Feb 14, 2026

Digital Services Tax Explained

What is Digital Services Tax?

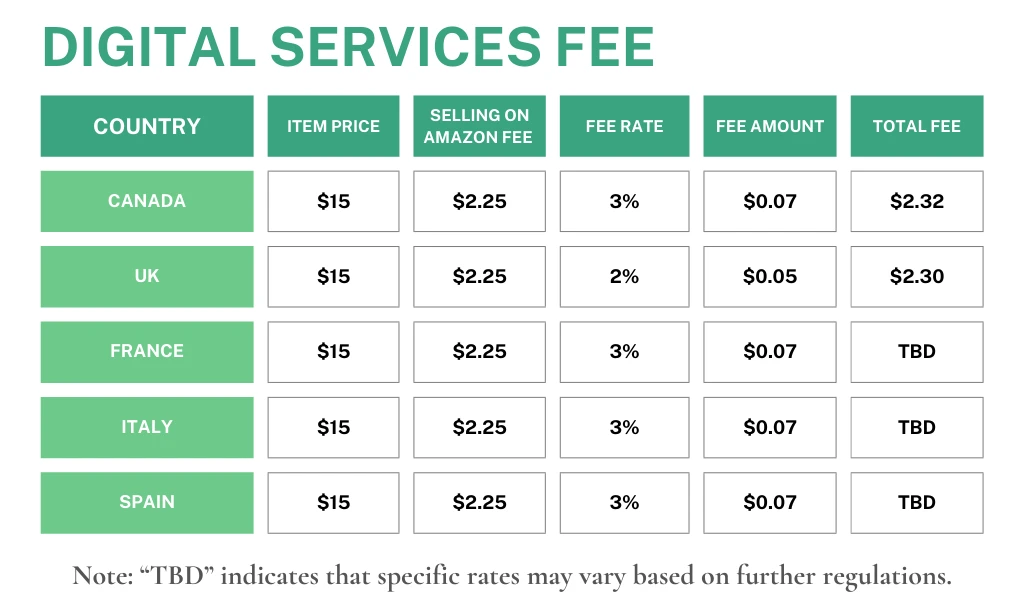

The Digital Services Tax (DST) is a global tax that governments impose on certain digital services provided by major tech companies like Amazon, Google, and Facebook. This tax applies to gross revenues generated from online activities, including advertising and digital sales, within specific jurisdictions. Amazon then passes this fee on to sellers in countries such as Canada, UK, France, Italy, and Spain, resulting in a complex fee structure.

Typically, DST rates are around 2% in the UK and 3% in Canada, but these rates can vary based on the location of your business and your customers. To simplify things, Amazon implements a fixed digital services fee based solely on your business location and the store you sell in.

It’s also important to note that this fee does not apply to US-based sellers making sales in the US store. However, if your business is registered in a country subject to the DST and you sell in the US store, the fee will still apply.

Here’s a breakdown of the fees based on country:

When does it apply?

Starting October 1, 2024, Amazon will implement a standalone Digital Services Tax fee. This fee will be clearly itemized as a separate line item on your invoice, allowing you to see it distinctly from other charges.

To stay informed about your costs, be sure to review your invoices regularly and adjust your pricing strategies to account for this additional fee.

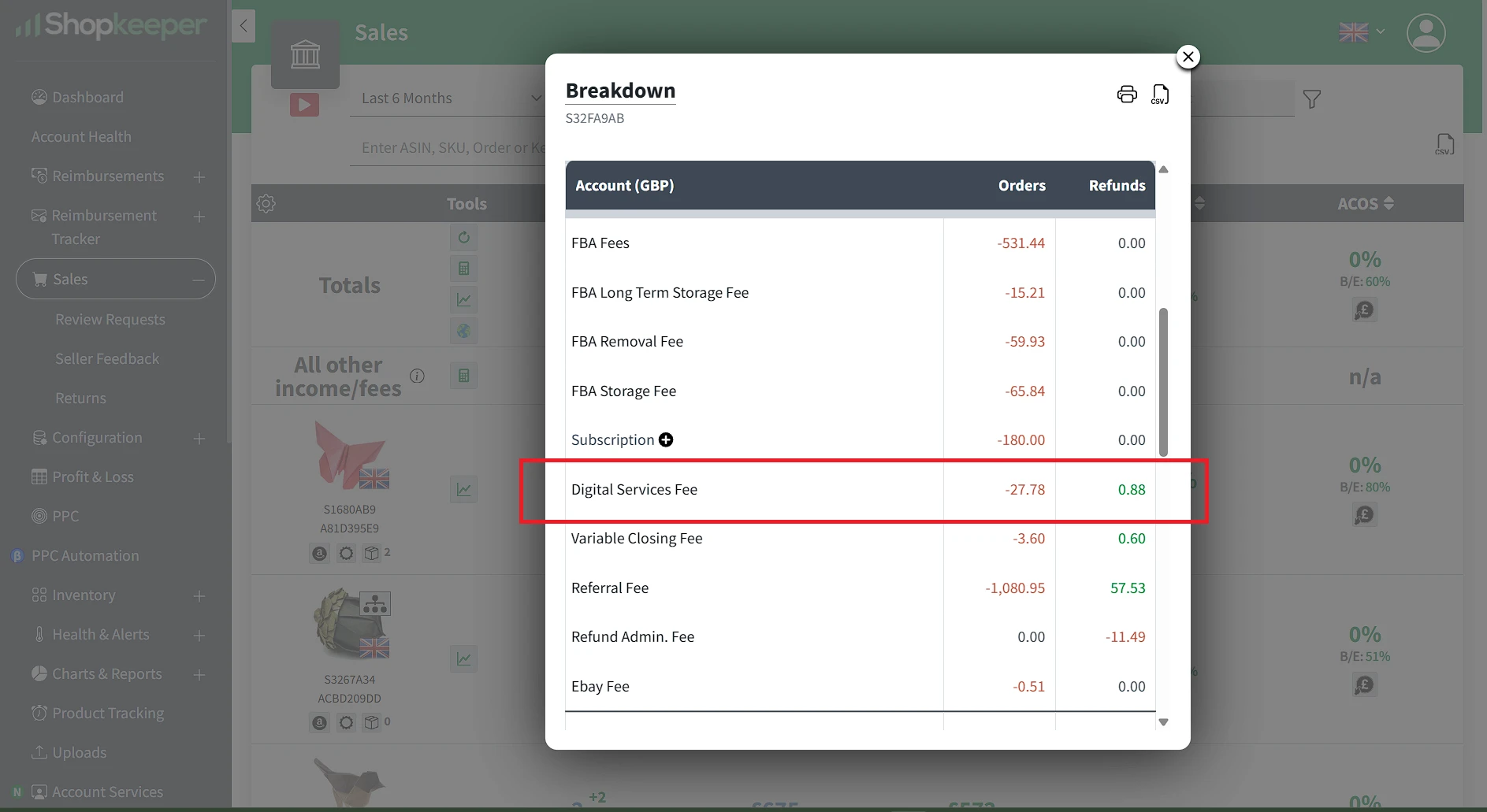

How will you see the fee?

On your Sales Page, the Digital Services Tax will be itemized separately, providing transparency regarding the fee applied to your sales. This will help you track how the fee impacts your overall sales performance.

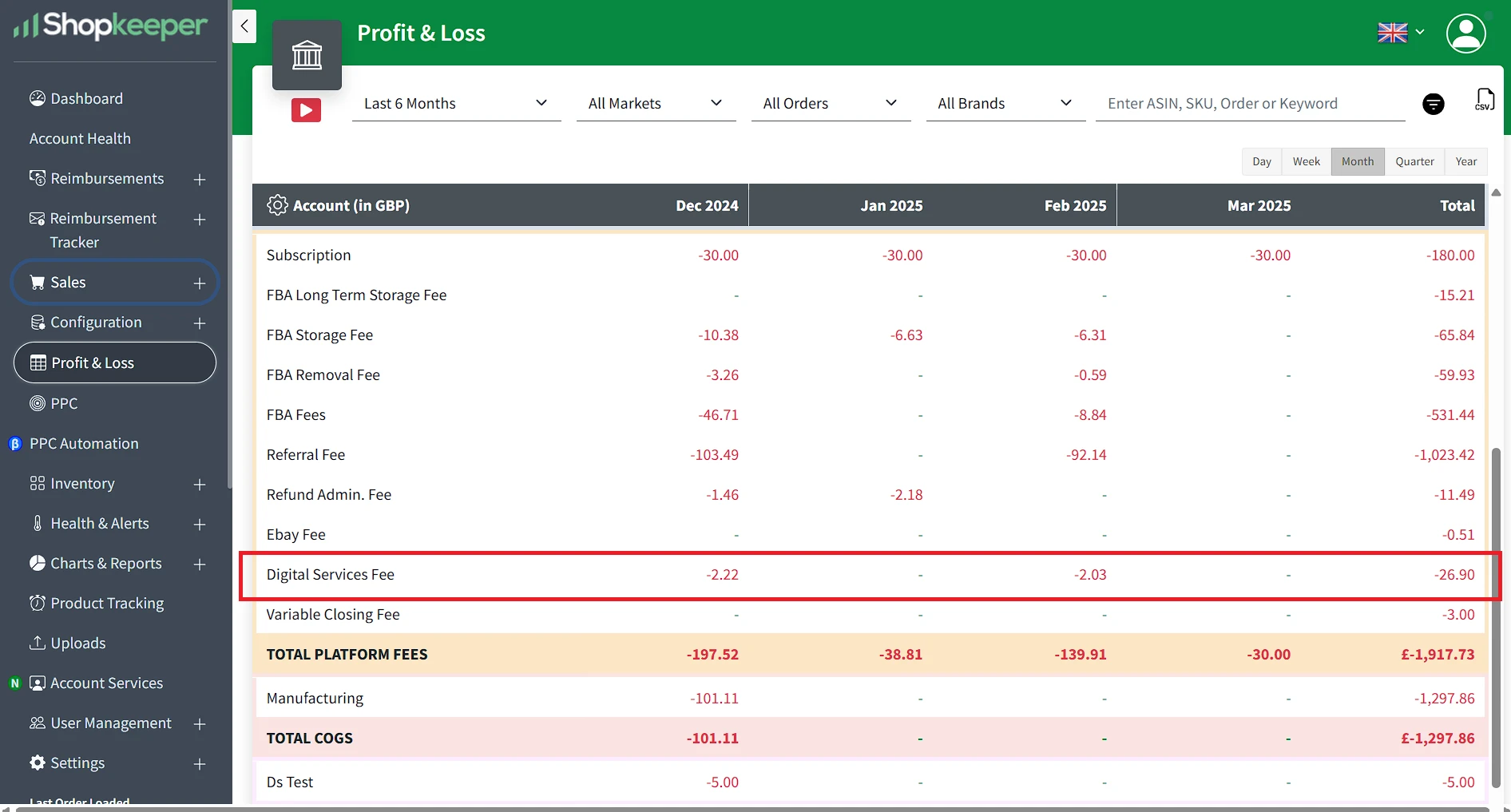

Additionally, on your Profit & Loss page, you will see the Digital Services Fee as a distinct line item allowing you to assess how it affects your overall profitability. This clear breakdown will help you stay on top of your financials and adjust your business strategy accordingly.

How Shopkeeper help?

Understanding the Digital Services Tax is essential for your business’s success. The DST can significantly impact your profit margins, so knowing how it affects your sales allows you to adjust your pricing effectively.

This is where Shopkeeper comes in. By automatically tracking the Digital Services Fee and all other charges, Shopkeeper simplifies your financial management. With real-time insights into how the DST impacts your bottom line, you can optimize your pricing strategies and improve your profitability. Don’t let unexpected fees catch you off guard—stay proactive and empower your business to thrive!