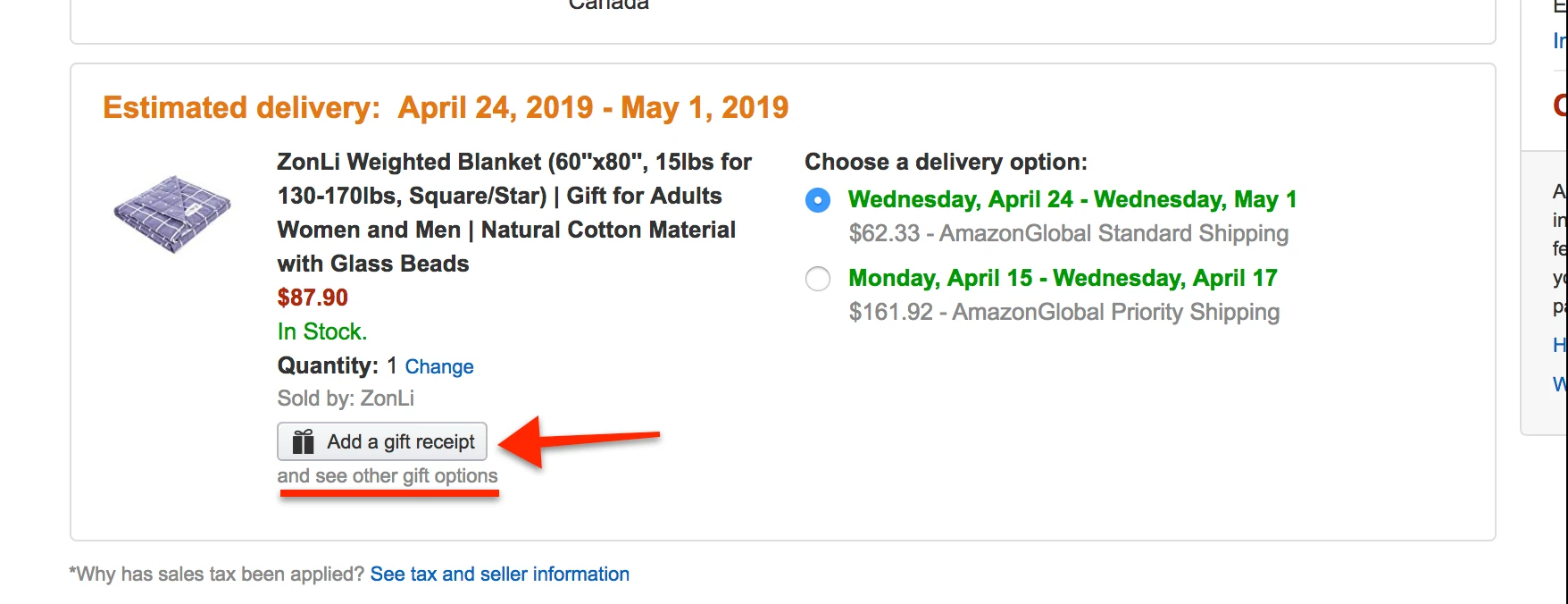

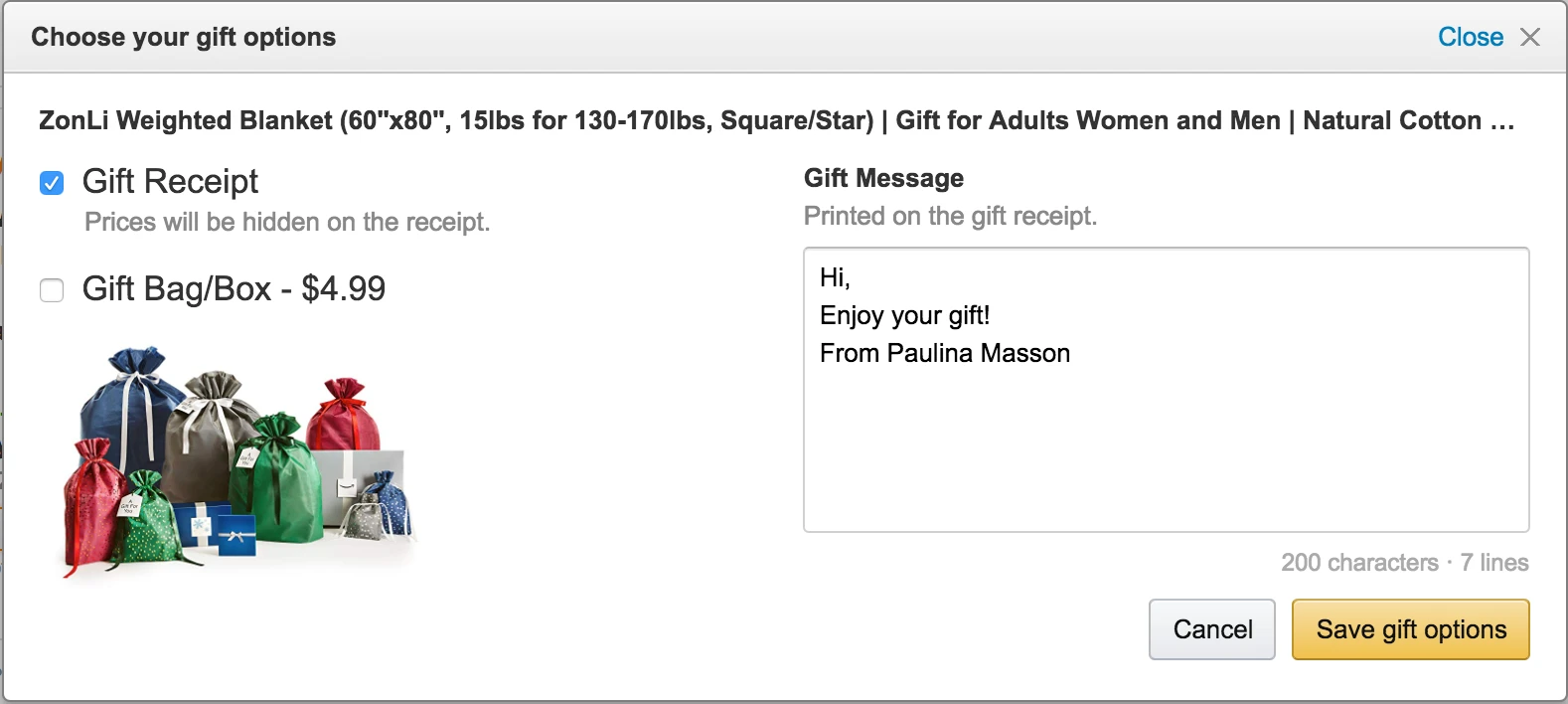

That way the buyers can see Gift Options when checking out:

You may ask, ok, but who is doing the actual gift wrapping?

If your listing is Amazon-fulfilled (FBA), then Amazon does the gift wrapping and they also keep the gift wrap charge. All you need to do is enable the gift wrap options on your listings like above, and it will just automatically become available for your buyers.

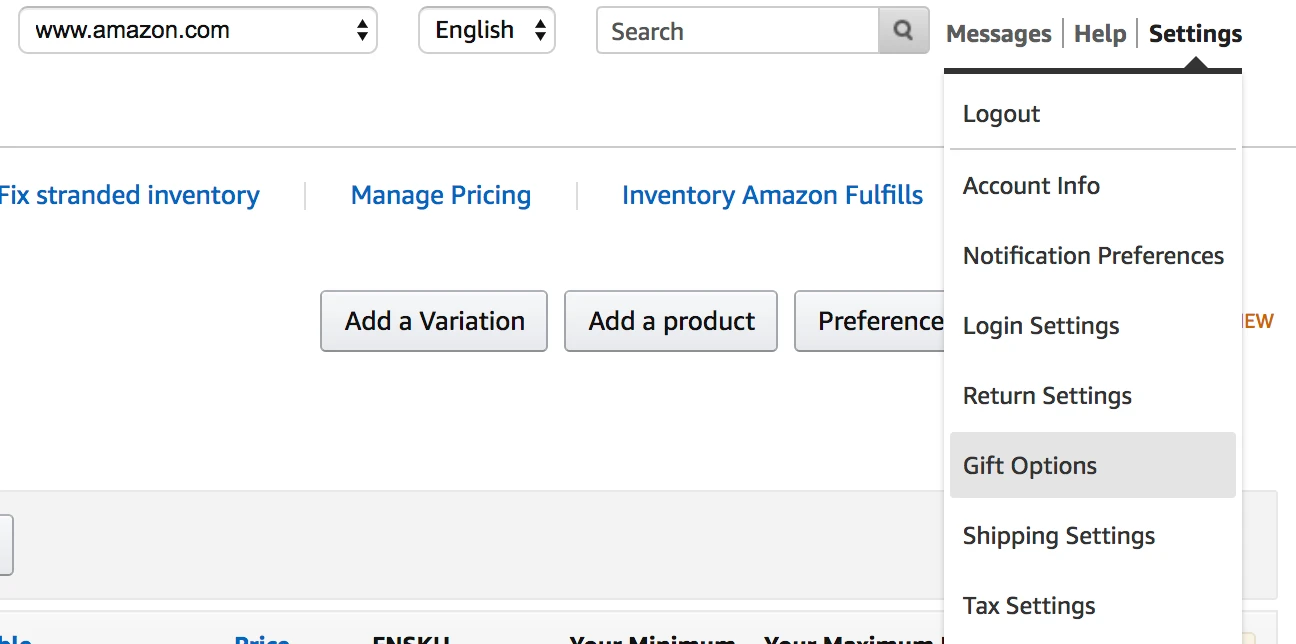

If your listing is Merchant-fulfilled, you will be the one doing the gift wrapping. For this option to be fully enabled, you will need to setup a few extra things in your Seller Central. First, go to Settings->Gift Options:

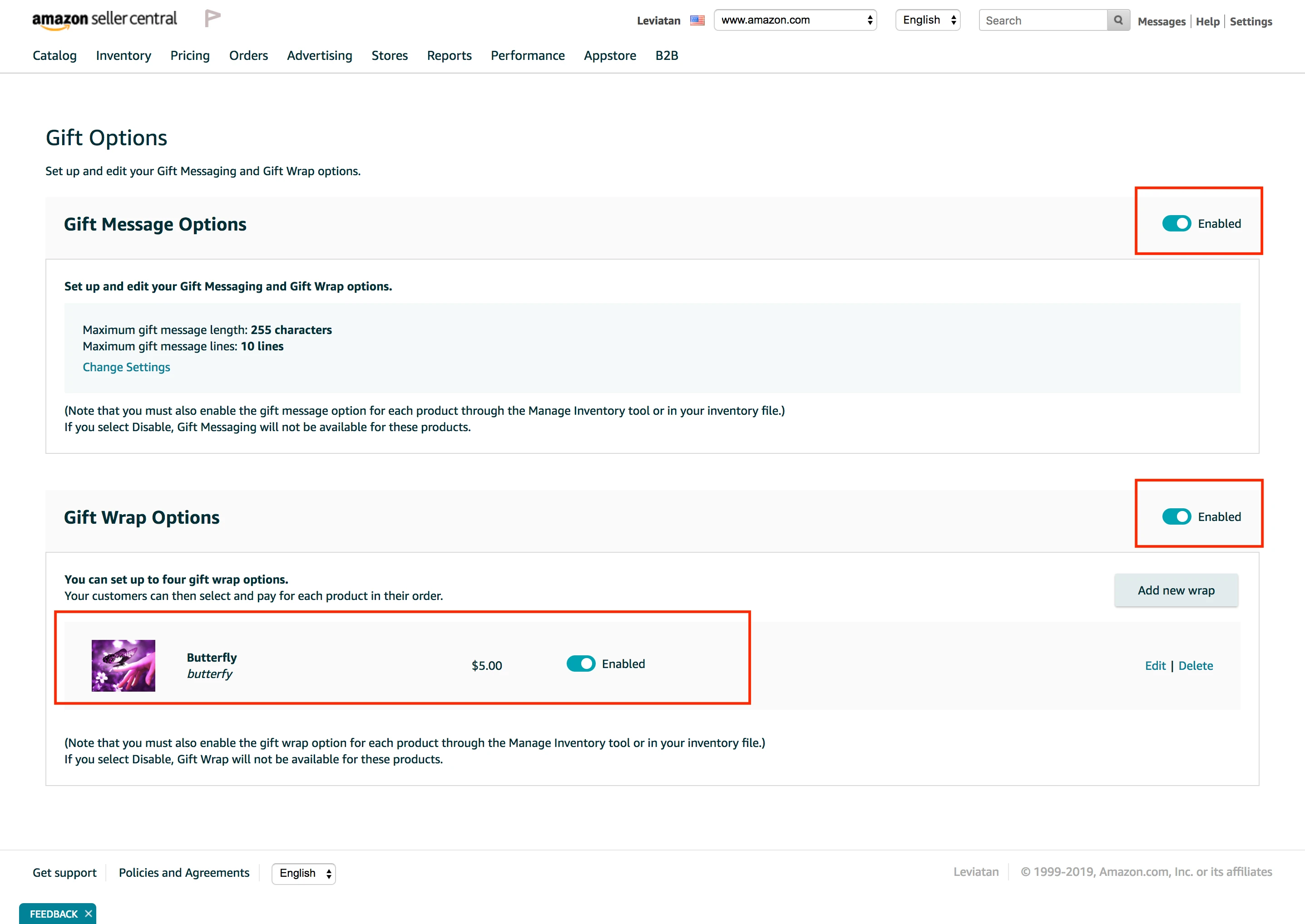

Then, create Gift Wrap options for your customers and set the gift wrap prices:

Then your buyers will be presented with your Gift Wrap options, and Amazon will send you all collected Gift Wrap Charges along with your payout.

Review Your Gift Wrap Fees

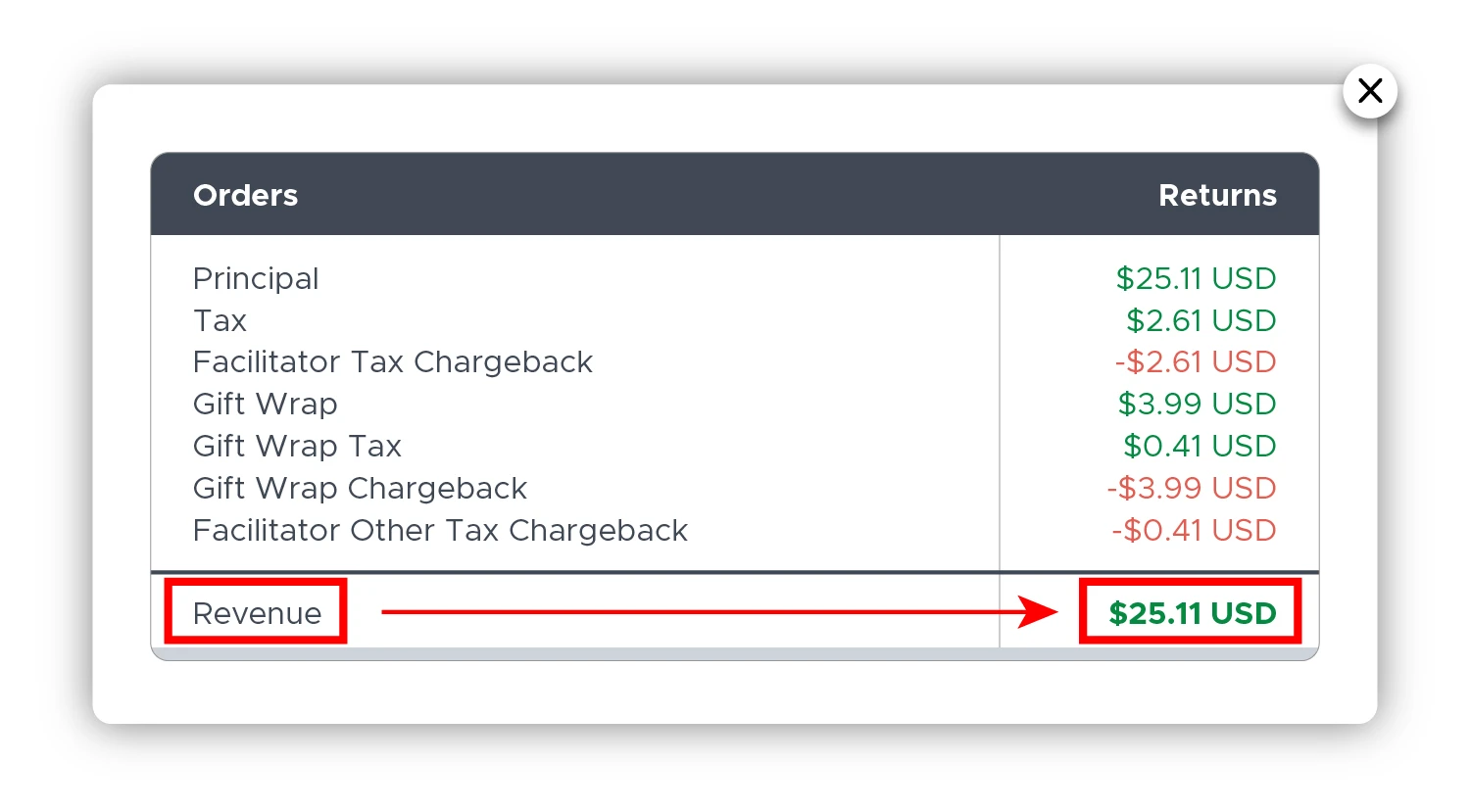

Gift Wrap Chargeback

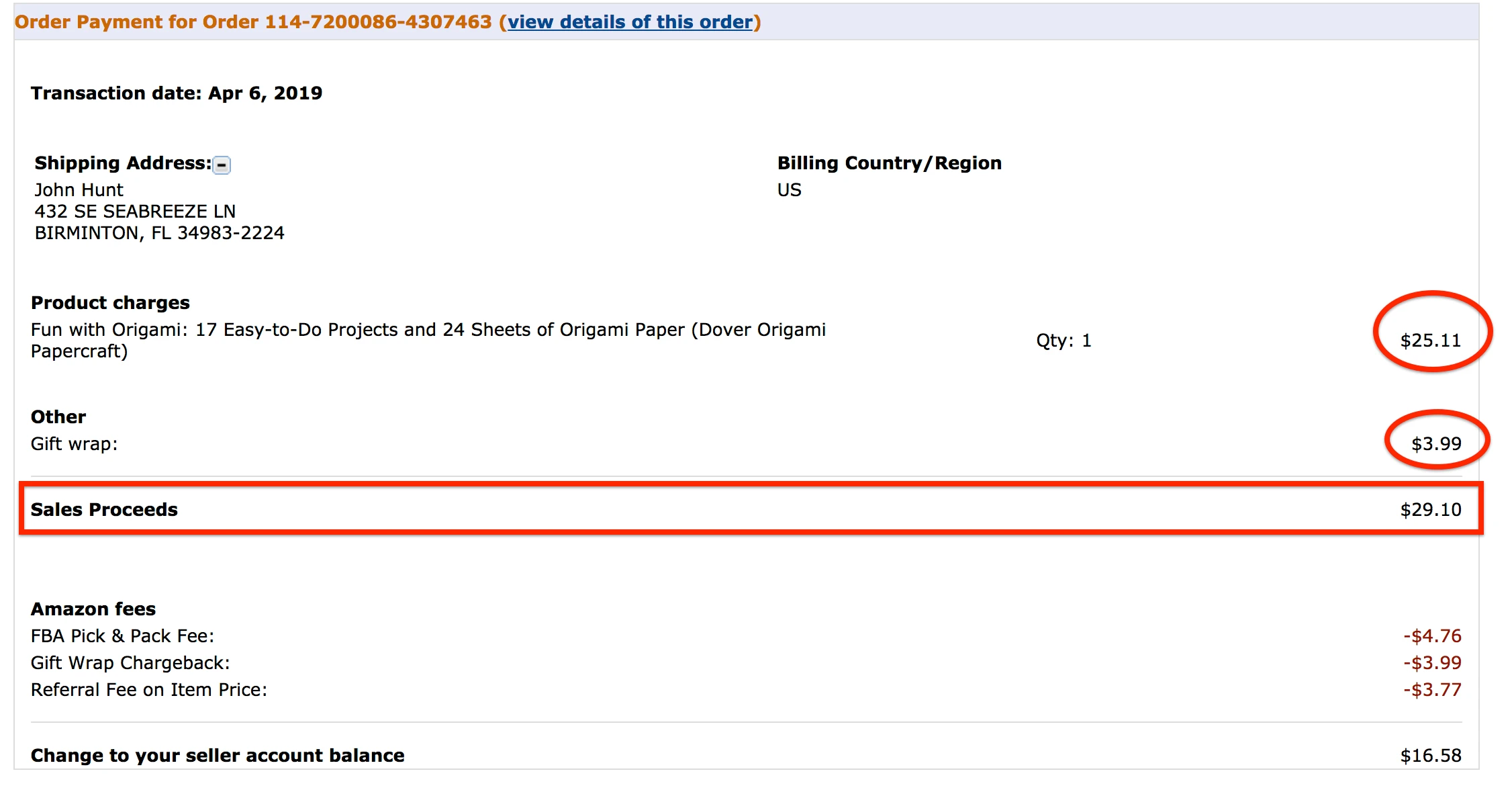

| GiftwrapChargeback appears in your transactions together with a Gift Wrap Charge, in cases where Amazon is the one doing the Gift Wrapping. |

|---|

That is, when your listing is FBA (Amazon-Fulfilled), Amazon is collecting a gift wrap charge from your customers and it appears in your transactions as your revenue. But because it's not you who is doing the gift wrapping, Amazon is also adding in a Gift Wrap Chargeback, to immediately take the collected Gift Wrap Charge away from you.

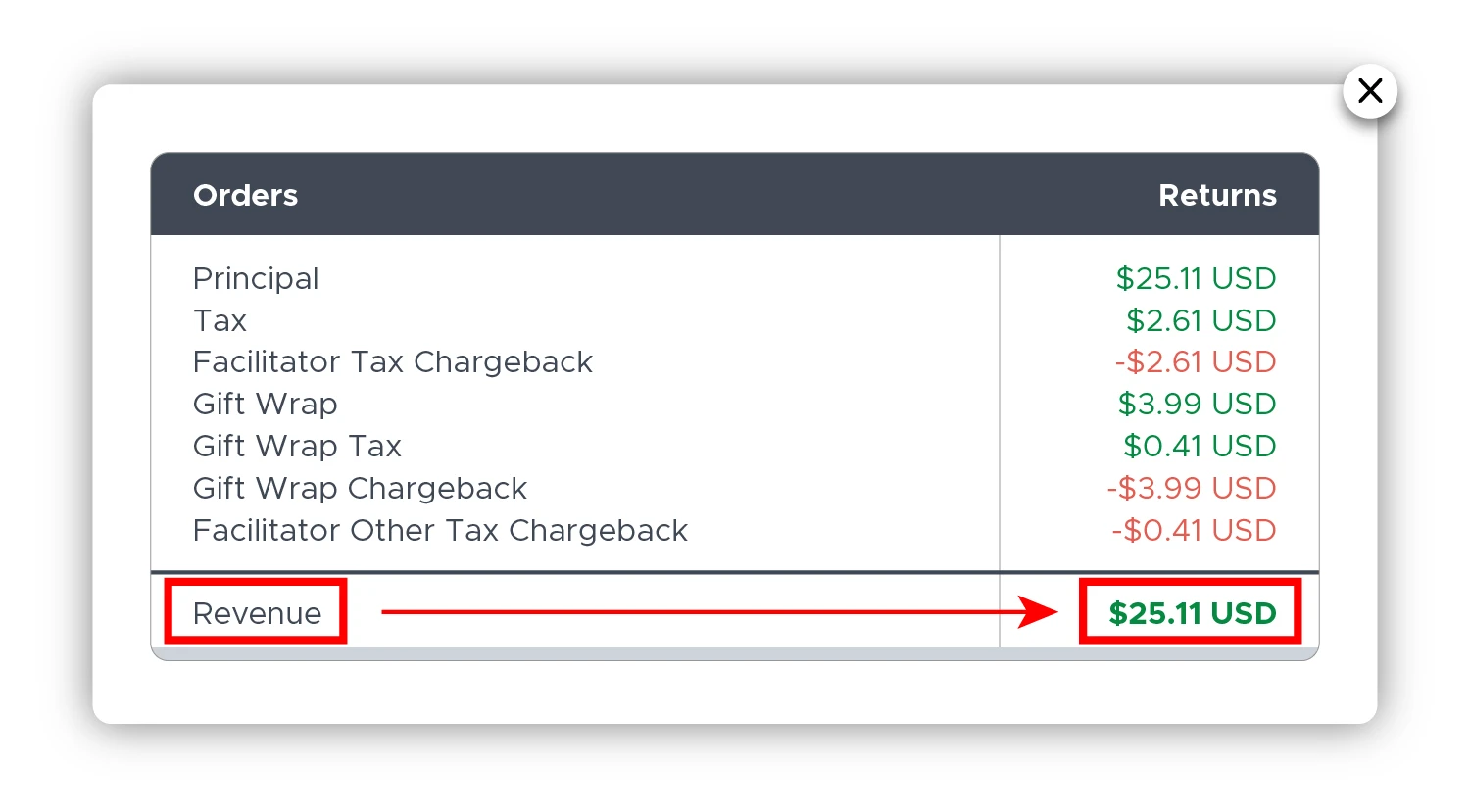

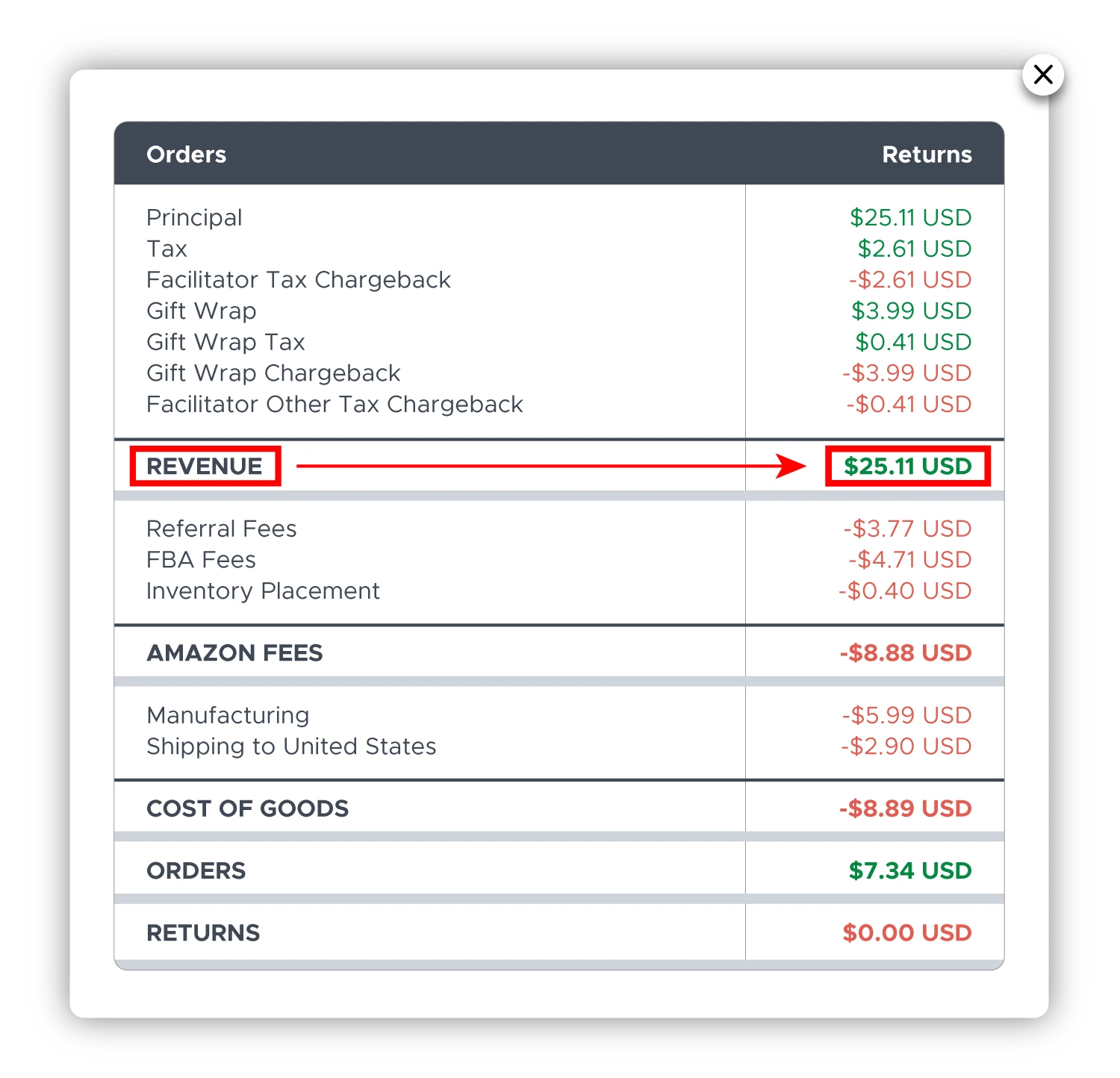

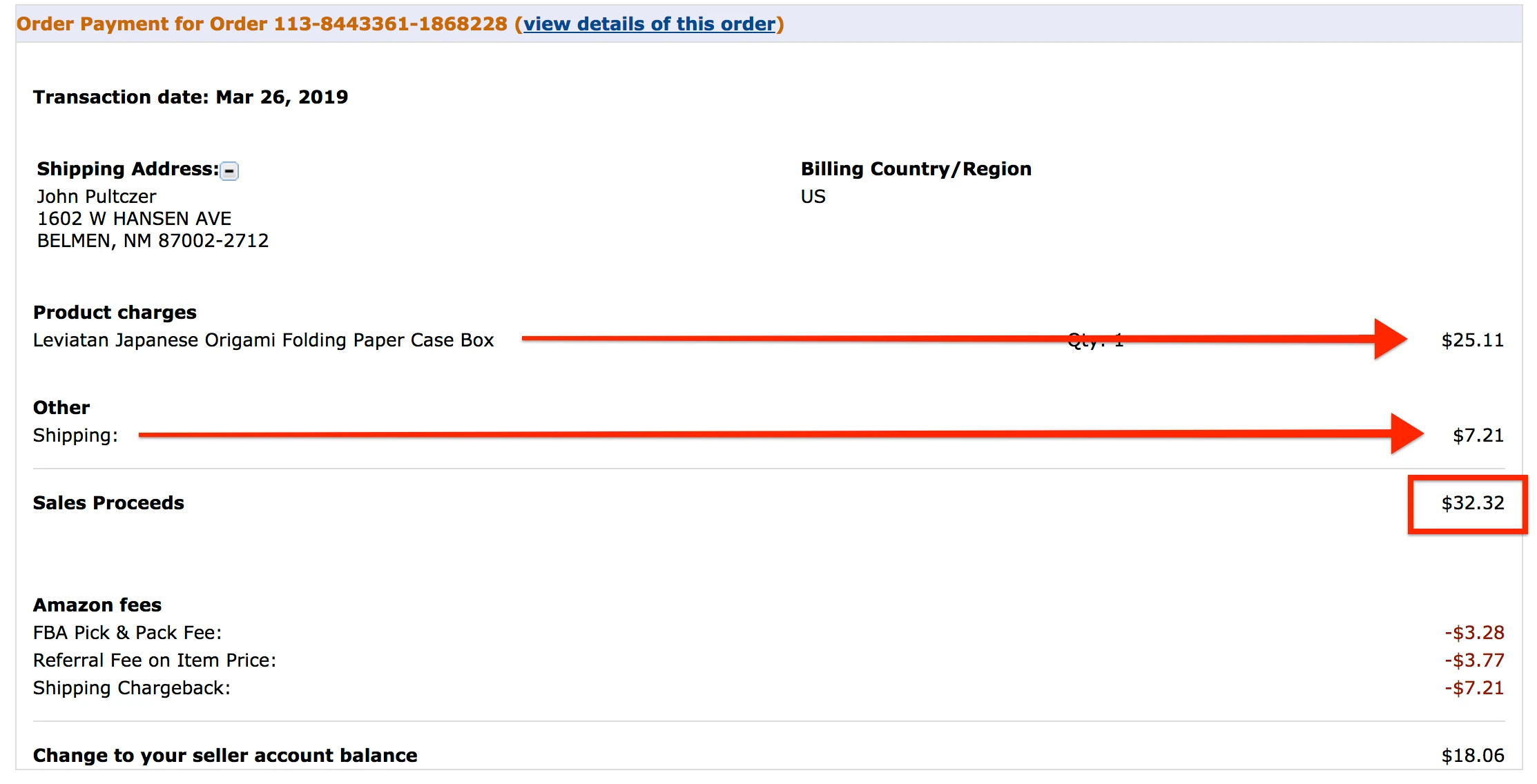

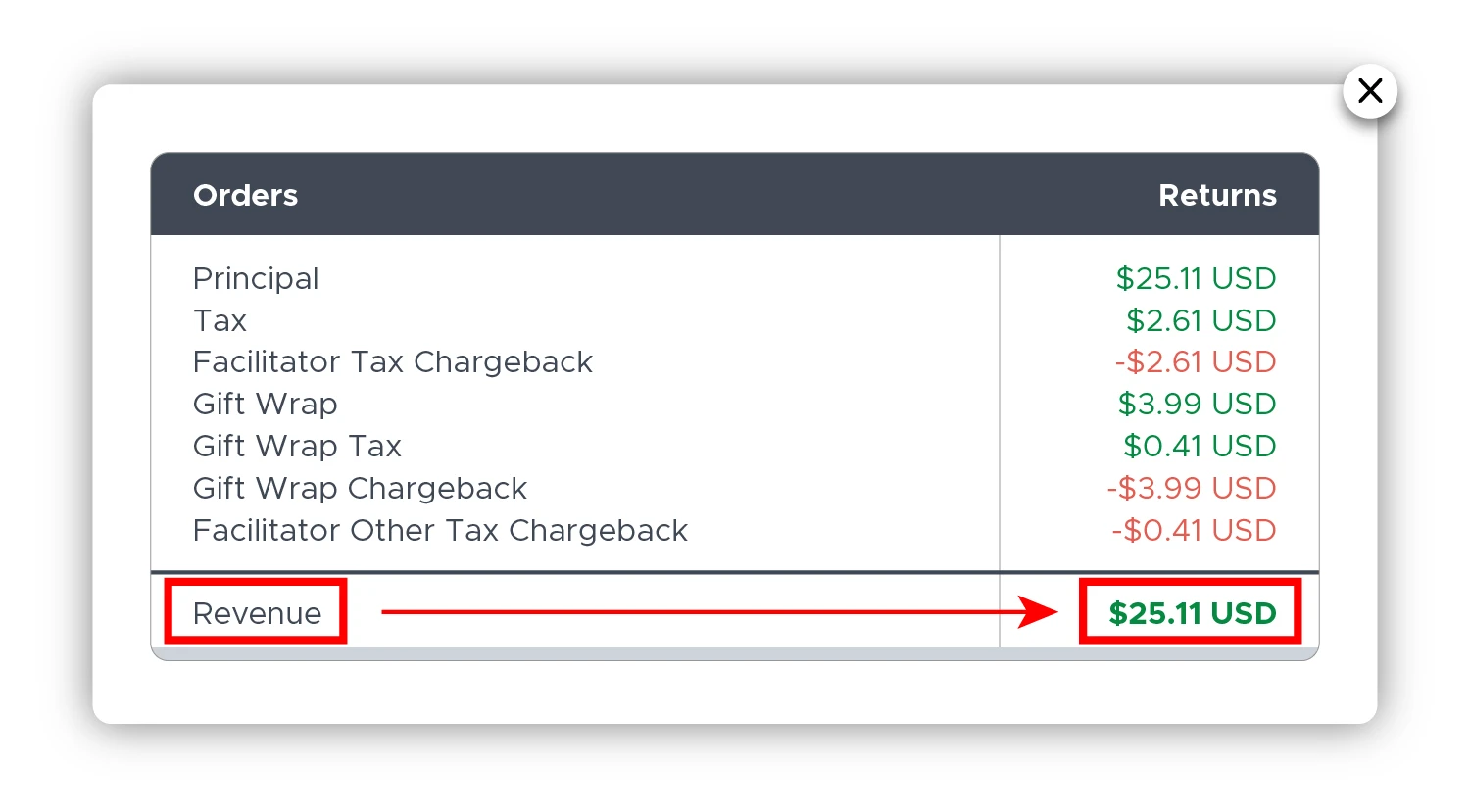

Unfortunately, this inflates your revenue figure:

If you want to do a financial analysis, or present your numbers to investors/partners, you shouldn't really use inflated Revenue that Amazon shows in their downloadable reports. It is better to use apps like Shopkeeper, which normalize your revenue, still showing all relevant transactions from Amazon:

Using inflated revenue directly from Amazon reports can be good and bad. Higher revenue figure means you can appear to be making more money to investors, potential business buyers, your followers, potential hires, etc.

But it can also be bad if you get charged for some things based on revenue. It also adds up to complexity of bookkeeping, and confusion whether you should show gift wrap chargeback as costs, or simply ignore all this math and declare revenue without showing gift wrap activity at all. I recommend showing all like Shopkeeper does, simply because then it’s much easier to follow the numbers from Amazon reports if you keep track of all the same transactions that they do.

In the end, if you’re just a small company, these details don’t matter so much. Just do what is the easiest for you.

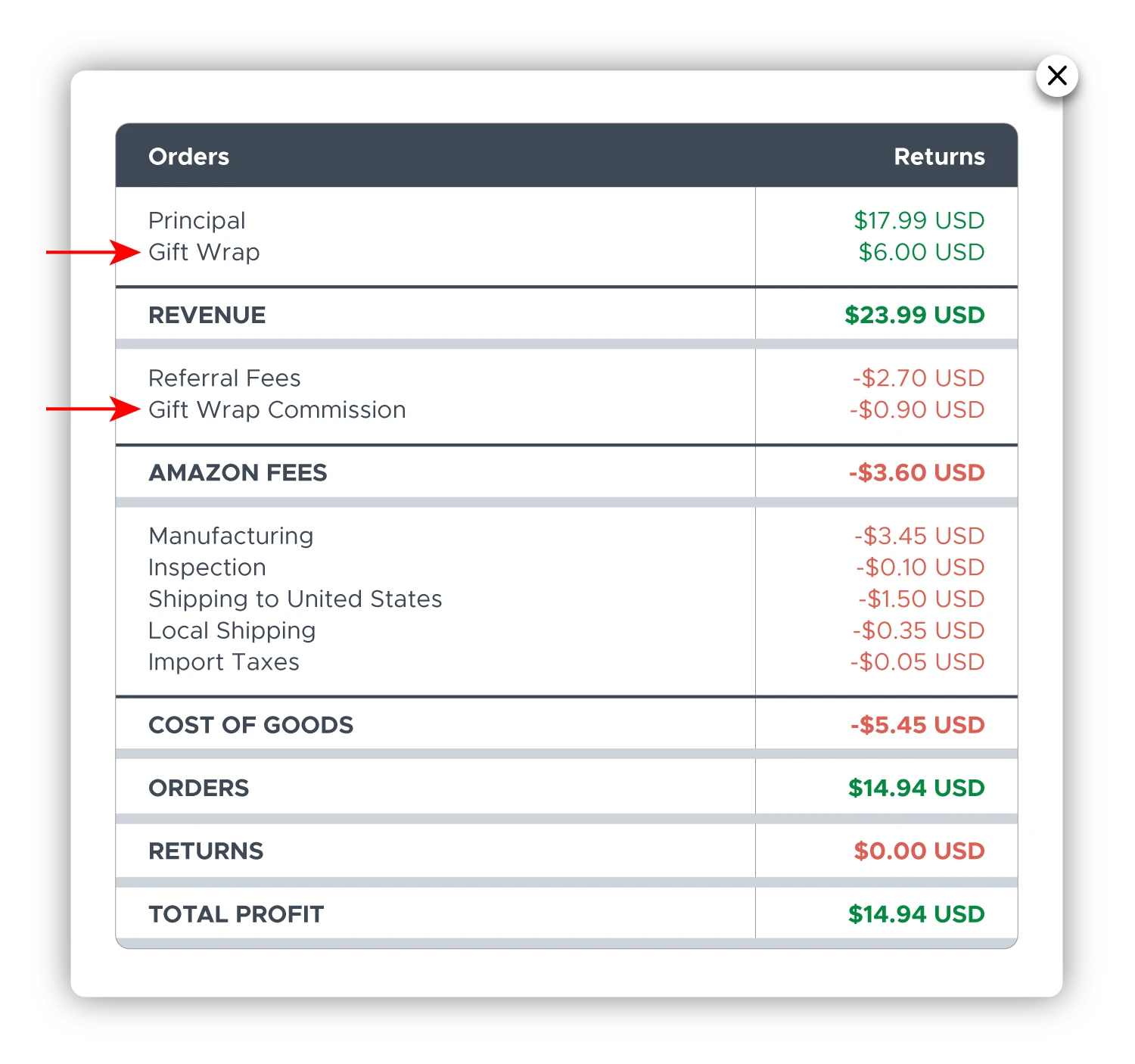

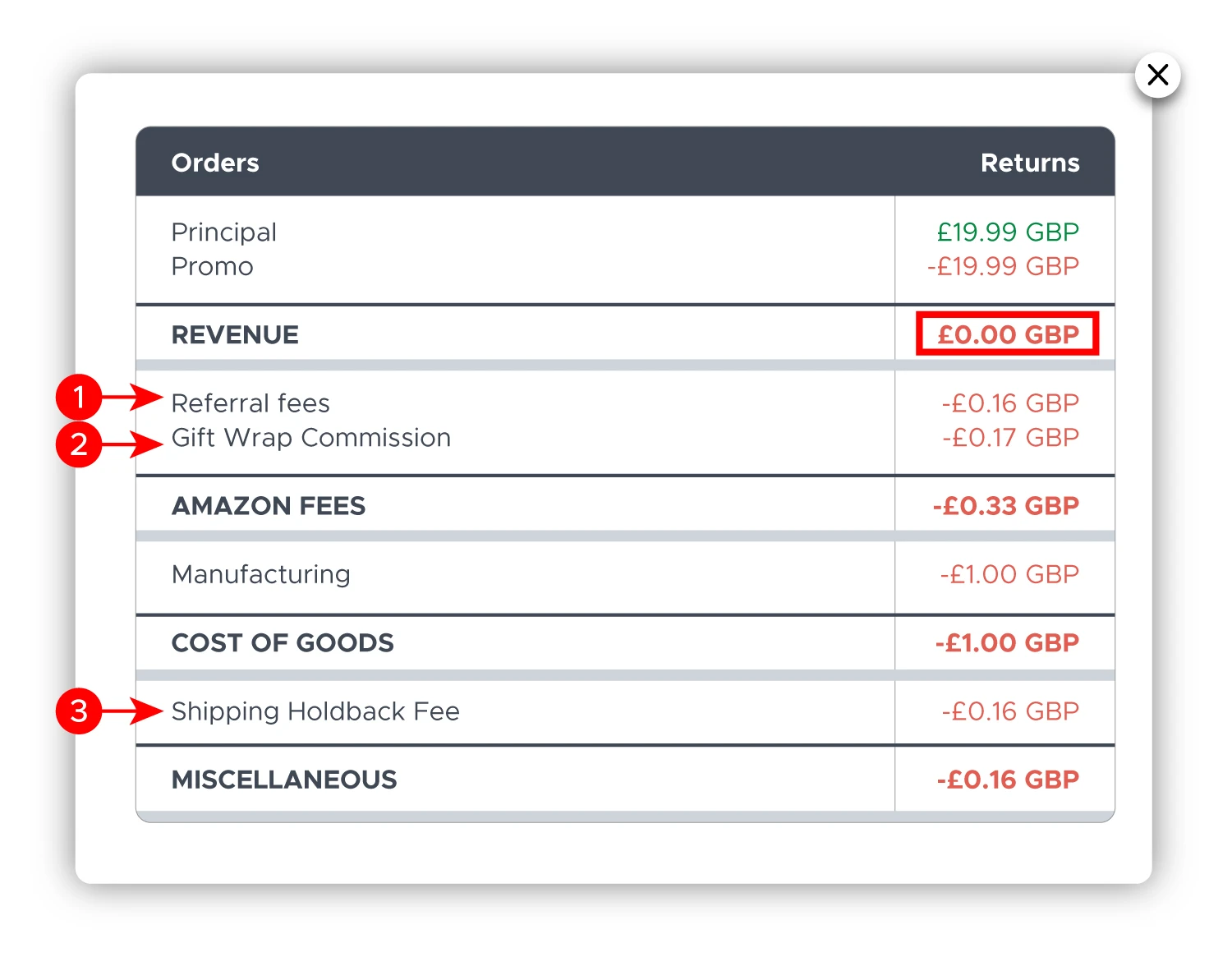

Gift Wrap Commission

GiftwrapCommission is basically a referral fee, charged on all gift wrap services that were provided by you, the seller. If Amazon is the one gift-wrapping it, you don't get charged a commission.

Here is how the normal gift wrap commission charge appears in Shopkeeper, when it's fulfilled by you, the Merchant (MFN):

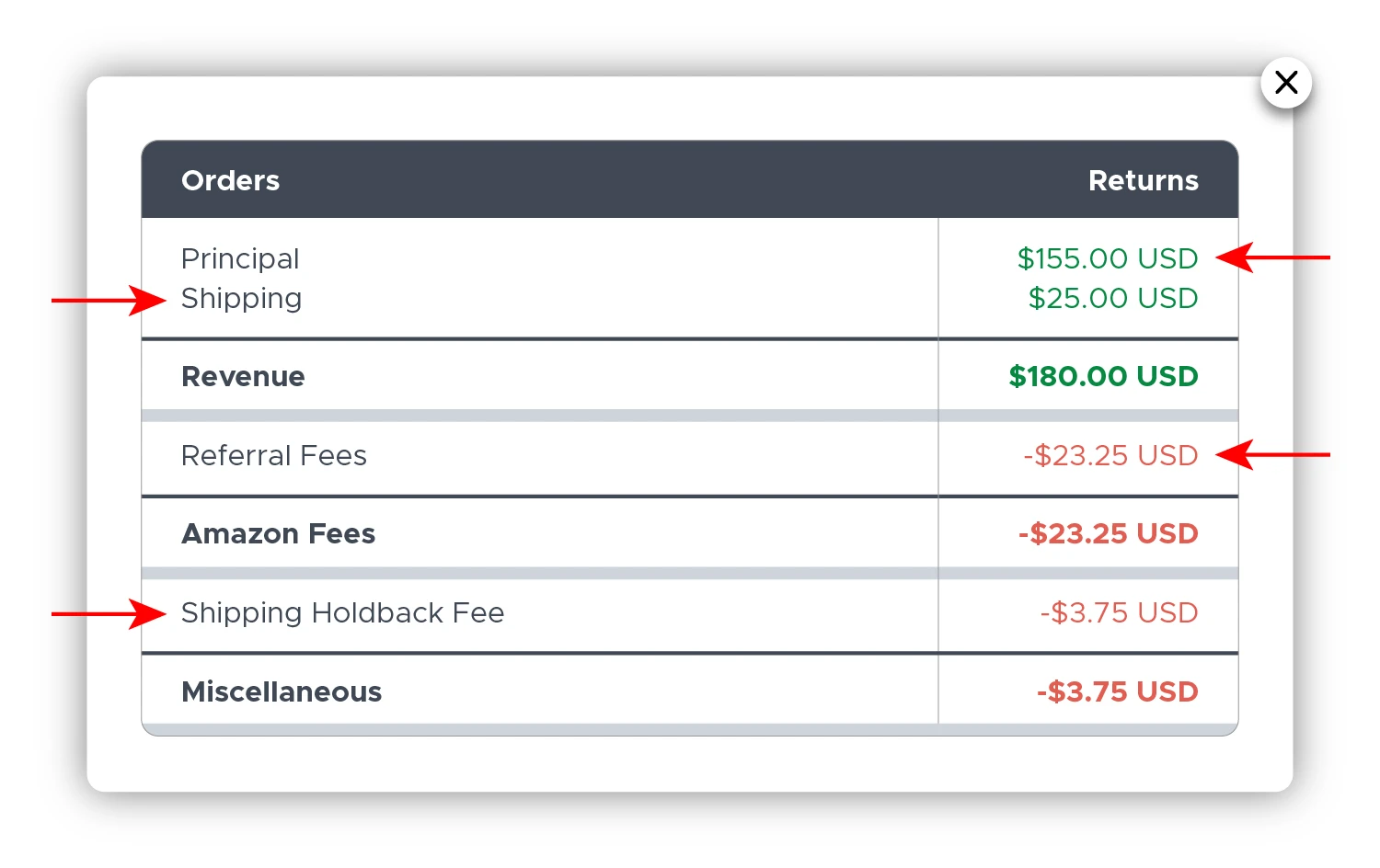

There is one more non-obvious situation, where Amazon charges you Gift Wrap Commission.

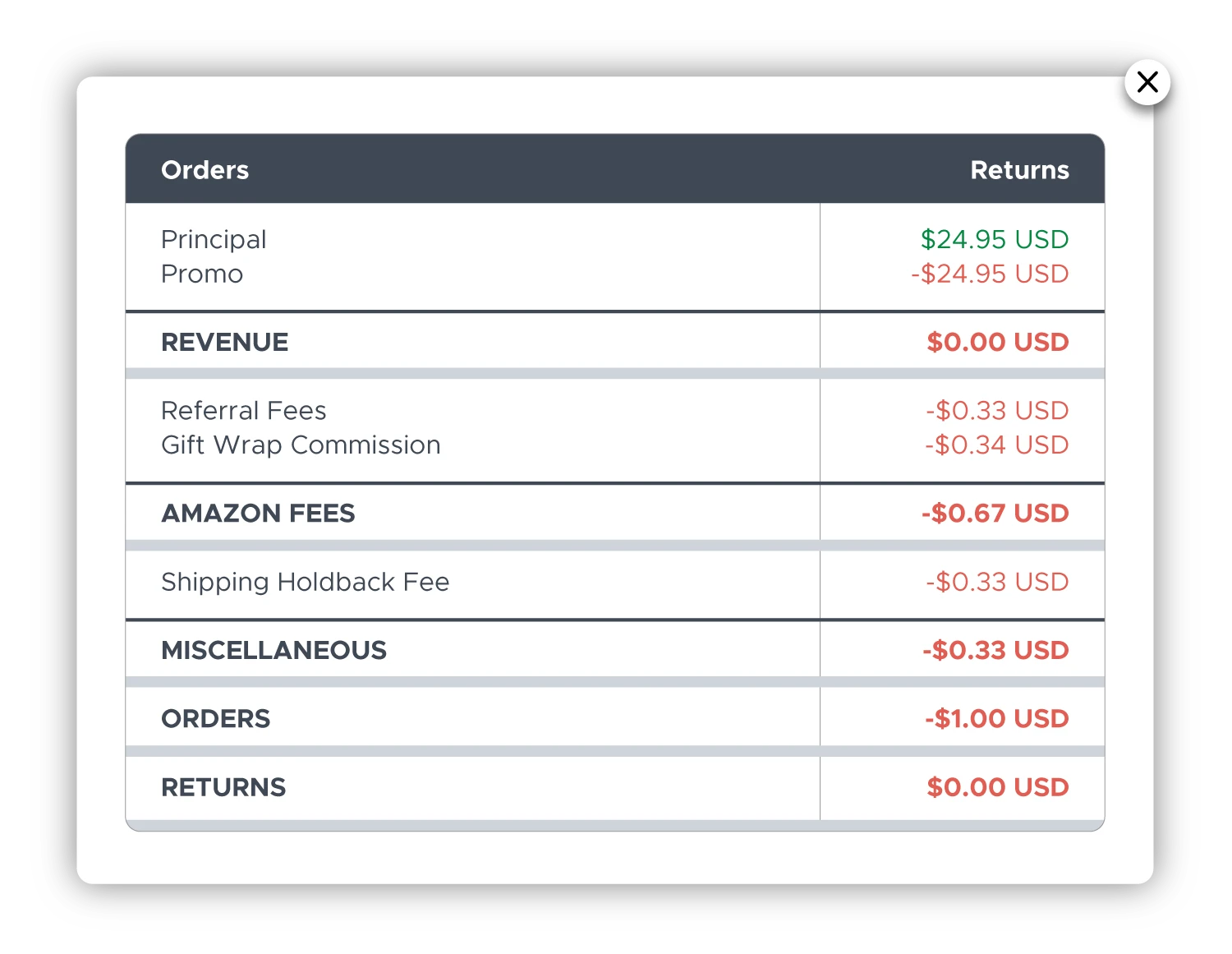

If you are running a promo, and offer your customer 100% off (so that the final price that the customer pays is 0.00) - then Amazon charges you a Gift Wrap Commission. AND also a small Referral Fee and Shipping Holdback Fee.

Amazon cannot charge you more than minimum Referral Fee because Referral Fee is based on sales revenue. Now the revenue is 0.00. So they also charge you two other small minimum amounts - Shipping Holdback Fee and Gift Wrap Commission Fee. This is their way to make money out of the zero-amount-sale that happened on their platform:

Special case where Amazon charges you 3 kinds of fees to offset your 100% promos.

Gift Wrap Tax

| Gift Wrap Tax is also called GiftWrapTax, gift-wrap-tax. |

|---|

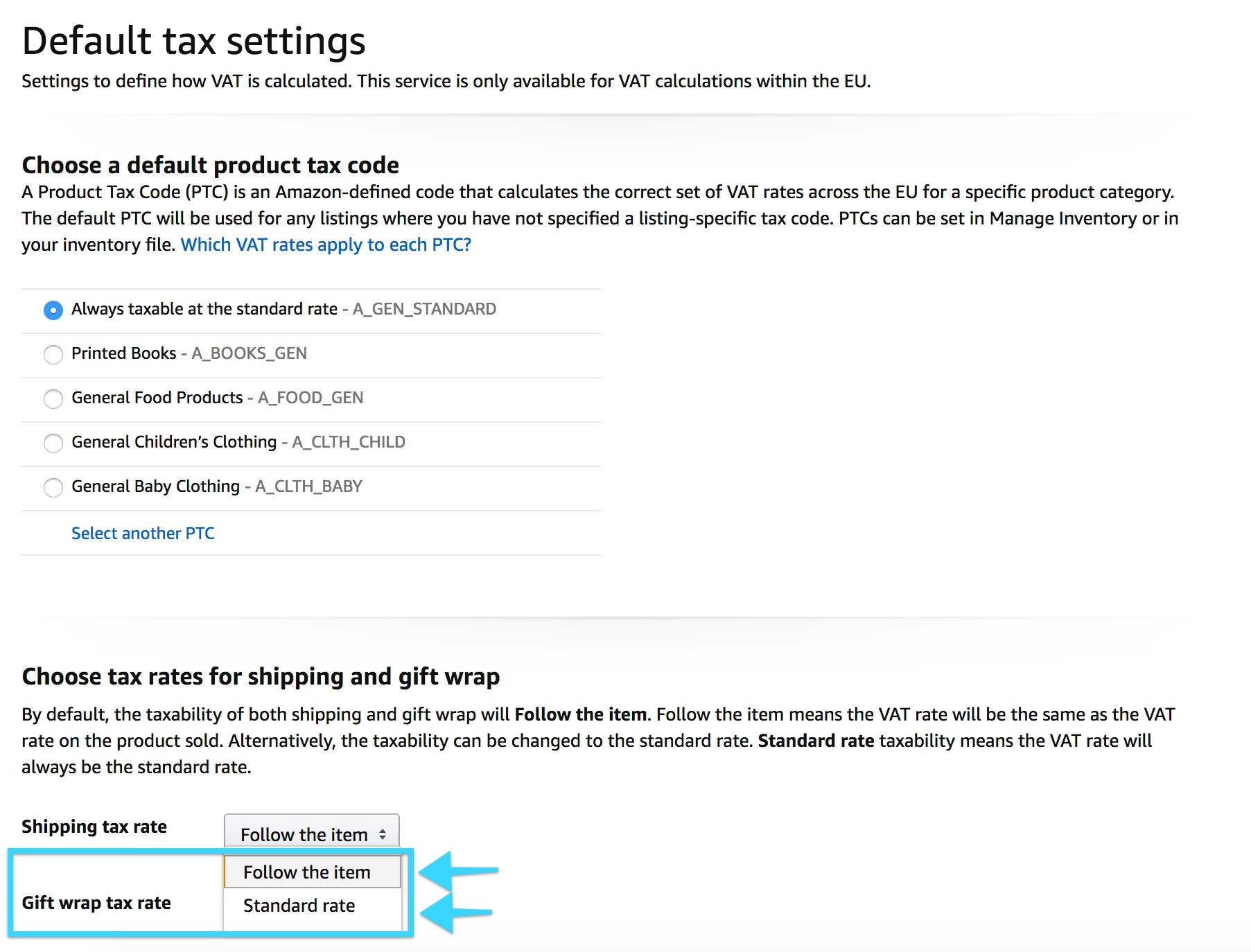

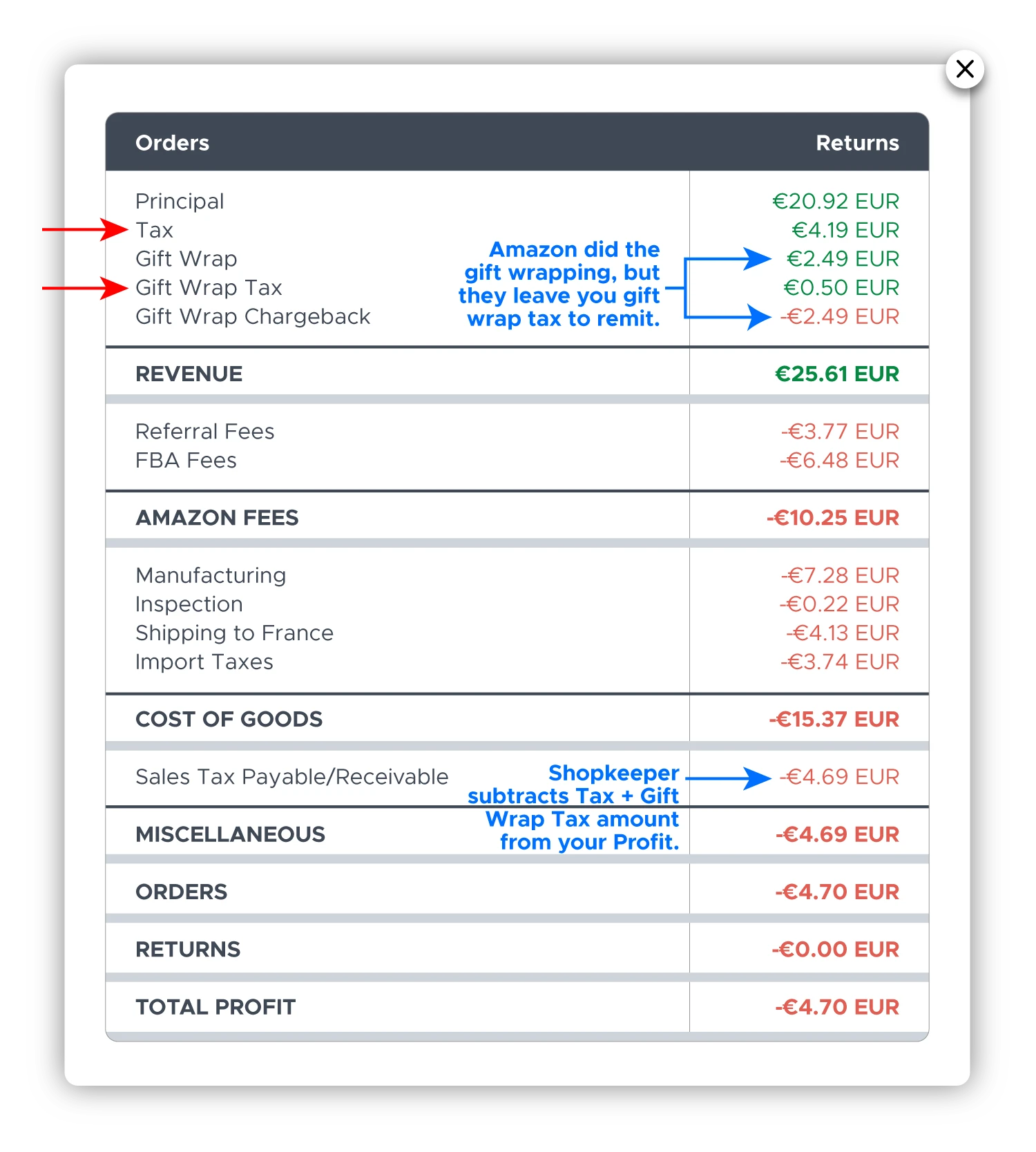

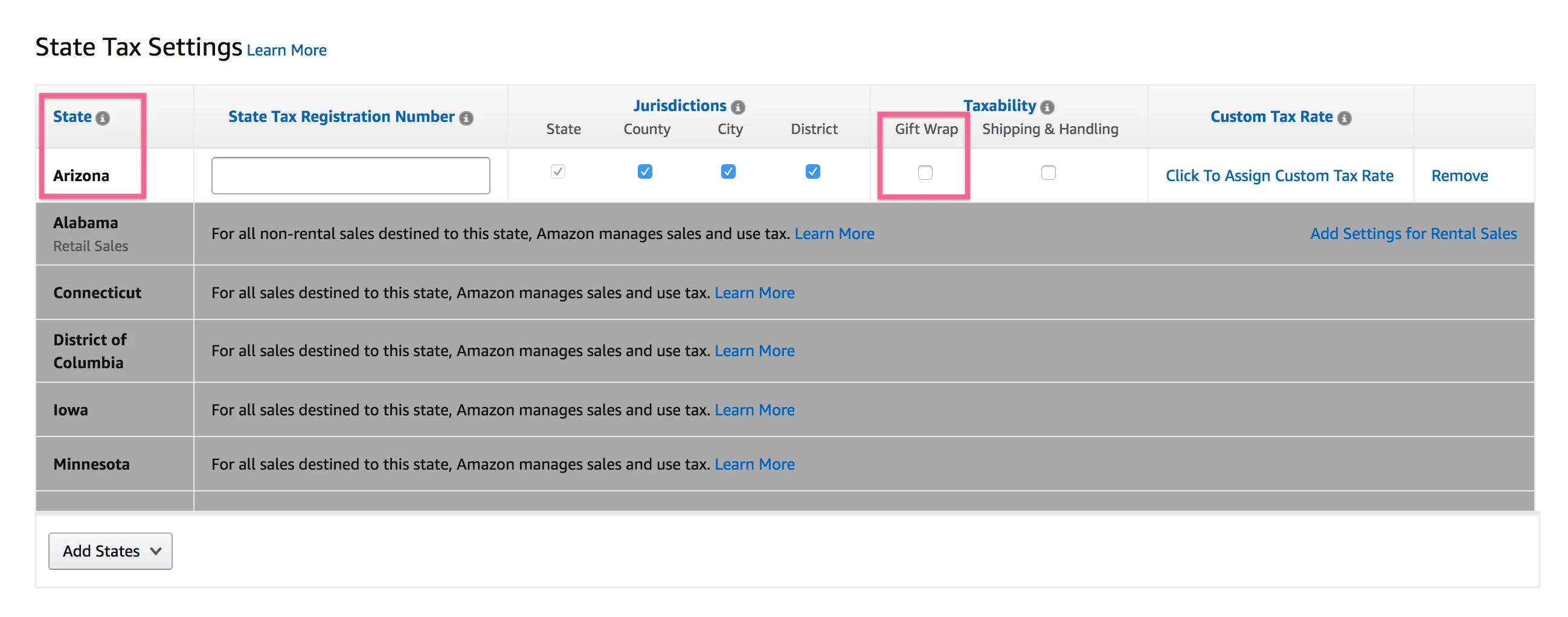

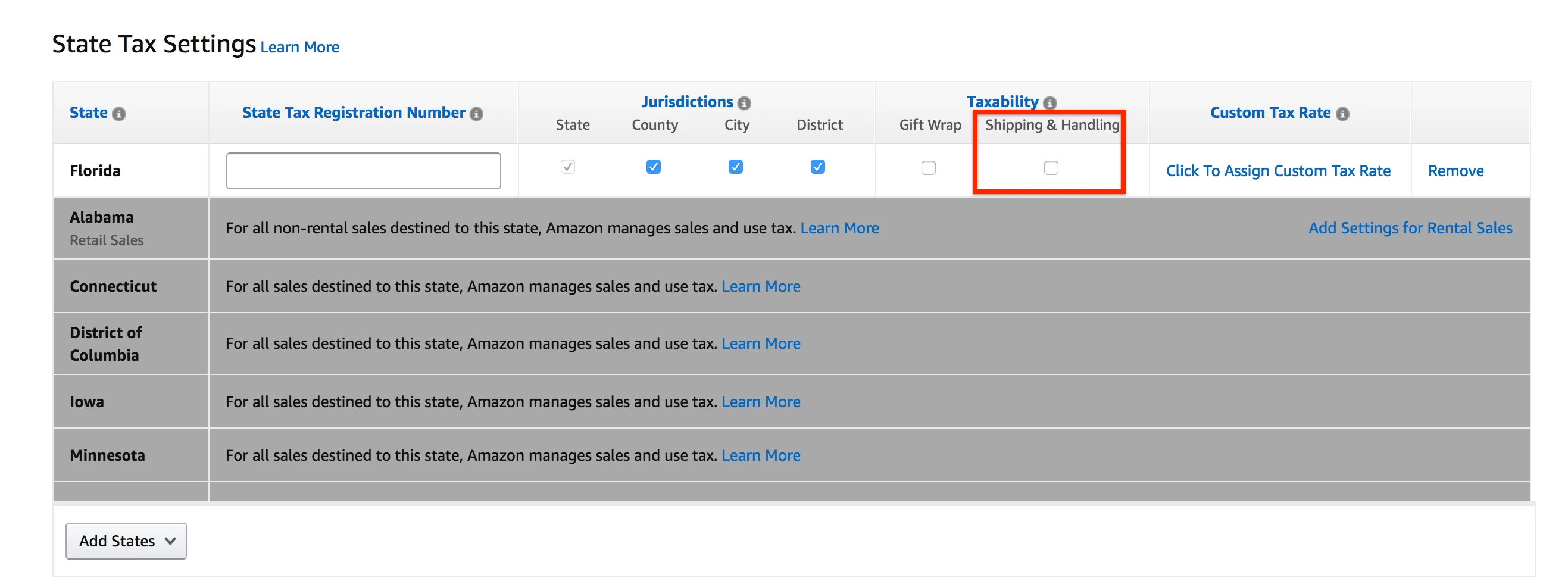

Gift Wrap Tax is collected on Gift Wrap Charges. The exact amount collected will depend on your tax settings in Seller Central:

You may not know this, but you are liable to remit collected Tax on Gift Wrap, EVEN if Amazon is the one doing the actual gift-wrapping, and keeping the Gift Wrap charges.

So when you remit your collected sales tax at the end of the year for VAT for example, don't forget to add the amounts for collected Gift Wrap Tax. Consult your accountant for more info on this, but just be aware Amazon does not remit collected Tax for Gift Wrap services that they performed - YOU have to do it.

Amazon leaves you to remit collected sales tax on the gift wrap charges, EVEN if they are the ones doing the gift wrapping.

The Gift Wrap Tax will appear on your Order Transaction as income.

Here’s how Shopkeeper will show it:

And that makes you see the actual profit you made, minus the sales tax collected.

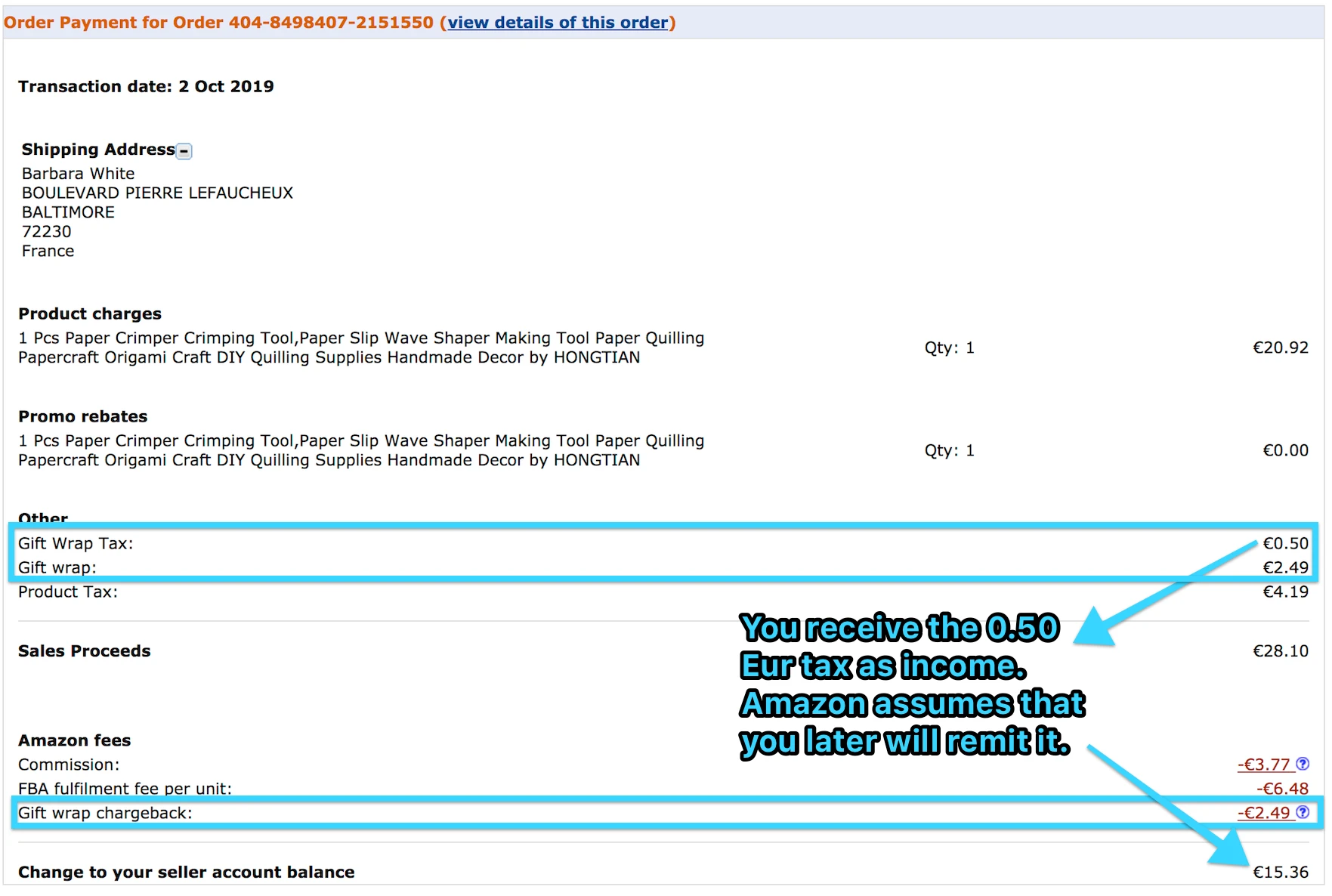

You can double check it on your Seller Central:

If you sell in USA, Gift Wrap Tax can be either collected or not collected, based on state-specific rules and regulations. You as a seller will have to research and decide whether to collect sales tax on gift wrap or not, in each specific state.

State by State Gift Wrap Tax Guide - Taxjar

For some states, Amazon is automatically collecting sales tax and remitting it on your behalf. Alabama, Connecticut, Iowa, Washington and many others. In that case, you don't need to worry about collected Gift Wrap Tax.

When Amazon auto-collects taxes on your behalf, your Seller central transaction shows a chargeback for Gift Wrap Tax, called MarketplaceFacilitatorTax-Other:

Note that according to Amazon, your Sales Proceeds (Revenue) is $32.12. This is inflated, because in the same transaction they are showing chargebacks as expenses. You may not want inflated revenue figures, if you are to present your numbers to potential investors, partners, etc.

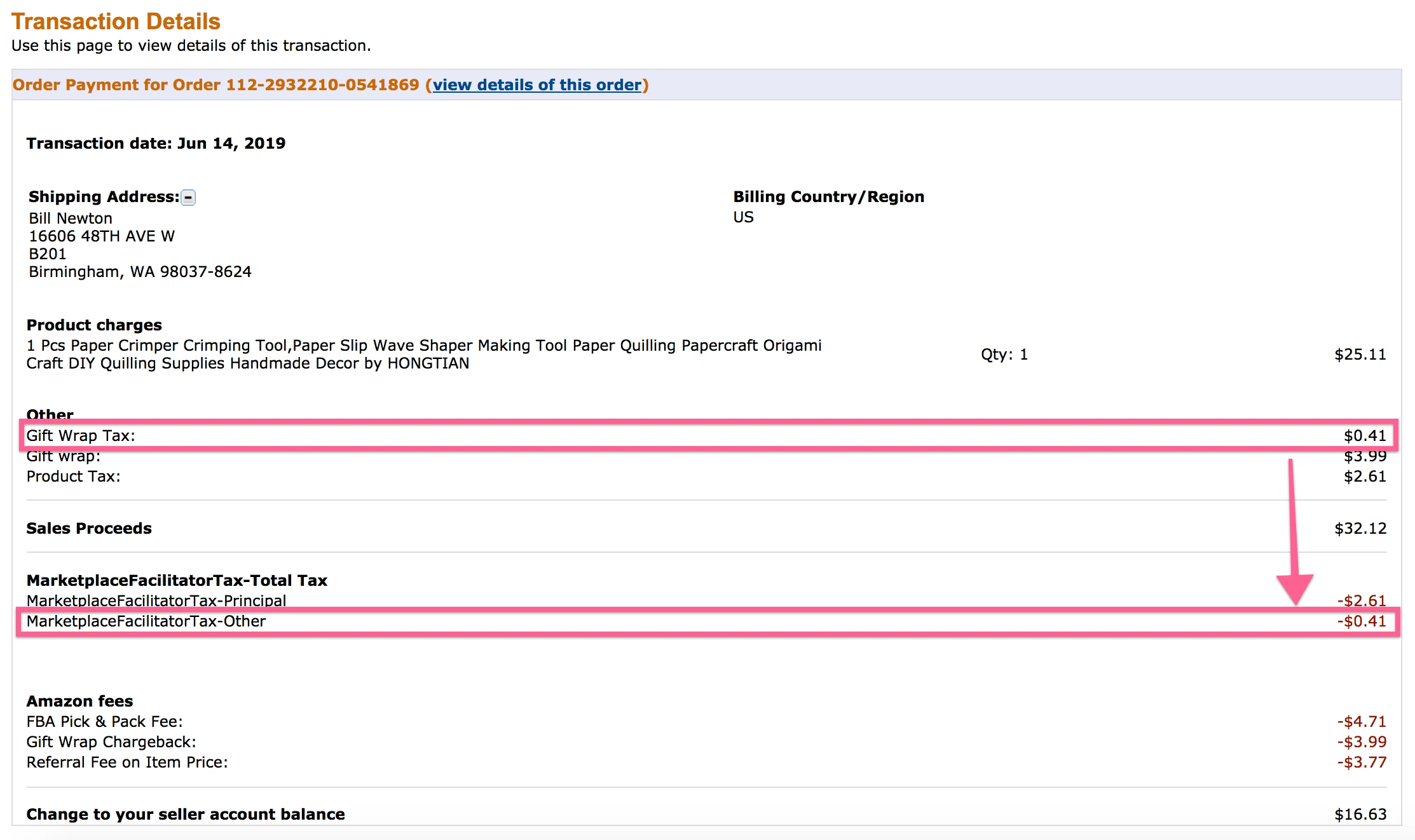

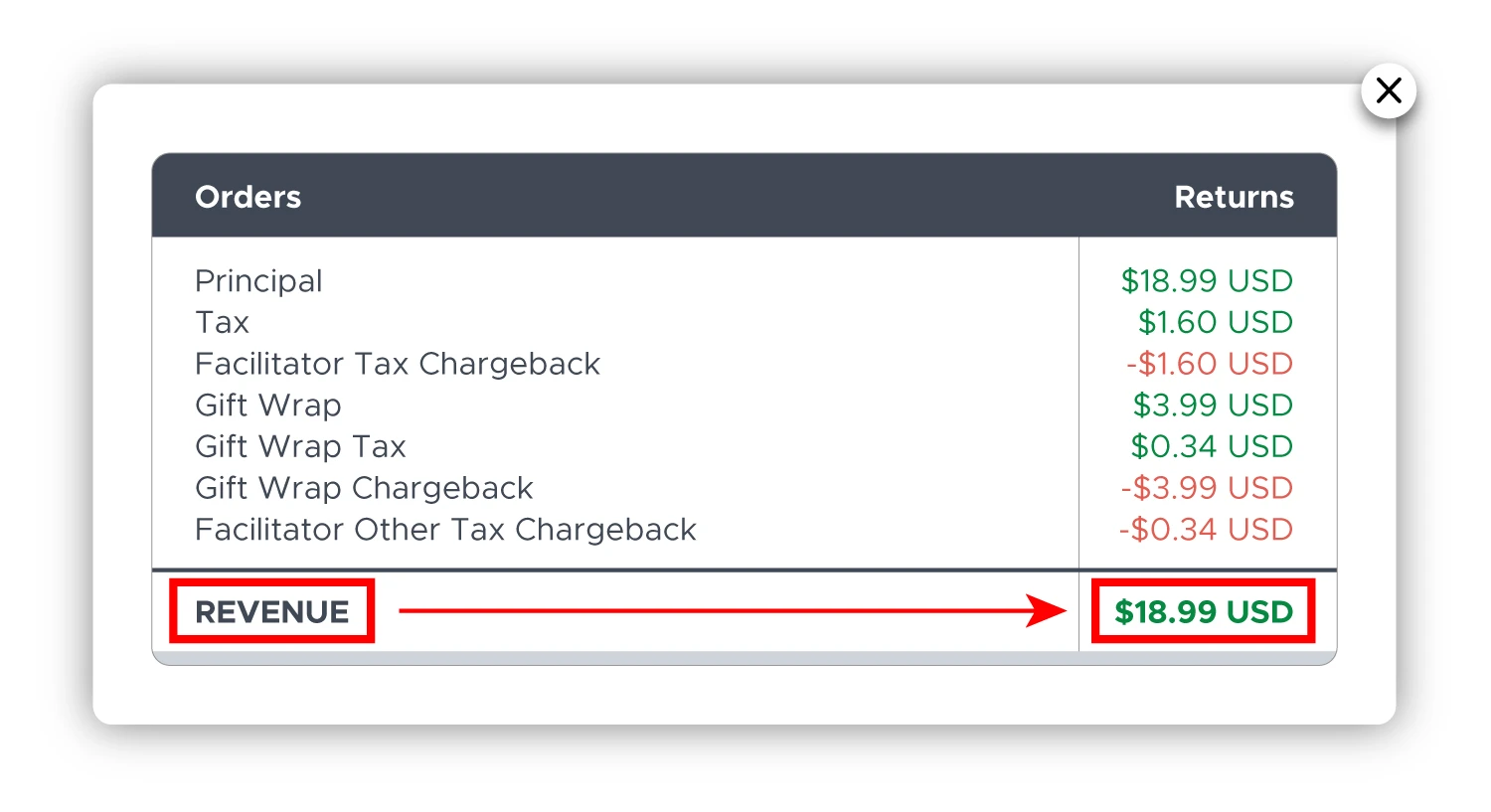

This is how Shopkeeper will organize it for you:

Shopkeeper does not inflate your revenues, like Amazon does. Both Gift Wrap charge and all chargebacks are summed up in Revenue amount, instead of showing chargebacks as expenses. This normalizes your revenues and you don't appear like you are making more money when you aren't.

See How Gift Wrap Fees Affects Your Profits

Global Inbound Transportation Duty

Sellers are required to pay GlobalInboundTransportationDuty in order to cover import tariffs and taxes when shipping goods into Amazon's fulfillment centers from other countries. It includes customs charges related to overseas shipping as part of Amazon's worldwide fulfillment services.

Global Inbound Transportation Freight

GlobalInboundTransportationFreight is a cost calculated by Amazon when the company manages the importation of goods on behalf of sellers, and freight expenses are involved. This fee encompasses the transportation costs incurred during the global shipping process, including import duties, taxes, and other fees associated with transporting goods across international borders.

Goodwill

| Goodwill is also called Other Concession. |

|---|

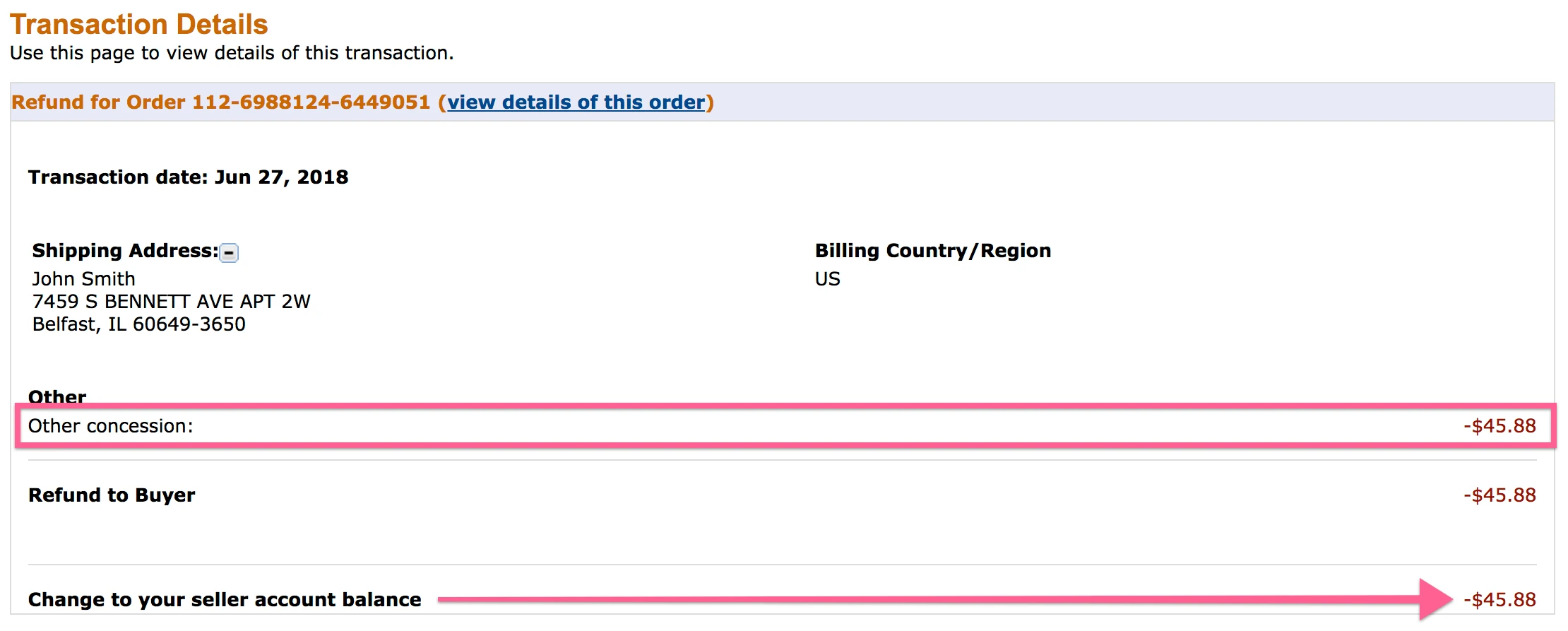

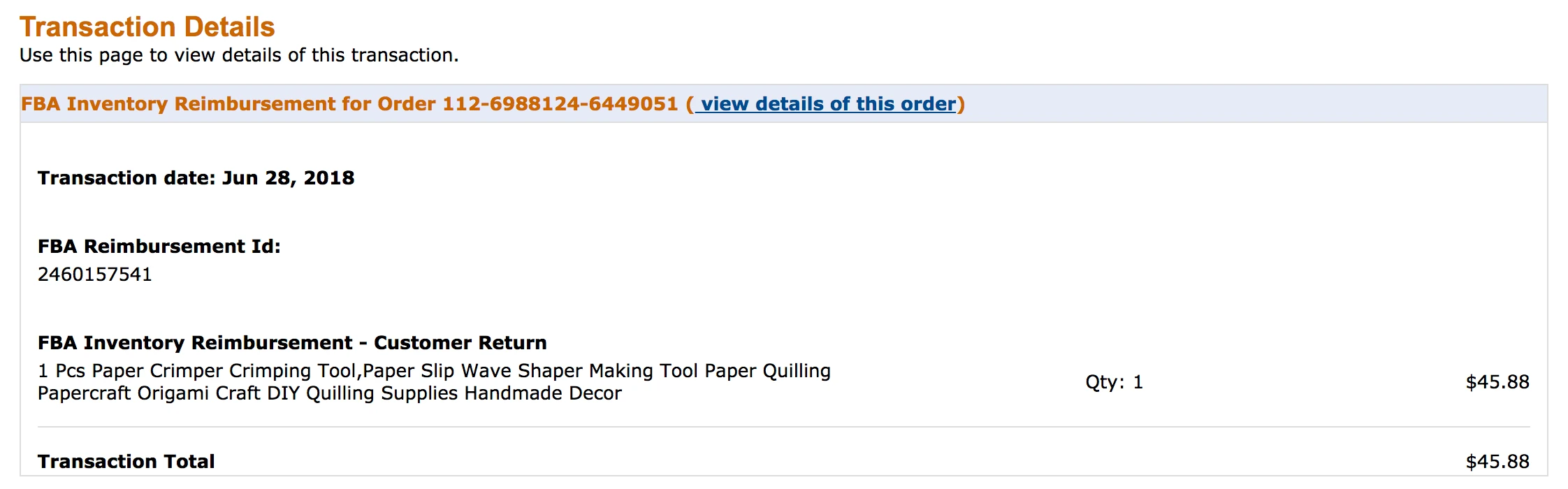

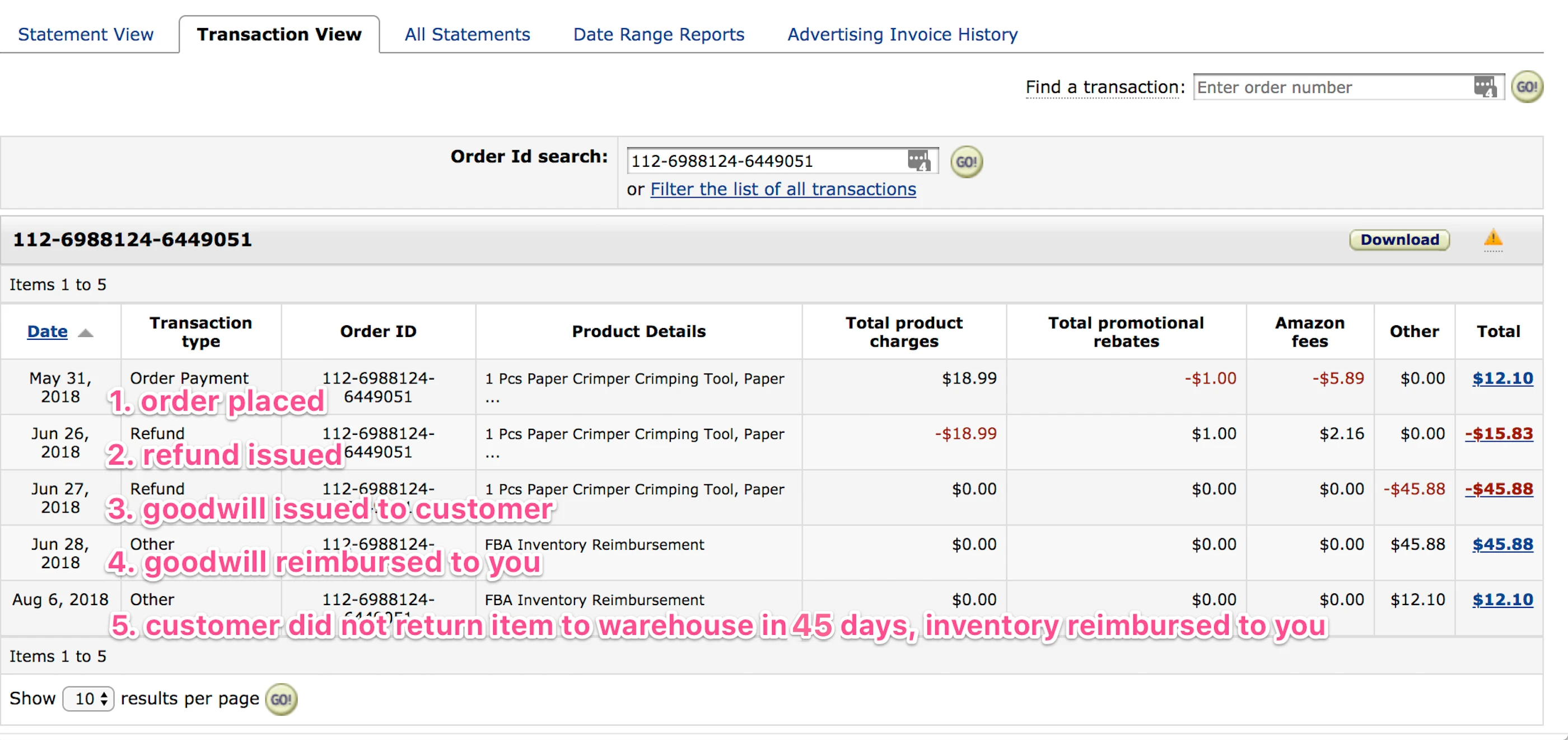

Goodwill is an amount issued to your customer by Amazon, when the customer is not entitled for this amount of refund. Most often, Goodwill concession is granted to compensate for negative customer service experience, late deliveries, lost packages and similar situations.

Amazon takes responsibility for Goodwill charge - so even though you will see it being deducted from your account, you will later see your account being credited for it (within 45 days).

Initially, the Goodwill amount which Amazon issues to your customer, appears as a charge to you, on Seller Central:

Within 45 days of this transaction, you will see an Inventory Reimbursement - Customer Return transaction, associated with the same order.

Here is the full sequence of financial events that happen when the product is refunded and extra goodwill amount is issued to your customer:

-

Order is placed - normal order transaction.

-

Refund is issued - normal refund transaction

-

Goodwill is issued to the customer - you get charged the amount they gave customer as a "bonus refund".

-

Goodwill is reimbursed to you - you get back the money you "paid" to your customer for being dissatisfied with Amazon experience.

-

Customer does not return the item to the warehouse in 45 days, so Amazon charges the customer and reimburses you for the unit.

... ooops, that step 5 has probably made this customer extra angry, as he was likely not aware he had to return the item to not get charged for it.. So he called, he complained, he got his refund and 45 dollars on top of it, and then - BAH - another unexpected charge, when he did not send in the item. Maybe he didn't even have the unit anymore. Pretty unfortunate situation.

Amazon does not have a special Goodwill Amount Reimbursement tag, so they reimburse you using a confusing Inventory Reimbursement tag.

This can make you think that you actually received the refunded item back in stock (as is the normal reason for Inventory Reimbursements). The confusing part is Quantity: 1. It may seem as if one unit was reimbursed, when in fact in this transaction it was not. Reimbursement was only for giving you back the Goodwill amount.

So if you rely solely on Seller Central reports for your accounting, you may use the Goodwill Reimbursement amount in your books incorrectly.

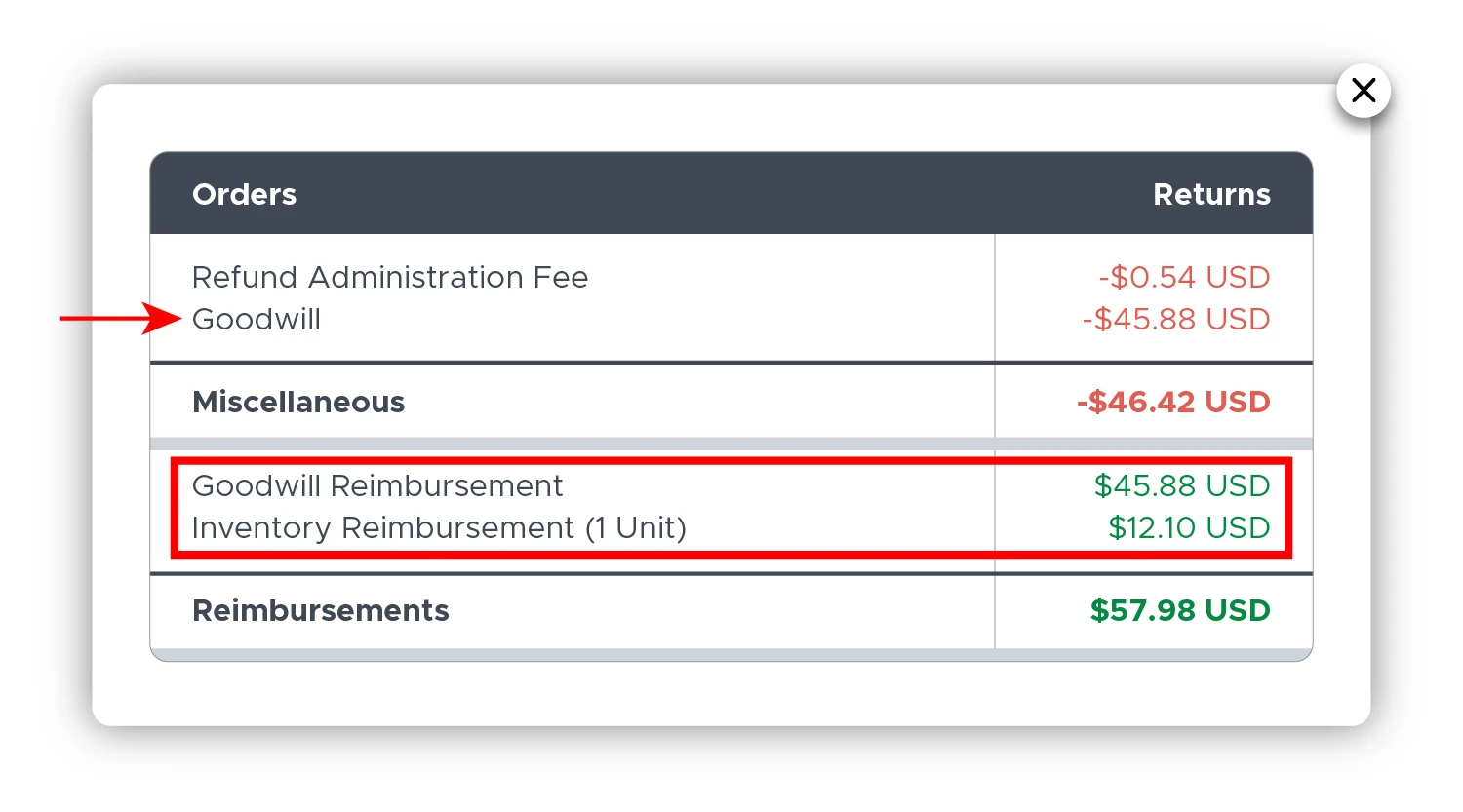

Shopkeeper helps you clarify this event by separating actual Inventory Reimbursements from Goodwill Reimbursements.

You can clearly see which reimbursement event was refunding you the Goodwill amount, and which reimbursement was for the unreturned unit to inventory.

Get Insights on Your Goodwill Fees

High Volume Listing Fees

| High Volume Listing Fee is also called HighVolumeListingFee. |

|---|

High Volume Listing Fee applies mostly to dropshippers, or any sellers that have more than 100,000 active but dead listings on Amazon. For every extra listing above the first 100,000 listings without sales in the last 12 months, Amazon charges a monthly fee of $0.005.

There are three rules which Amazon uses to count the ‘dead’ listings. It has to satisfy the following:

You have an active offer for that asin, meaning there is at least 1 unit in stock that is available for sale.

AND

This is not a new listing, and this ASIN was created more than 12 months ago.

AND

This ASIN did not have any sale from any seller in the last 12 months.

You see, the good thing is, that you share this burden with other sellers. If any of you have had sales in the last 12 months, then this listing will not count as ‘dead’.

For exact up to date fee amount, see this page on Amazon:

High Volume Listing Fee - Amazon Seller Central USA

In Amazon Europe, HighVolumeListingFee also exists, but different rules apply:

If you exceed 2 million SKUs in a given month, you will be charged. For example, for each active non-media SKU over 2 million, a fee of €0.0004 per SKU will apply. See the most recent fees on Amazon page:

High Volume Listing Fee - Amazon Seller Central Europe

Import Taxes Amount

The import_taxes_amount charge denotes the taxes or levies imposed on goods that are being transported abroad. When an item crosses borders, the destination country's government may levy customs charges, taxes, or fees, which are covered by this charge. It guarantees that you pay these taxes in advance, preventing delays or extra fees at the time of delivery.

Inbound Carrier Damage

The INBOUND_CARRIER_DAMAGE charge on Amazon is incurred when items sent by a seller to an Amazon fulfillment center are damaged during shipment. If the damage occurs during transit, the seller may be charged or get an adjustment for the damaged items. Responsibility for the damage is determined by whether the seller or Amazon's partnered carrier handled the shipping, which influences whether the seller is compensated or must seek reimbursement.

Check Your Damage Reimbursements

FBA Inbound Convenience Fee

FBAInboundConvenienceFee applies when Amazon assists in receiving your products into their fulfillment facilities, which may include services such as label application or other preparation required to stock your items.

Let's say your shipment requires new labels; Amazon may charge $0.20 per unit for relabeling, which adds up depending on the quantity of your shipment.

FBA Inbound Defect Fee

Amazon charges an FBAInboundDefectFee when products prepared by sellers are brought in. It acts as a penalty for products that need more labor or revisions from Amazon in order to satisfy the requirements for fulfillment or storage. This charge serves as a motivator for sellers to make sure their goods are ready before shipping them to Amazon's fulfillment centers, which minimizes the time and money Amazon must spend correcting or altering goods once they arrive. By following Amazon's policies and offering premium products right away, sellers can prevent this charge and guarantee a more efficient and economical incoming process for their inventory.

FBA Inbound Shipment Carton Level Info Fee

FBAInboundShipmentCartonLevelInfoFee is imposed when you do not submit accurate or complete carton-level information (such as dimensions and contents) for inbound shipments; Amazon may charge for the additional effort required to manually handle these shipments.

If you ship 30 cartons to Amazon without carton-level specifics, they may charge $3 each carton for manual processing, totaling a $90 price.

FBA Inbound Transportation Fee

FBAInboundTransportationFee refers to the fees that the seller must pay to Amazon for having their products shipped to Amazon for fulfillment. Most often, this refers to the cost of buying shipping labels for your products that are shipped to Amazon for fulfillment. You have the option to ship these items to Amazon directly for fulfillment, which means you can skip this fee and pay for your own labels. However, through Amazon’s partner shipping programs it can be much more cost effective to pay the inbound fee and in turn pay the Amazon Inbound Transportation. This helps for convenience and can get your inventory replenished faster!

Check Your Inbound Fees

FBA Inbound Transportation Program Fee

The FBAInboundTransportationProgramFee is a special fee that applies when you work with UPS for shipping your products to Amazon's FBA warehouses. This fee covers the cost of using Amazon's partnered shipping services, which usually involves purchasing UPS shipping labels when creating a shipment to restock inventory.

FBA Inbound Transportation Service Fee

When using Amazon’s inbound transportation to replenish inventory, it’s critical to report that inbound inventory accurately to Amazon. Amazon will charge the FBAInboundTransportationServiceFee based on the information that you provide (number of boxes, sizes, weights etc.) but if Amazon receives the shipment and finds that information to be inaccurate, you will be hit with a service fee to make up for the difference. Not a huge deal, but just something to be aware of if you get hit with a service fee on your inbound shipments and find yourself asking “What is this?”.

So do your best to accurately report your inbound packages to Amazon. This will help you avoid these additional service fees that you may or may not have accounted for!

Increase Visibility on Low Traffic Items

This is likely a Sponsored Products campaign designed to promote items that aren’t getting much traffic or visibility.

It targets ASINs with low impressions or clicks to help boost exposure.

-

Increase Visibility on Low Traffic Items_OOC - Often auto-generated by Amazon’s advertising recommendations or used as part of a broad strategy. “OOC” may stand for Out of Campaign or Out of Category, indicating that the ASINs being promoted don’t currently belong to an existing manual campaign or fall outside standard targeting structures.

-

Increase Visibility on Low Traffic Items_SO - “SO” could stand for Sponsored Offers or a custom label depending on your ad setup. It’s likely a variation of the same low-traffic item visibility campaign, possibly tailored for a specific product group or targeting method.

Inspection Amount

Inspection_amount describes the cost imposed on Amazon sellers to have their products inspected to make sure they satisfy quality requirements prior to sale or shipment. In order to preserve the quality of the product, this fee is incurred when things are shipped to fulfillment centers. It may affect the overall expenses and profit margins of sellers.

FBA Inventory Fee

The FBA Inventory Fee is charged for storing your products in Amazon's fulfillment centers and includes two primary costs:

-

Monthly Storage Fees: These are determined by the amount of space (measured in cubic feet) your products take up, with higher rates typically applied during peak times, such as the holiday season.

-

Long-Term Storage Fees: This fee is applied to inventory that has been stored for more than 12 months, aimed at reducing stagnant stock.

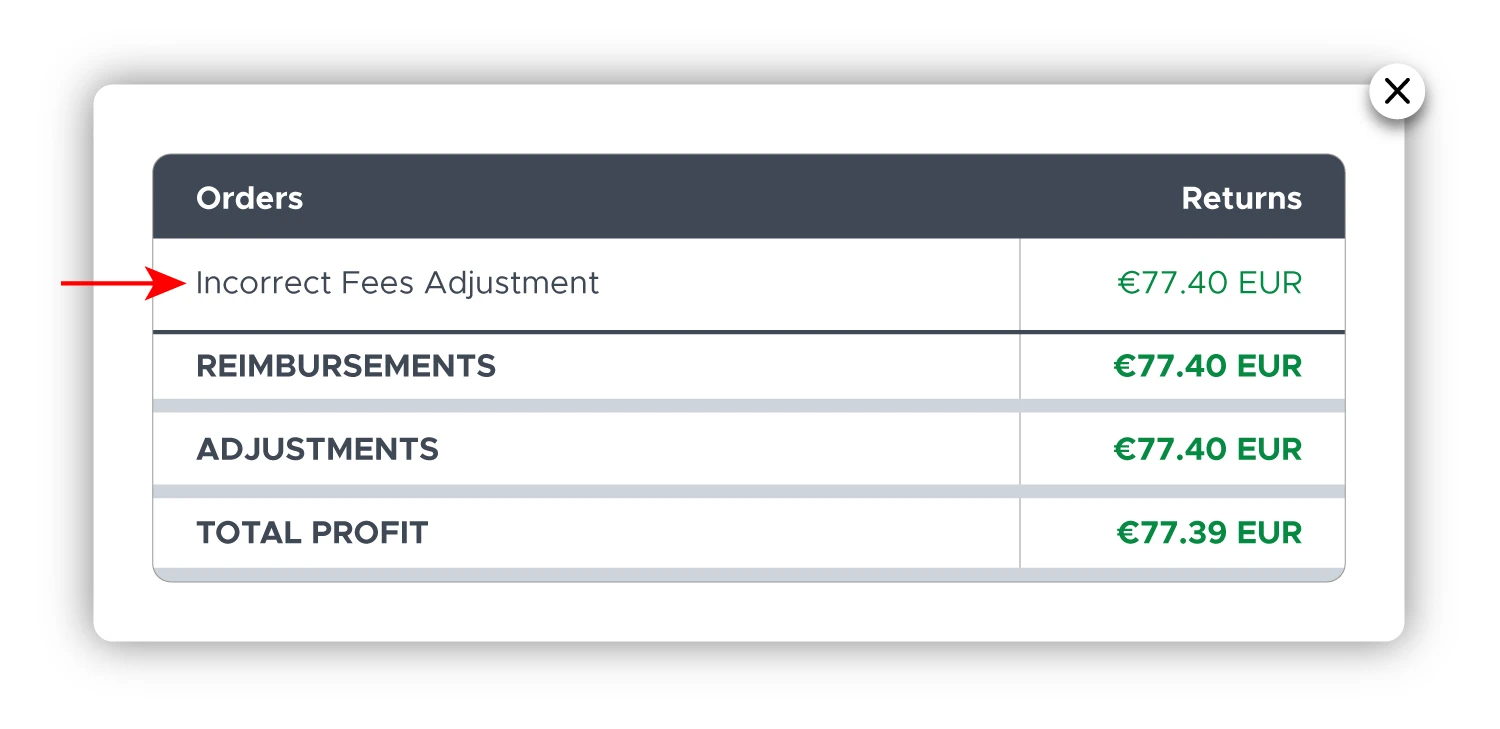

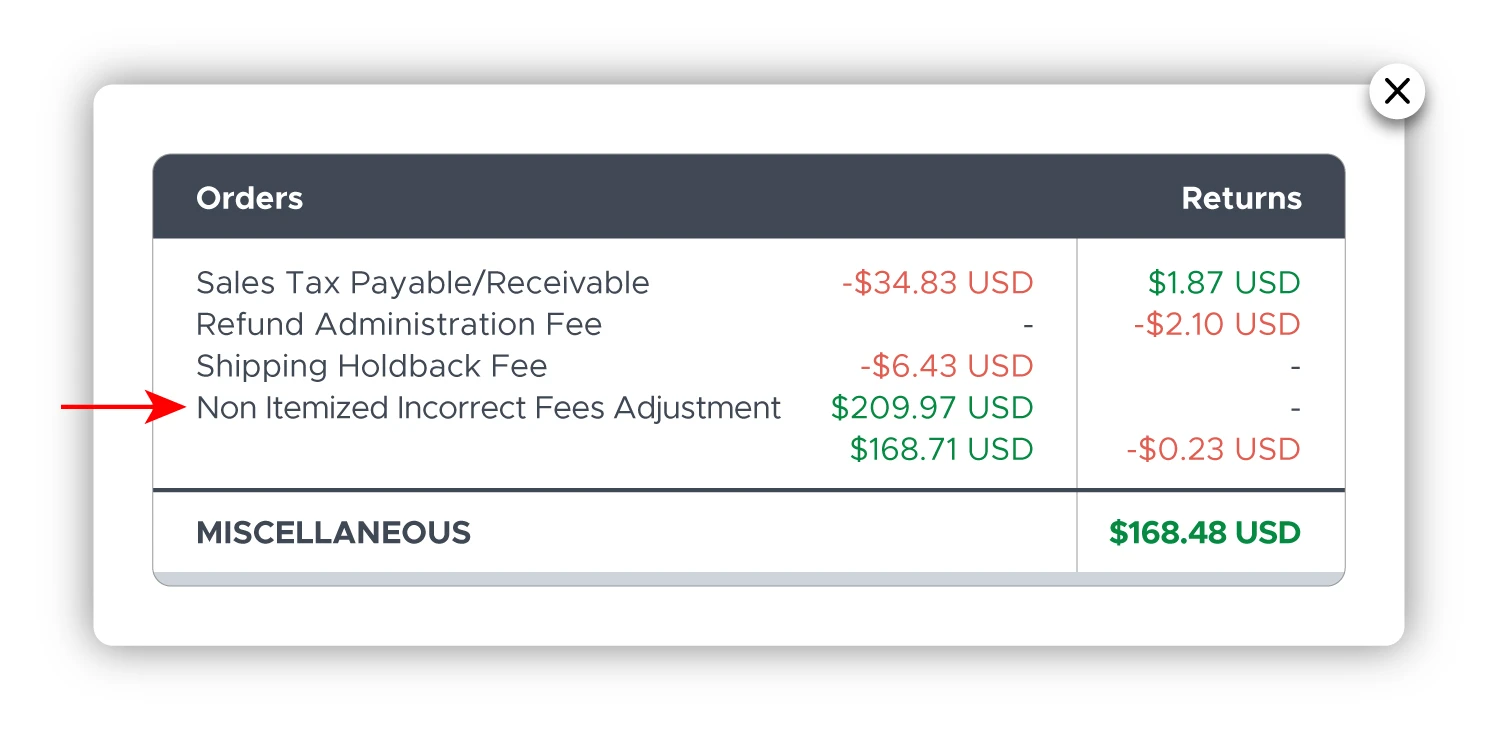

Incorrect Fees Items

| Incorrect Fees Items is also called INCORRECT_FEES_ITEMS, IncorrectFeesNonItemized, INCORRECT_FEES_NON_ITEMIZED. |

|---|

This fee is exactly what it says - Amazon adjustments for incorrect fees.

Distinction between items and non-itemized is Amazon specific - they use the term item to mean an individual SKU, a separate product.

When the adjustment is non-itemized, no SKU is associated with that transaction. This means that incorrect charges were for a service that does not specify one SKU or had more than one SKU affected.

When the adjustment is IncorrectFeesItems - it means that Amazon has indicated which SKU and how many units of that SKU are affected by the adjustment. For example, they had incorrect measurements of your product, and you complained. Then Amazon will add in an adjustment, depositing you the difference that you overpaid, showing in the transaction on Seller Central, as 279 units of SKU KR-FG78-54R, calling it adjustment INCORRECT_FEES_ITEMS.

Shopkeeper shows Incorrect Fee adjustment on a particular date when it gets posted by Amazon. Even if there are no sales of that product on that day:

On June 26, in this example, Amazon posted an adjustment for Incorrect Fees in multiple EU countries at the same time. Shopkeeper shows these financial transactions, even though there were no sales of this product on June 26. That way you get the most complete financial picture of that day.

If Amazon does not specify which SKU was affected, Shopkeeper shows the adjustment amount in the Totals row on adjustment posted date:

Audit Your Incorrect Fees Items

FBA International Inbound Freight Fee

The FBAInternationalInboundFreightFee is a charge made by Amazon to offset the freight expenses related to shipping items internationally. This charge is incurred by sellers that ship their inventory from areas outside of the nation where Amazon's fulfillment centers are situated. It includes all costs connected with shipping, clearing customs, and other relevant fees when moving goods across international boundaries.

FBA International Inbound Freight Tax And Duty

FBAInternationalInboundFreightTaxAndDuty refers to the import taxes and customs charges associated with delivering goods internationally to Amazon's fulfillment centers via the Fulfillment by Amazon (FBA) program. These fees are critical for sellers to consider when shipping their products across borders to be kept and maintained by Amazon.

Assume a seller in the UK wants to send 100 toys to an Amazon fulfillment center in the United States. The US government charges a 5% import tax and a 10% customs levy on toys. If the total value of these toys is $1,000, the seller will incur the following costs:

-

Import Tax: $3,000 x 5% = $150

-

Customs Duty: $3,000 x 10% = $300

Thus, the total FBAInternationalInboundFreightTaxAndDuty for sending these toys to the US would be $450.

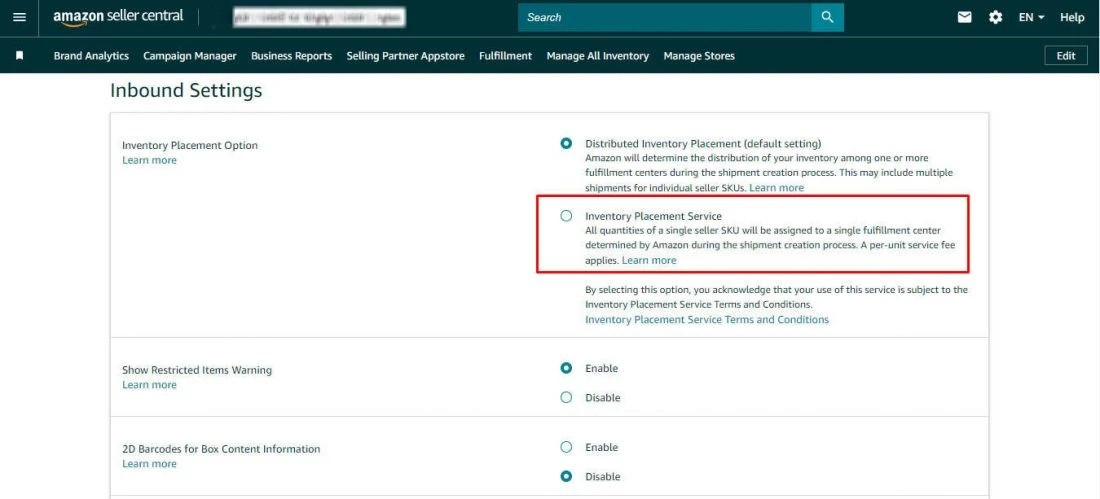

Inventory Placement Fee

As stated by Amazon Seller Central, all quantities of a single seller SKU will be assigned to a single fulfillment center determined by Amazon during the shipment creation process. A per-unit service fee applies.

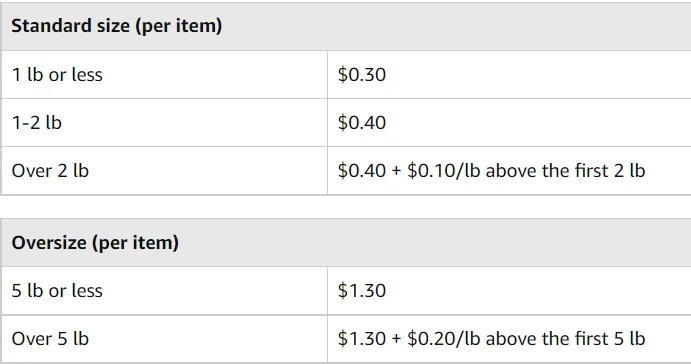

The InventoryPlacementFee is a charge by Amazon for its Inventory Placement Service, facilitating inventory distribution. This service incurs a per-item fee based on weight and size. While the standard Distributed Inventory Placement Program is free of charge, companies who sell large or heavy goods may have to pay significant additional fees. There are several exceptions, such as jewelry, clothing, and dangerous products, which would need to be handled separately.

Fees for standard-size items range from $0.30 to $0.40 per unit, with additional charges for heavier items. Oversize items incur a flat fee of $1.30, plus extra charges per pound over 5 pounds.

While the service streamlines distribution, it's not free, and businesses should weigh its benefits against costs. For instance, shipping 1,000 units of sub-1-pound inventory incurs a $500 fee. Businesses must carefully assess whether the convenience of centralized shipping outweighs the additional expense.

Item TDS

The tax that Amazon collects from sellers when a product is sold is known as the ItemTDS. This fee is determined by the buyer's location's sales tax regulations. Amazon determines the applicable sales tax at the time of purchase, adds it to the total cost, and pays the appropriate tax authorities. Amazon handles the tax collecting procedure, so sellers don't have to do it themselves.

Labeling Fee

When you opt for Amazon to generate barcodes or labels for your products, you incur a LabelingFee. If you specifically request Amazon to label your items with ASIN/FNSKU barcodes, they charge a fee per label. As of now, the fee is $0.20 per label.

See How Labeling Fees Affect Your Costs

Local Shipping Amount

The cost of delivering an item inside the same country or region is known as the "local_shipping_amount" charge. For instance, this fee may be applied to your total if you're purchasing anything from a third-party vendor who doesn't provide free delivery. It is distinct from overseas shipping charges and is frequently observed in situations where Prime perks, such as free shipping, are not applicable.

FBA Long Term Storage Fee

Amazon imposes an annual FBALongTermStorageFee on items stored in their warehouse for more than 12 months. The intention is to discourage using fulfillment centers as long-term storage and to maintain an efficient inventory flow. The fees increase for items stored beyond 365 days, calculated per cubic foot. Sellers are advised to keep track of their inventory and, if necessary, remove or dispose of slow-moving items to avoid incurring these long-term storage charges, which fluctuate based on peak and off-peak seasons.

Lost Or Damaged Reimbursement

The LostOrDamagedReimbursement is a payment made to sellers for items lost or damaged while in Amazon's possession or during the fulfillment process through the Fulfillment by Amazon (FBA) program. If a seller's inventory is lost or destroyed in an Amazon fulfillment center, the seller receives reimbursement for the affected goods based on their documented value.

Low Value Goods Tax - Other

LowValueGoodsTax-Other is a tax collected on goods below a certain value threshold, often triggered by international shipments. It is required by some countries to ensure fair tax application on cross-border e-commerce.

Low Value Goods Tax - Principal

LowValueGoodsTax-Principal is applied on the whole cost of the product, excluding any additional fees such as shipping or handling. It is particular to the amount paid for the products and reflects the item's taxable value as determined by local tax regulation for low-value imports. For example, if you buy a $20 item and the tax rate is 10%, the LowValueGoodsTax-Principal will be $2. This ensures that the primary cost of the item is taxed in accordance with the applicable regulations.

Low Value Goods Tax - Shipping

LowValueGoodsTax-Shipping is connected to the shipping and taking care of charges related with delivering the item. It is separate from the tax on the product's price and explicitly addresses the cost of delivering the item to the client.For example, if the item's shipping cost is $5 and the applicable tax rate is 10%, the LowValueGoodsTax-Shipping will be $0.50. This ensures that all aspects of the purchase, including shipping, are properly taxed in accordance with local legislation.

Manufacturing Amount

The cost of making a product, particularly for bulk or custom-made items, is referred to as the manufacturing_amount fee. This fee includes labor, raw material, and overhead charges that are incurred during the manufacturing process. It helps customers comprehend the pricing structure by breaking down the overall cost of an item. For goods manufactured especially for a customer, such as those offered through Amazon's bespoke services or bulk orders from other sellers, this sum is frequently pertinent. In conclusion, the manufacturing_amount provides buyers with clarity regarding product pricing by reflecting the costs associated with creating an item.

Analyze Manufacturing Charges

Marketplace Facilitator Regulatory Fee - Principal

The MarketplaceFacilitatorRegulatoryFee-Principal is a charge imposed by Amazon on sellers in certain regions where Amazon acts as a marketplace facilitator. This fee is linked to tax regulations that require Amazon to collect and remit taxes on behalf of sellers for transactions conducted through its platform. Essentially, Amazon handles the responsibility of collecting and paying the necessary taxes to local authorities when sellers use its marketplace to sell goods.

Understanding and preparing for this fee is crucial for sellers, especially in jurisdictions where these tax rules apply. It ensures compliance with tax laws without sellers needing to individually manage tax collection and remittance for their sales on Amazon. For detailed information on how this fee applies to specific situations, sellers should consult Amazon's official seller resources or reach out to Amazon Seller Support directly.

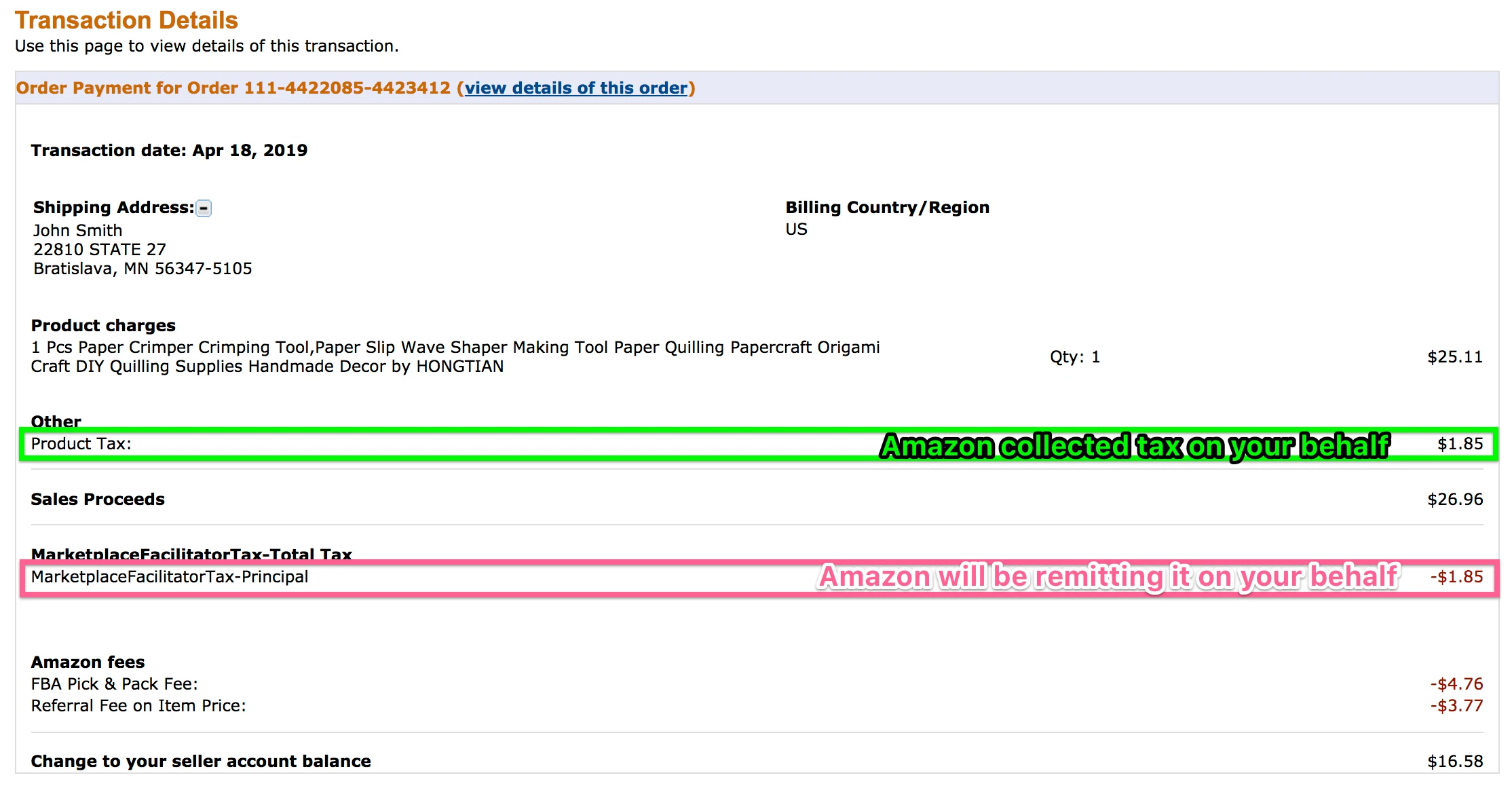

Marketplace Facilitator Tax

| Marketplace Facilitator Tax is also called MarketplaceFacilitatorTax-Principal, MarketplaceFacilitatorTax-Total Tax. |

|---|

Marketplace Facilitator Tax is a tax collected & remitted by Amazon on your behalf, due to agreements with the specific states in USA. Eventually all states will have such agreements and sales tax will be collected & remitted for you automatically in all of USA.

You don't have to do anything, and there is no extra cost to you. But Marketplace Facilitator Tax will show up in your Seller Central transactions, so you need to understand what they are:

There is a bit of grey area in how Amazon sellers currently handle sales tax in those USA states that do not have agreements with Amazon. Here is a video explaining it:

In short, you are liable to collect sales tax in any USA state where your business has a nexus. Having inventory in a state is one way to be considered having a nexus. And as you know, Amazon stores your inventory all over USA, so you have nexus in basically all of the states.

That means you are in fact liable to register for remitting sales tax in each state in USA.

Most sellers are not collecting sales tax in all states. It's huge overhead and extra costs to register and do remittances, which often would be higher costs than actual sales tax collected. So most sellers now are just standing in a 'grey area', waiting for Marketplace Facilitator Agreements between Amazon and all the states to be signed.

Here is an up-to-date list of agreements with the states that are currently signed by Amazon:

Marketplace Facilitator Tax Collection - Amazon Seller Central

Shopkeeper will normalize your revenue, so that collected tax does not leave you with inflated revenue. Amazon inflates your revenue by showing collected tax as income, and tax chargeback as expenses. You don't want to appear as if you're making more money when you aren't:

There are other kinds of Marketplace Facilitator Tax Chargebacks: that you may see in your transactions:

MarketplaceFacilitatorTax-Shipping

MarketplaceFacilitatorTax-Other

MarketplaceFacilitatorTax-RestockingFeeMarketplaceFacilitatorTax-Shipping is a chargeback on the Shipping Tax, which Amazon collects and remits on your behalf. It is also called Facilitator Shipping Tax Chargeback.

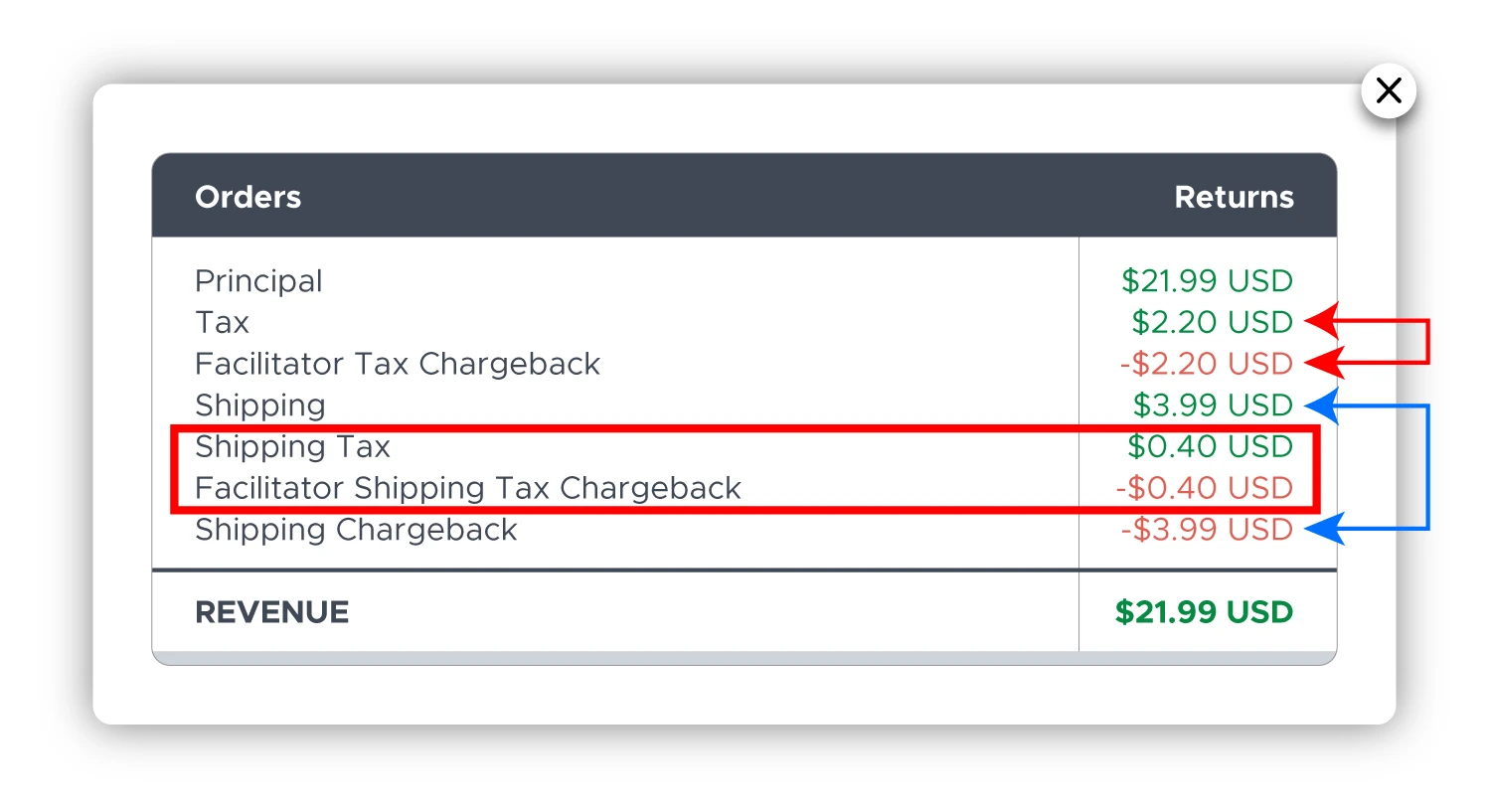

Here is an example Amazon order you would see via Shopkeeper:

Normally you are the one liable for Shipping Tax - meaning you are the one who has to remit it, EVEN if Amazon is the one doing the shipping. But in this case, the buyer is from one of the states that has automatic tax collection / facilitator agreement with Amazon, so Amazon does not send you the Shipping tax as they normally would - instead, they are keeping it and will remit it on your behalf.

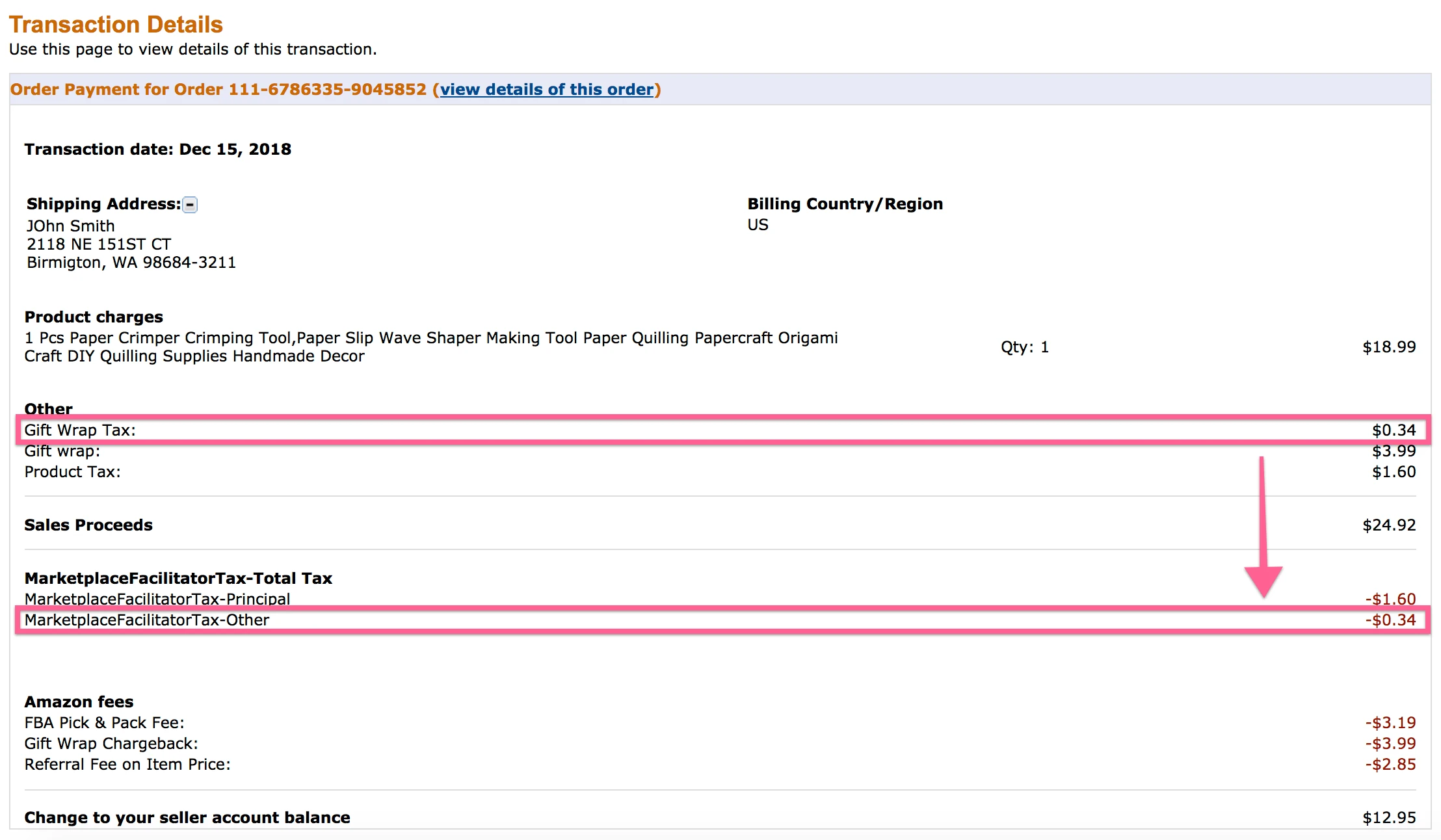

MarketplaceFacilitatorTax-Other is any other type of tax chargeback, which Amazon collects and remits on your behalf. For example, Amazon collects Gift Wrap Tax for you. Then, in the same transaction, you see MarketplaceFacilitatorTax-Other amount:

As you see, it is starting to get quite messy and confusing if you try to analyze Seller Central numbers via Order page.

Shopkeeper displays it more organized and does not inflate your revenue with items that have chargebacks in the same Amazon Order:

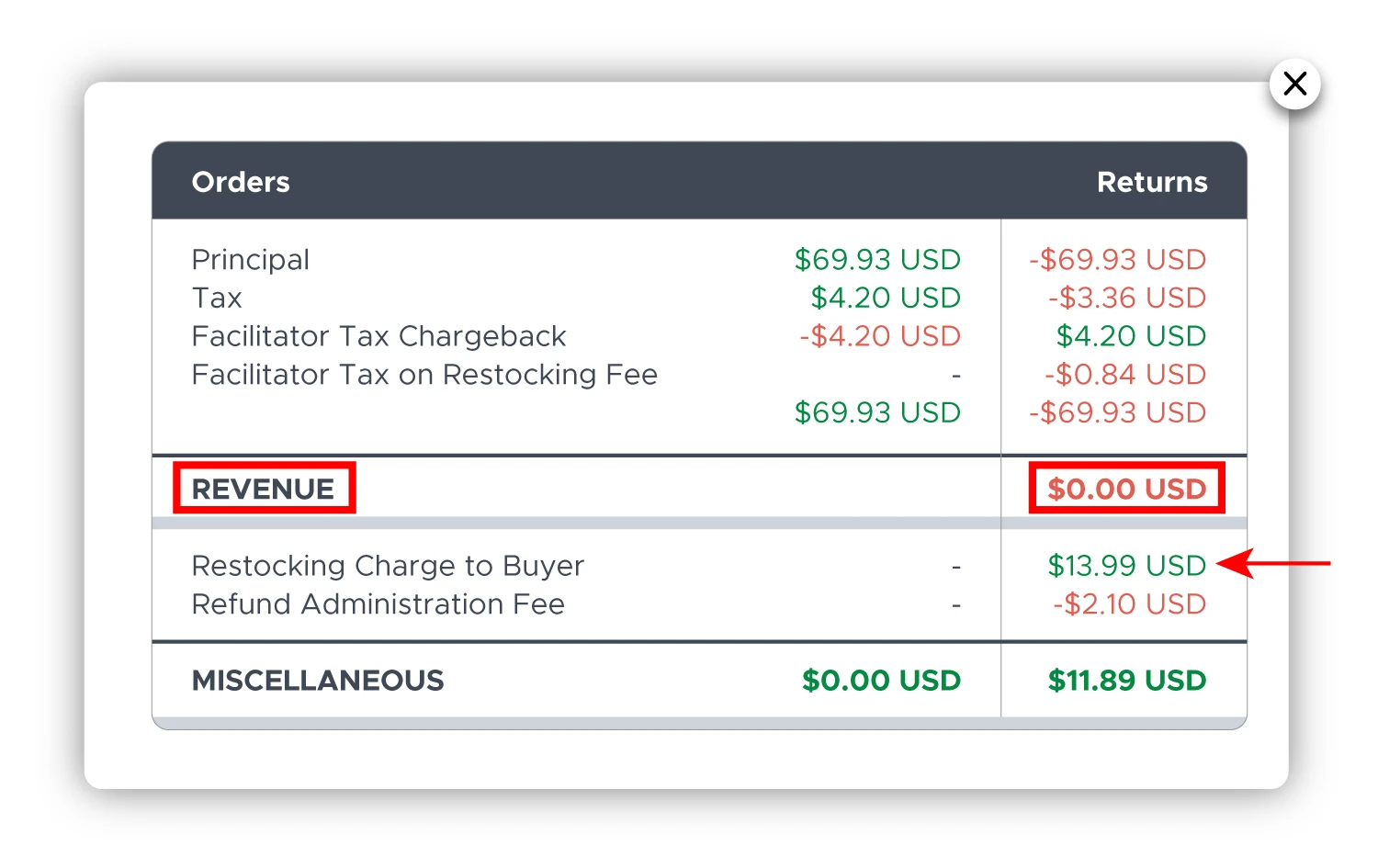

MarketplaceFacilitatorTax-RestockingFee appears in Refunds, which have Restocking Fees.

Seller Central support explains MarketplaceFacilitatorTax-RestockingFee as:

This tax would be charged for an order that a restocking fee was charged on, but not for all Marketplace Facilitator States.

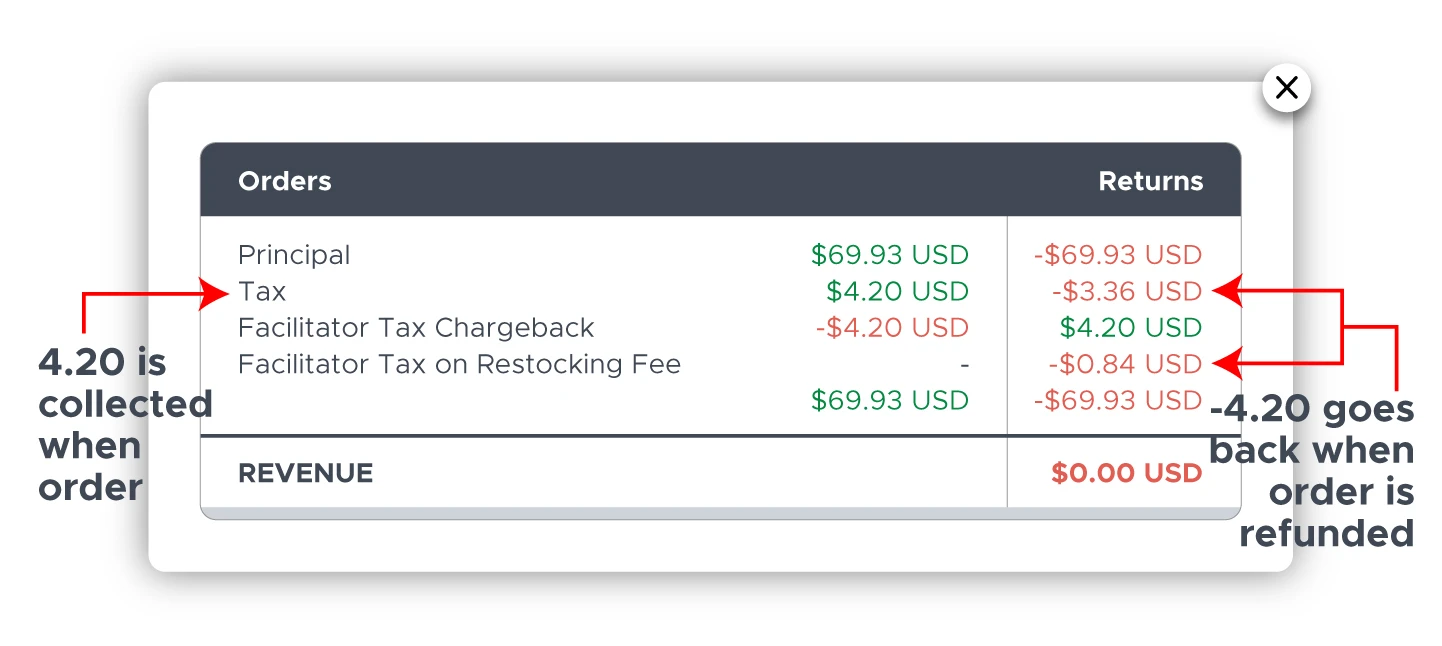

Here is how such situation looks like:

When there is a Restocking Fee charged (with Refund), for some facilitator states instead of full tax refund to buyer, refunded tax is split into two parts, to account for tax on Restocking Fee.

According to Seller Central support, only some states collect tax on Restocking Fee, as per individual state Facilitator Tax agreements between state and Amazon.

Marketplace Facilitator VAT - Principal

MarketplaceFacilitatorVAT-Principal is the VAT (Value Added Tax) added on the primary cost of the product being sold on the marketplace. It covers the item's taxable value, minus any additional fees like shipping or restocking. This guarantees that the fundamental value of the goods is taxed in accordance with local VAT laws.

Learn More about Marketplace Facilitator VAT

Marketplace Facilitator VAT - Restocking Fee

MarketplaceFacilitatorVAT-RestockingFee refers to the VAT applied on the restocking fee imposed when a product is returned. A restocking fee is frequently charged to offset the expense of managing returns, and this price is subject to VAT, guaranteeing that the service of refilling is also taxed.