Feb 14, 2026

Cost Periods: Account for changes in your COGS

- Cost per unit accounting

- How do you account for changes in your COGS?

- Example using Shopkeeper Costs Periods

- Considerations

- Conclusion

Once your shipment arrives at Amazon, there will be no tracking information for it anymore.

As its former consumer CEO Dave Clark said, Amazon uses chaotic storage practices to optimize available space in warehouses and logistics. Your goods are stored conveniently so Amazon can ship them as soon as possible.

These practices, in conjunction with powerful inventory management software, are the key to such good service to buyers.

But what about the sellers?

These storage practices only makes it inconvenient to track COGS by shipment, as you really don’t know when Amazon will ship a specific item, if it’s going to use your old or new stock, etc.

Here is where the cost-per-unit accounting concept comes into play.

Cost per unit accounting

The idea of this concept is for you to calculate an average cost per unit every time you need to input COGS. And apply the COGS from the specific date you wish those costs to take place. With Shopkeeper Cost Period feature, it is easy to set specific dates for your COGS.

For private label sellers, you only need to know the average cost incurred to produce a single unit of your product and divide it by the total number of units produced.

For arbitrage sellers, you only need to know the average cost incurred to buy a single unit of your product and divide it by the total number of units you bought.

Cost per Unit = Total Cost of Goods available for sale/Total Units Available for sale

How do you account for changes in your COGS?

Let's suppose you have 100 units at a $1 per unit manufacturing cost before Jan 1st, 2025.

Then you sell 50 units, so you only have 50 units left.

Then you get a new shipment of 50 units on Jan 1st, 2025, and the cost per unit is $2. This implies that starting Jan 1st, 2025, you have new average costs.

The average cost per unit of your 2 batches of inventory is now $1.50. So you would create a new cost period starting Jan 1st, 2025, and the new cost per unit would be $1.50.

Example using Shopkeeper Costs Periods

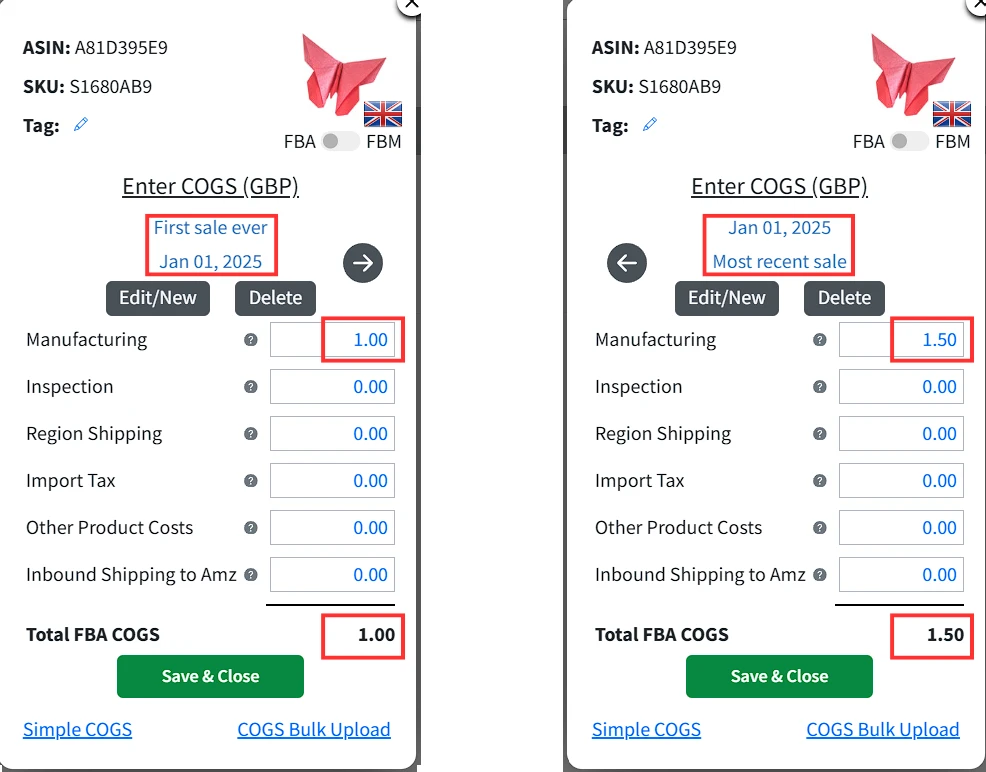

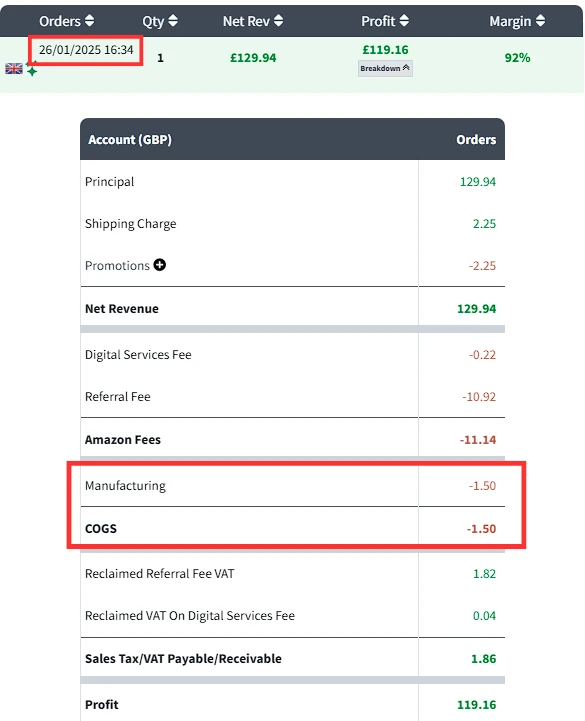

This is how the example above will look on Shopkeeper using the Cost Period feature. Shopkeeper will apply $1 to orders before Jan 1st, 2025, and $1.5 to orders starting on Jan 1st, 2025.

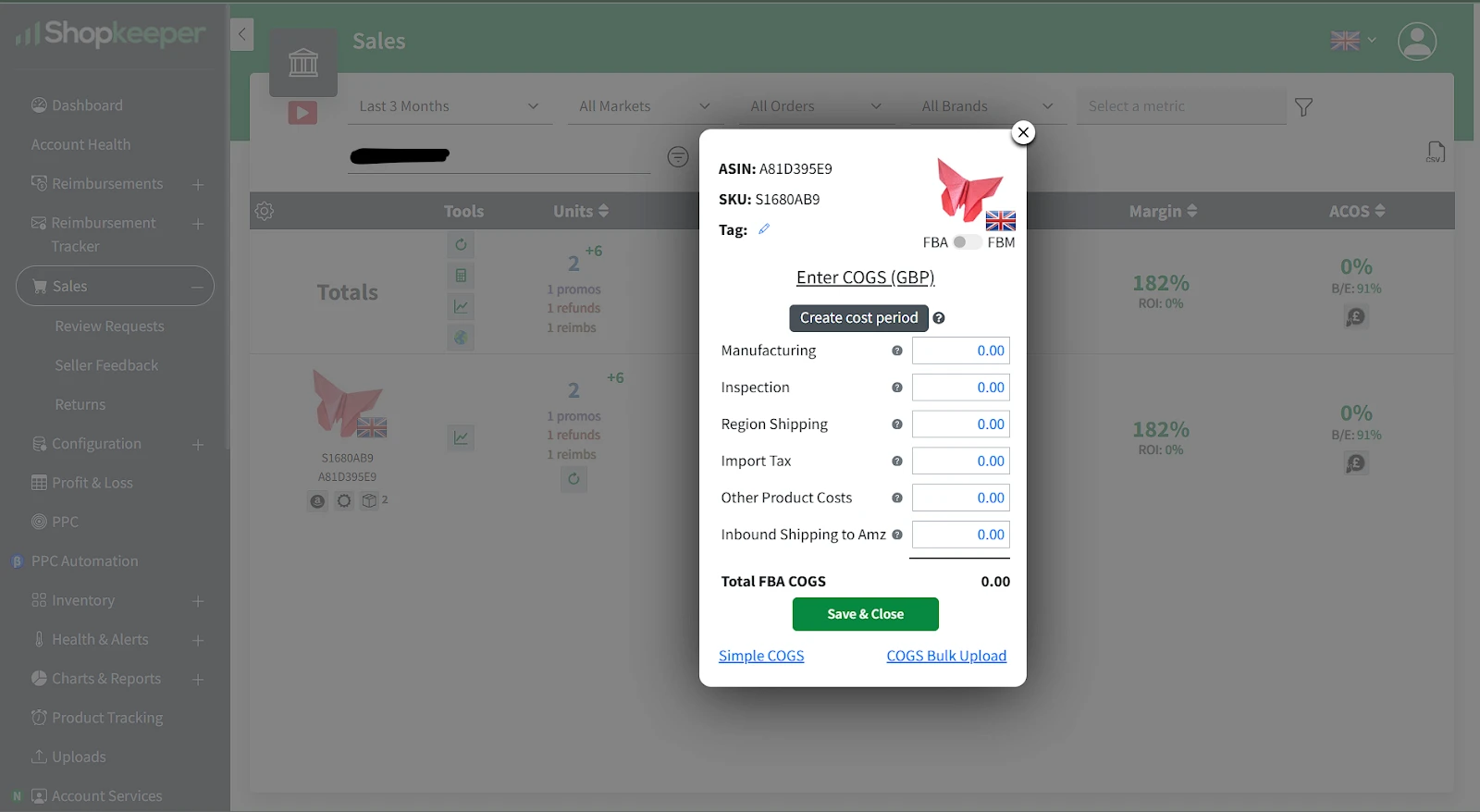

First, go to the Sales page or Cost of Goods page. There, you will see each product image and below a gear icon. Click it to open the COGS pop-up to start using the Cost Period feature.

Now, click the Cost Period feature and apply the dates and the new COGS per date. As you see, we’ve set $1 to orders before Jan 1st, 2025, and $1.5 to orders starting on Jan 1st, 2025

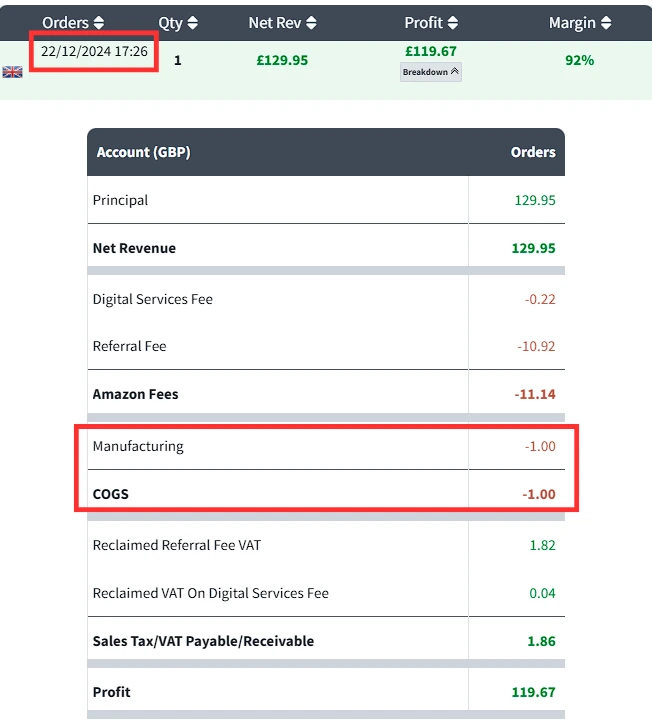

And the final result is Shopkeeper applying the COGS per dates as desired.

Considerations

Finally, it’s very important to consider that returns, refunds, and lost & damaged inventory do not necessarily ever go back to the location where they started from. This further complicates your tracking by shipment.

Conclusion

Then, using the average cost per unit, you do not have to worry about any of the challenges when trying to track new inventory and returns, refunds, and lost & damaged inventory that Amazon doesn’t assign to shipments. At any moment in time, you know what your average is, regardless of which shipment or which location a unit is from.