Invalid DateTime

August 1, 2024: VAT on Amazon Fees for EU and UK

- Tax Settings: Reclaiming VAT on Amazon Fees After August 1, 2024

- Tax Settings: Reclaiming VAT on Amazon Fees Before and After August 1, 2024

- Considerations

Starting August 1, 2024, Amazon began charging VAT on Amazon fees for all sellers in European markets and the United Kingdom.

Whether you are registered for VAT or not, Amazon will charge these fees without exception.

The only difference is that VAT-registered sellers will be able to reclaim it. To assist with this, Shopkeeper has developed a tool to offset this VAT on Amazon fees starting August 1, 2024.

In this article, we will show you how to configure Shopkeeper to reclaim VAT on these fees. We will also discuss considerations you should be aware of with this change and how you can counteract it.

Tax Settings: Reclaiming VAT on Amazon Fees After August 1, 2024

If Amazon was already charging you VAT on fees before August 1, 2024, and you wish to reclaim it both before and after this date, this is not the procedure to follow. If you want to offset VAT both before and after August 1, 2024, please refer to the procedure found under “Tax Configuration: Reclaim VAT on Amazon Fees.”

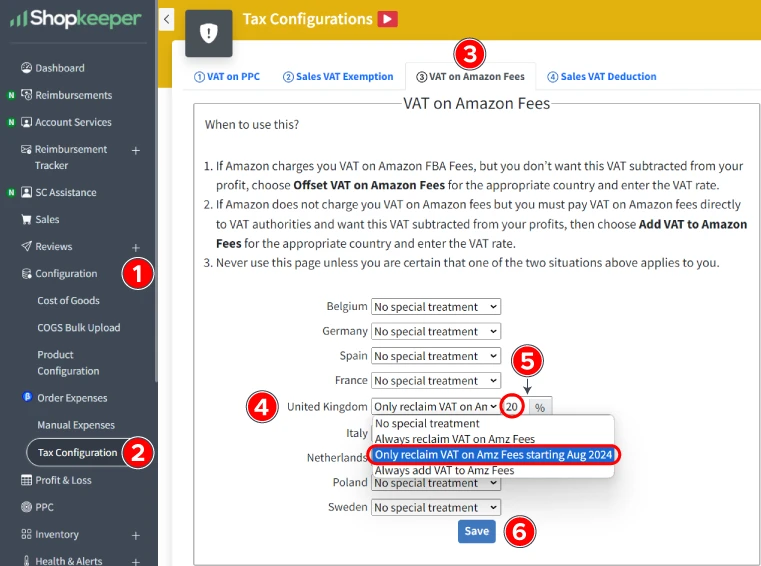

Follow these steps only to reclaim VAT from August 1, 2024, onwards:

-

In the left navigation menu, scroll down to Configuration and expand it using the + sign.

-

Click on Tax Configuration.

-

You will see tabs at the top of the Tax Configuration page. Click on the third tab labeled "3. VAT Option on Amazon Fees."

-

For each applicable marketplace, choose "Only reclaim VAT on Amz fees starting Aug 2024" from the dropdown menu.

-

Enter the % of VAT you are reclaiming.

-

Save the settings using the blue Save button.

It may take the system a few minutes to recalculate your profits with the added VAT. Shopkeeper will start applying an offset to all Amazon fees only after August 1, 2024.

Here is a tutorial video:

New Feature: VAT on Fees from August 1st 2024. - Watch Video

Tax Settings: Reclaiming VAT on Amazon Fees Before and After August 1, 2024

-

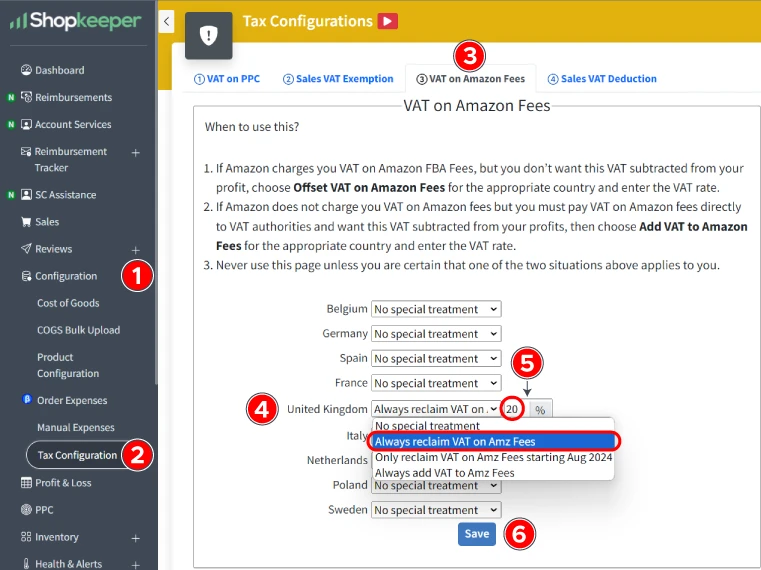

In the left navigation menu, scroll down to Configuration and expand it using the + sign.

-

Click on Tax Configuration.

-

You will see tabs at the top of the Tax Configuration page. Click on the third tab labeled "3. VAT Option on Amazon Fees."

-

For each applicable marketplace, choose "Always reclaim VAT on Amz Fees" from the dropdown menu.

-

Enter the % of VAT you are reclaiming.

-

Save the settings using the blue Save button.

It may take the system a few minutes to recalculate your profits with the added VAT. Shopkeeper will start applying an offset to all Amazon fees before and after August 1, 2024.

Here is a tutorial video:

VAT on Amazon Fees Compensation - Watch Video

Considerations

Differences Between Amazon API and Seller Central

When checking the transaction details of a confirmed order, you will find that Seller Central separates the VAT from the fee.

For now, Amazon sends the fee with VAT included in its API. By adding the fee and VAT you see in Seller Central, you will find the fee value displayed in Shopkeeper.

Delay in VAT on Sales

With this change, Amazon no longer specifies VAT on sales in pending orders, only in confirmed (shipped) orders. This delay is temporary due to the changes and should be resolved by Amazon soon.

Why is it vital to consider VAT on sales?

The margin will be affected since the sales price will include VAT. Therefore, the margin shown in Shopkeeper will be lower while Amazon confirms the pending orders.

If you do not want to wait for Amazon to send the VAT on sales as it did previously, follow these steps to activate the VAT estimator on sales:

-

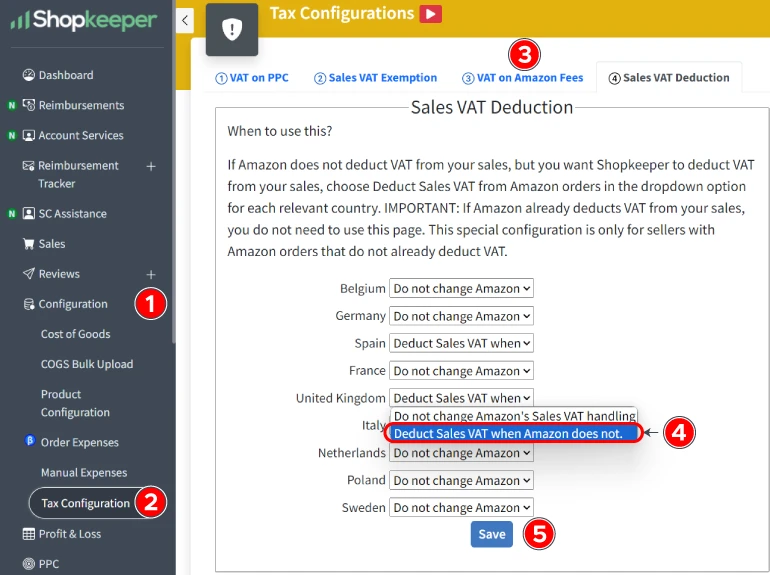

In the left navigation menu, scroll down to Configuration and expand it using the + sign.

-

Click on Tax Configuration.

-

You will see tabs at the top of the Tax Configuration page. Click on the fourth tab labeled "Deduct Sales VAT when Amazon does not."

-

For each marketplace where you want Shopkeeper to deduct VAT from your orders even though Amazon Seller Central does not, select "Deduct VAT from sales when Amazon does not."

-

Save the settings using the blue button.

Here is a tutorial:

Sales VAT Deduction - Watch Video

It may take the system a few minutes to recalculate the data with the VAT on sales deducted. This tool will apply VAT on sales to all orders, including pending ones, thus avoiding a negative impact on the margin.

UK Seller Selling in the EU

This scenario is the most complex since Amazon has not yet finished informing which fees will have VAT charged and which will not.

The changes will be made gradually to avoid negatively impacting sellers.

Claimed VAT: Ideal vs. Real

Whenever required by the relevant authority in each country, the seller must carry out the necessary procedures to reclaim this VAT on Amazon fees.

However, sellers may not always be able to reclaim 100% of the VAT on the fees.

Since Amazon does not notify what % of VAT on the fees can or cannot be reclaimed by the seller, it is important to inform Shopkeeper of the amount that could not be reclaimed through a manual expense.

To enter a manual expense, follow these steps:

-

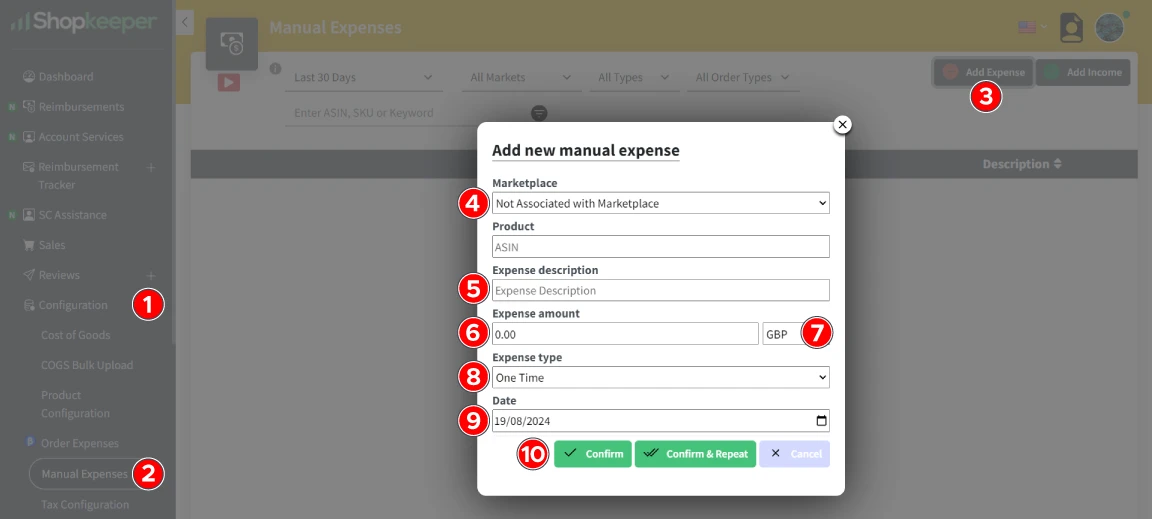

In the left navigation menu, scroll down to Configuration and expand it using the + sign.

-

Click on Manual Expenses.

-

You will see two buttons at the top right of the Manual Expenses page. Click on the button labeled “Add Expense."

-

In the Manual Expenses pop-up window, enter the marketplace for which you want to adjust the reclaimed VAT on Amazon fees.

-

Enter a description that will allow you to understand in the future what this manual expense is for.

-

Enter the adjustment value.

-

Enter the model of the adjustment value.

-

Select whether the expense repeats only once.

-

Select the date on which you want this change to apply to your sales page and P&L.

-

Save the settings using the green "Confirm" button. If you want to use this same template to save another manual expense, use the green "Confirm and Repeat" button.

Here is a tutorial:

Manual Expense: VAT on Fees not Reclaimed - Watch Video

VAT Reclamation: Seller's Duty

This tool does not automatically reclaim VAT for the seller. It only offsets the VAT value on Amazon fees. The reclamation of VAT on fees is a duty of the seller, which must be carried out with the relevant authority.